Saturday Mar 07, 2026

Saturday Mar 07, 2026

Tuesday, 8 September 2015 01:08 - - {{hitsCtrl.values.hits}}

Global Foreign Direct Investment (FDI) fell by 16% to $1.23 trillion in 2014, according to the UNCTAD World Investment Report 20151. The report says the drop can be explained by the fragility of the global economy, policy uncertainty for investors and elevated geopolitical risks. New investments were also offset by some large divestments.

The report reveals that China became the largest recipient of FDI in 2014, followed by Hong Kong (China) and the United States of America. Developing economies as a group attracted $681 billion worth of FDI and remain the leading region by share of global investment inflows. Among the top 10 FDI recipients in the world, half are developing economies: Brazil, China, Hong Kong (China), India and Singapore.

This is in line with the expansion abroad by multinationals from developing economies which reached its highest level ever, at almost half a trillion dollars. In 2014, 9 of the 20 largest investor countries were developing or transition economies (Chile, China, Hong Kong (China), Taiwan Province of China, Kuwait, Malaysia, the Republic of Korea, the Russian Federation and Singapore), with firms from developing Asia now investing abroad more than any other region.

Developing economies accounted for a record 35% of global FDI outflows, the report says, up from 13% in 2007. A characteristic of their global expansion is investment in other developing economies. FDI stock from developing economies to other developing economies (South–South FDI), excluding Caribbean offshore financial centres, grew by two-thirds from $1.7 trillion in 2009 to $2.9 trillion in 2013.

At $499 billion, developed economies recorded a 28 per cent decline in inflows last year. However, this figure was significantly affected by the single mega divestment by Vodafone (United Kingdom of Great Britain and Northern Ireland) of its Verizon Wireless business in the United States. The Vodafone deal was indicative of a general trend in merger and acquisition activity which saw divestment deals rising to one out of every two mergers and acquisitions. This is in spite of a revival in cross-border mergers and acquisitions that recorded the highest number of large-scale deals (greater than $1 billion) – from 168 in 2013 to 223 in 2014 – since 2008.

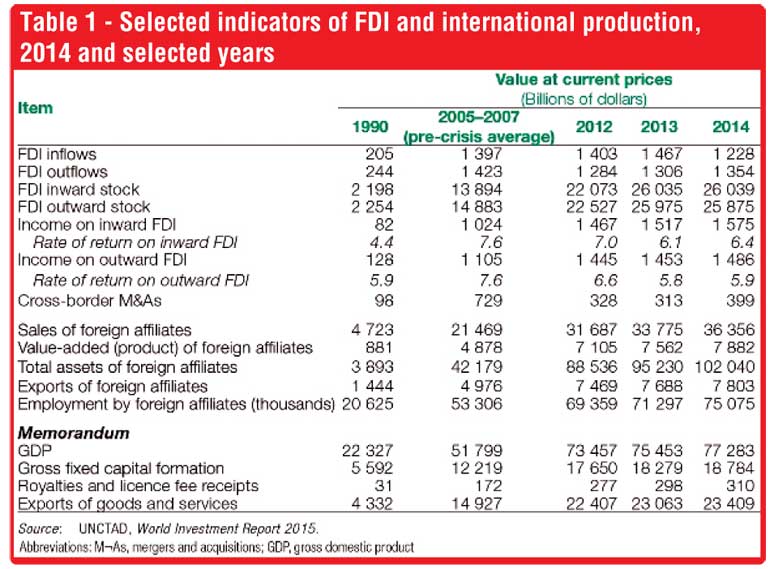

The report, which monitors international business activity in a number of areas, found that international production by multinationals rose in 2014. The foreign sales and assets of multinationals expanded faster than their domestic counterparts, generating added value of approximately $7.9 trillion. In addition, the foreign affiliates of multinationals employed a total of 75 million people, creating four million jobs globally last year (table 1).

In the past decade, investment has increasingly targeted the services sector, due to liberalisation in the sector and as a consequence of long-term trends towards services in all economies. In 2012, the latest year available, services accounted for 63% of global FDI stock, more than twice the share of manufacturing, at 26%. The primary sector represented 7% of the total (with 4% unspecified), the report says.

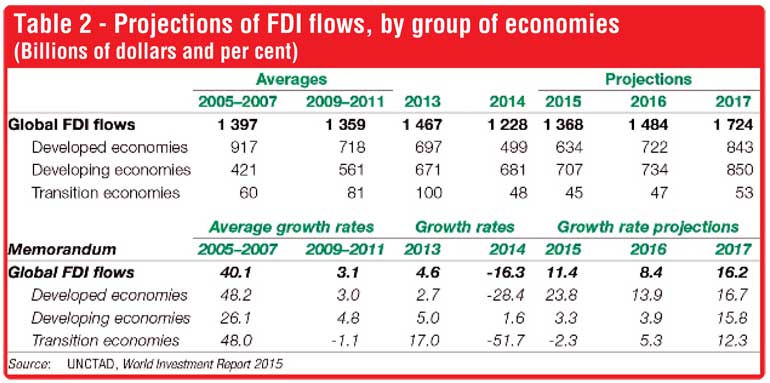

Looking beyond 2014, the report says that a sustained recovery in global FDI is in sight with global FDI inflows projected to grow by 11% to $1.4 trillion in 2015. The report also foresees further rises to $1.5 trillion in 2016 and to $1.7 trillion in 2017 (table 2). Developed countries should see a large increase in flows in 2015 (up by more than 20%), reflecting stronger economic activity. FDI inflows to developing countries will continue to be high, rising by an average of 3% over the next two years.

These estimates are supported by both UNCTAD’s FDI forecast model and a survey of large multinational enterprises. Trends in cross-border mergers and acquisitions also point to a return to growth in 2015. The share of multinational enterprises intending to increase FDI expenditures over the next three years (2015–2017) has risen from 24 to 32%, according to the report, with few intending to reduce them.

However, FDI growth could be upended by a multitude of economic and political scenarios, including ongoing uncertainties in the eurozone, potential spillovers from geopolitical tensions and persistent vulnerabilities in emerging economies.

India leads regional Foreign Direct Investment as inflows to South Asia rise by 16% in 2014

Foreign Direct Investment (FDI) inflows to South Asia rose to $41 billion in 2014, primarily owing to good performance by India (Figure 1), according to UNCTAD’s World Investment Report 20151. FDI inflows to the country surged by 22% to about $ 34 billion.

|