Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 24 August 2021 03:47 - - {{hitsCtrl.values.hits}}

The CBSL is now losing its grip on both the exchange rate and interest rates amidst market tensions

At present, policymakers are facing unprecedented challenges in dealing with the economic setback exacerbated by the COVID-19 pandemic. Since last year, the Central Bank of Sri Lanka (CBSL) has adopted an easy money policy including low interest rates and selective credit concessions with a view to expedite economic revival.

Meanwhile, the CBSL continued to accommodate fiscal shortfalls by purchasing Treasury bills and bonds in the primary market while commercial banks disbursed substantial credit to the Government. These moves led to a rapid increase in the money supply causing demand pressures on inflation and imports.

While maintaining a low interest rate policy, the CBSL is attempting hard to prevent rupee depreciation in the context of the widening trade deficit and heavy debt settlements. It has led to widen the balance of payments deficit and to develop black market activities in forex dealings.

Thus, monetary and fiscal policies have been pro-cyclical in the sense that they contributed to accelerate inflation and to worsen the balance of payments deficit, instead of being anti-cyclical to ease such macroeconomic imbalances.

CBSL losing grip on interest rates and exchange rate

The CBSL is now losing its grip on both the exchange rate and interest rates amidst market tensions. The yield rates on Treasury bills and bonds are on the rise with substantial undersubscription in recent auctions. In the meantime, commercial banks seem to have ignored the “gentlemen’s agreement” initiated by the CBSL to keep the exchange rate at a particular level. The dollar is traded at much higher rates in formal and informal markets.

Lately recognising the adverse implications of its expansionary monetary policy adopted over the last one and a half years, the CBSL has now taken a U-turn by introducing certain mild monetary tightening measures last week. The success of these measures seems doubtful, as the CBSL has not announced any change in its current policy stand towards exchange rate fixing or bank lending to the Government.

Monetary policy tightening

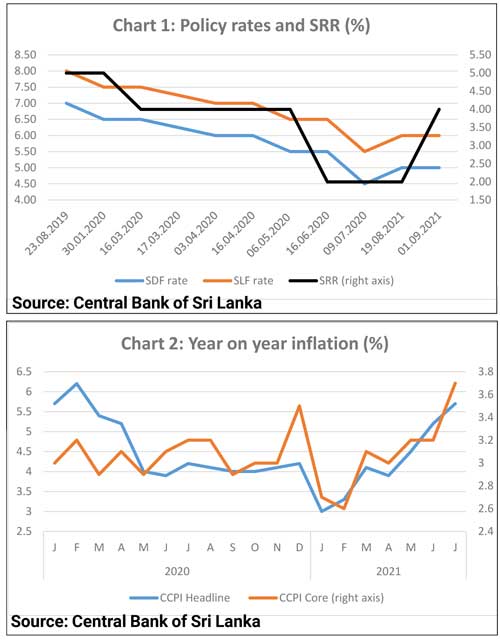

The CBSL, at its Monetary Policy Review meeting held last week, announced that the Monetary Board has decided to increase its Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) by 50 basis points each, to 5% and 6%, respectively. This would also result in the Bank Rate, which is linked to the SLFR with a margin of +300 basis points, automatically adjusting to 9%.

In addition, the Monetary Board decided to increase the Statutory Reserve Ratio (SRR) applicable on all rupee deposit liabilities of licensed commercial banks by 2 percentage points to 4%, with effect from the reserve maintenance period commencing on 1 September 2021. The CBSL has taken these decisions in order to deal with the external payments imbalances and to mitigate any excessive inflationary pressures over the medium term, amidst improved growth prospects. This is the first time that the Central Bank adopted a tight monetary policy stance after a lapse of 18 months (Chart 1).

Demand pressures

Increased bank lending to the Government has led to raise the money supply and thereby to create demand pressures on inflation and foreign exchange market, as elaborated in my recent article appeared in Daily FT (https://www.ft.lk/opinion/MMT-styled-fiscal-and-monetary-policies-inject-liquidity-into-market--creating-demand-pressures/14-720362).

The monetary expansion has resulted in excess liquidity in the market stimulating the aggregate demand. In the backdrop of supply shortages due to the pandemic, such excess demand was bound to accelerate inflation soon, as I projected in this column last February (https://www.ft.lk/columns/Inflationary-pressures-on-the-horizon/4-712891).

But the CBSL continued to deny that the money supply has any impact on inflation due to low demand during the pandemic. In its Monetary Policy Review of July 2021, CBSL asserted, “Inflation remains moderate, given the subdued aggregate demand conditions, although food inflation has accelerated due to supply-side disruptions. Inflation is expected to remain broadly within the desired 4-6% range during the remainder of 2021.”

Deviating from the above position announced just one month ago, the CBSL’s most recent Monetary Policy Review issued last week states, “Inflation is projected to hover around the upper bound of the desired 4-6% target range in the near term. The envisaged improvements in aggregate demand conditions and the likely increases in global energy and other commodity prices may generate some inflationary pressures in 2022, requiring preemptive policy measures to ensure the maintenance of inflation in mid-single digit levels over the medium term.”

Both the headline inflation and core (underlying) inflation, as reflected in the Colombo Consumer Price Index (CCPI), are on the rise in recent months (Chart 2).

Forex market under tension

The rupee has been under severe stress in recent weeks with the exchange rate depreciating to nearly Rs. 220 per US Dollar in the formal market, despite CBSL keeping its official exchange rate within a stable margin of Rs. 198–202, as elaborated in my article appeared in Daily FT last week (https://www.ft.lk/opinion/Rupee-under-stress-as-trade-deficit-expands/14-721803).

The CBSL felt that limited conversion by exporters and the advancing of imports together with some speculative activity, prompted by anomalies between interest rates on the rupee and foreign currency products in the financial market, exerted undue pressure on the exchange rate in the domestic market. This too motivated the CBSL to raise policy interest rates last week.

Interest rate hike likely to reduce financial repression

The easy monetary policy adopted thus far has led interest rates on savings to fall below the rate of inflation, which resulted in negative real interest rates. This type of situation is known as “financial repression”, as first pointed out by Ronald McKinnon and Edward Shaw in their celebrated contributions in 1973.

Lower real rates of return maintained in a financial repression environment discourage both saving and investment. Sri Lanka’s recent experience shows how financial repression can be used to finance the Government’s domestic debt by increasingly borrowing from the banking sector at low cost ignoring inflationary consequences. Thus, low interest rates have helped the Government to reduce its debt servicing costs while penalising savers, as discussed in my article appeared in Daily FT (https://www.ft.lk/columns/Low-interest-rate-policy-punishes-savers/4-715286).

Government borrowings from banks heavy

It would be rather difficult to restrain the money supply growth through the recently introduced contractionary monetary policy measures alone, unless there is substantial reduction in Government borrowings from the banking sector. The Government has been increasingly relying on domestic bank borrowings in recent months due to the limitations of foreign borrowings from global markets reflecting the country’s weakening debt sustainability.

The Government securities have become unattractive even in the domestic market owing to low yield rates, and therefore, the CBSL is compelled to buy the unsold Treasury bills and bonds in recent auctions. For example, the Treasury bill auction held a week ago was undersubscribed to the extent of 55% of the total amount offered. Invariably, the CBSL had to buy the rest of the bills resulting in a further increase in its holdings of Government securities.

CBSL’s credit to Government rising

The CBSL has disbursed credit to the Government by directly purchasing Treasury bills and bonds from the primary market, which led to currency printing along the lines of the baseless Modern Monetary Theory (MMT). The CBSL’s net credit to the Government increased by as much as 112% over the last 12 months, and its holdings of Treasury bills and bonds now stand at Rs. 1,170 billion.

They form a major part of the CBSL’s net domestic assets, giving rise to the monetary base or high-powered money, which is the basis of currency issues – commonly known as money printing.

The CBSL’s increased lending to the Government in this manner has had a steep positive impact on the monetary base or high-powered money since last year. The monetary base has multiplier effects on the aggregate money supply, as commercial banks can use it as the base for credit creation. The impact on the monetary base, and consequently on the aggregate money supply, was partly offset by a decline in net foreign assets due to the balance of payments difficulties experienced in recent months.

Fiscal-monetary policy coordination crucial

The CBSL has now turned to adopt a stand-alone tight monetary policy stance while keeping its current policy stand towards accommodation of fiscal needs and exchange rate fixing intact. As explained above, the CBSL has accommodated the Treasury’s cash shortfalls by purchasing Government securities. It led to raise the currency printing at a faster pace. The increased high-powered money enabled commercial banks to provide substantial credit to the Government and public corporations causing multiple money creation.

Therefore, unless such public sector borrowings are curtailed, the monetary expansion will continue irrespective of the newly-introduced monetary policy restrictions. This points to the need of close coordination between fiscal and monetary policies.

(The writer is Emeritus Professor of Economics at the Open University of Sri Lanka and a former Director of Statistics, Central Bank of Sri Lanka, reachable at [email protected])