Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 15 June 2021 02:25 - - {{hitsCtrl.values.hits}}

This swap is reported as the first instance that Bangladesh is extending financial assistance to another country in its history. Bangladesh, which was ridiculed as a “bottomless basket” by the US State Secretary, Henry Kissinger in 1971, today holds a large foreign reserve stock of $ 45 billion, 10 times of Sri Lanka’s reserves

Defending the recent $ 250 million currency swap agreement with Bangladesh, Money, Capital Market and State Enterprise Reforms State Minister Ajith Nivard Cabraal is reported to have stated at a recent webinar on the Colombo Port City that it was not a disgrace for Sri Lanka to enter into such agreement. He expressed similar sentiments at the Sri Lanka Investment Forum held last week.

Defending the recent $ 250 million currency swap agreement with Bangladesh, Money, Capital Market and State Enterprise Reforms State Minister Ajith Nivard Cabraal is reported to have stated at a recent webinar on the Colombo Port City that it was not a disgrace for Sri Lanka to enter into such agreement. He expressed similar sentiments at the Sri Lanka Investment Forum held last week.

It is reported that he mentioned, “Bangladesh is loaning more money to the US than to anybody else, the same way Sri Lanka is. When Sri Lanka loans money to the US or any other advanced country in the European Union, we call it an investment. The only thing (difference) when you give it to a so-called third world country, is a loan — that is the only difference.”

Cabraal further said, “It is only at the time of where the investment is made that the norm slightly changes. If it is an investment in Sri Lanka it will be called a loan, but if it is an investment in an advanced country you will call it an investment— that is the difference.”

The above statement needs to be analysed carefully, as there are several caveats surrounding it.

Misleading statement

In terms of the internationally-accepted statistical framework on the transactions between a particular country and the rest of the world, the treatment given to loans, investments or any other transactions is identical for rich and poor countries alike.

Hence, it is inaccurate to say that when a country provides a loan to an advanced economy such as the US or the European Union, it is considered as an investment while such lending to a third world country like Sri Lanka is treated as a loan. There is no discrimination as such in international financial flow statistics.

From the lending country’s point of view, a loan given to a poor country or a rich country is an investment. But for the borrowing country, whether it is Sri Lanka or the US, such a financial inflow is a foreign loan.

Hence, it is misleading to change the nomenclature of foreign loans as investment for the sake of avoiding embarrassment caused by Sri Lanka’s borrowings from Bangladesh or from any other country.

Swap with Bangladesh is not an investment but a loan

The swap agreement with the Bangladesh’s Central Bank is the latest swap facility sought by the Government and the Central Bank of Sri Lanka in recent times. This currency swap is effectively a loan that Bangladesh will give to Sri Lanka in dollars, with an agreement that the debt will be repaid with interest at maturity.

Ironically, this swap is reported as the first instance that Bangladesh is extending financial assistance to another country in its history. Being one of the most impoverished countries of the world receiving billions of dollars in aid, Bangladesh has not yet been viewed globally as a lender to other countries.

But its economy has achieved remarkable progress over the last two decades, and became the fastest growing South Asian country in 2020. Bangladesh, which was ridiculed as a “bottomless basket” by the US State Secretary, Henry Kissinger in 1971, today holds a large foreign reserve stock of $ 45 billion, 10 times of Sri Lanka’s reserves.

BOP methodological standards

BOP methodological standards

A country’s foreign loans along with all other international transactions are recorded in its Balance of Payments (BOP). Countries use internationally accepted methodological standards to compile consistent and timely BOP statistics. The BOP Manual of the International Monetary Fund (IMF) is used as the bible for compiling BOP statistics by its member countries.

Starting with the first edition of the Manual released by the IMF in 1948, and continuing towards the latest edition of the Balance of Payments and International Position Manual (BPM6) released in 2009, the guidelines have evolved over the decades to capture fast changing trade and financial transactions between countries.

Financial account of BOP

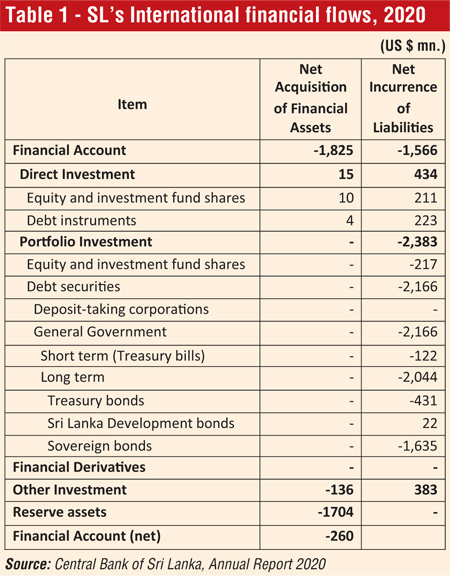

As shown in Table 1, BPM6 categorises the Financial Account of the BOP into (a) direct investment (b) portfolio investment, (c) financial derivatives, (d) other investment and (e) reserve assets. Direct investment includes equity and debt instruments. Similarly, portfolio investment consists of equity and debt instruments.

The Government’s short-term Treasury bills and long-term securities (Treasury bonds, Sri Lanka Development bonds and Sovereign bonds) funded by foreign investors are listed under debt securities of portfolio investment.

Financial inflows through swap agreements are included in other investment as loans. Therefore, they are not investments for the borrowing country – Sri Lanka.

Thus, foreign loans are treated as debt liabilities in terms of BPM6, and this is common to all member countries of the IMF irrespective of their development status.

SL experiencing financial outflows

SL experiencing financial outflows

Sri Lanka experienced net capital outflows in 2020, as shown in Table 1. Both net acquisition of financial assets and net incurrence of financial liabilities declined significantly during the year.

Net outflows of foreign investment from the Government securities market, repayment of an International Sovereign Bond (ISB), net outflows of investment from the Colombo Stock Exchange, lower foreign direct investment inflows and foreigners’ sales of ISBs led to a decline in liabilities in 2020. The decline in gross official reserves due to BOP difficulties was the main reason for the fall in the net acquisition of financial assets last year.

Negative international investment

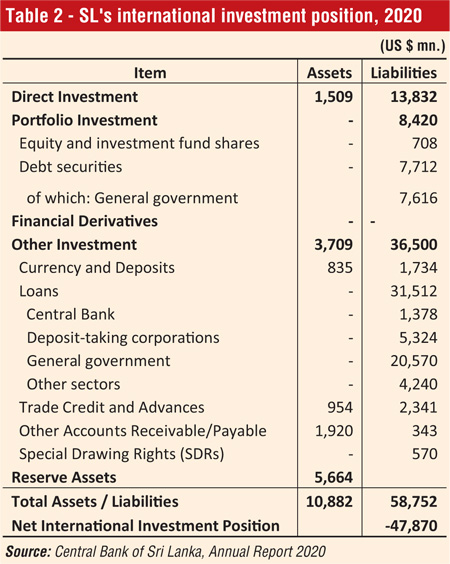

Sri Lanka runs a negative balance of $ 48 billion in her international investment position, as shown in Table 2. This is mainly an outcome of the Government’s outstanding loan liabilities of $ 28 billion accounting for 50% of the total liabilities.

There is a rising trend of foreign borrowings by commercial banks and blue-chip companies as well in recent times, as they have been allowed to borrow foreign currency from global capital markets since 2013.

A few days ago, the Central Bank, with a view to encourage foreign currency inflows to the country amidst BOP difficulties, has invited the private sector to pursue avenues of offshore funding leveraging on its strength. In order to hedge the foreign exchange risk of offshore borrowing, the Central Bank is ready to make available zero-cost swap facility for the private sector. An option is also given to private entities to invest in US dollar funds raised offshore in Sri Lanka Development Bonds (SLDBs).

Such induced borrowings will further enhance the country’s debt liabilities, and intensify the debt service problems, as the repayments and interest payments pertaining to such loans have to be met by using the country’s foreign reserves in any case, irrespective of the type of borrower.

SL bonds unattractive for foreign investors

SL bonds unattractive for foreign investors

The Government has to settle an International Sovereign Bond of $ 1,000 million in July, and Sri Lanka Development Bonds amounting to $ 1,325 million in August this year.

The debt problem has aggravated by now due to the difficulties faced by the Government in attracting foreign investors to its dollar-denominated bonds in recent auctions. This restrains the rolling-over of maturing foreign bonds and other loans.

Reflecting the investor concerns with regard to Sri Lanka’s credit worthiness, the last two auctions of the Sri Lanka Development Bonds (SLDBs) were heavily undersubscribed. In the auction held in November last year for $ 200 million, the Central Bank was able to raise only $ 24.82 million accounting for as much as 67% of undersubscription. The auction held in January, which had an offering of $ 200 million raised only $ 43.6 million reflecting undersubscription to the tune of 78%.

There is a noticeable increase in yields of recent SLDBs, which again is a reflection of the disturbing concerns among foreign investors on the country’s debt sustainability.

Depending on swaps unhealthy

Given the difficulties in raising foreign borrowings in international capital markets in the backdrop of sovereign rating downgrades for the country in the recent past, the Central Bank has turned to swap arrangements to temporarily resolve the BOP difficulties compounded by increasing debt service commitments falling in coming weeks.

The loan settlements due in the next 12 months amount to $ 7.3 billion. Of this total, domestically raised foreign loans through offshore banking amounting to around $ 3 billion could be rolled over leaving around $ 4 billion for immediate settlement, according to the Central Bank.

Prior to the swap with Bangladesh, an agreement was signed with the People’s Bank of China for a swap facility amounting to CNY 10 billion (approximately $ 1.5 billion). More swap facilities for Sri Lanka are on the pipeline, according to the Finance Ministry.

Although these swaps are helpful to ease the BOP difficulties in the short run, rigorous structural adjustments are imperative to deal with the country’s macroeconomic imbalances, specifically the BOP and fiscal deficits.

Fiscal targets handed over to future generations

To make matters worse, last week, the Parliament approved an amendment to the Fiscal Management (Responsibility) Act of 2003 to further relax the fiscal rules.

Accordingly, the Treasury guarantees provided for bank loans to state-owned enterprises and private entities are to be raised from 10% to 15% of GDP.

Also, the ratio of debt to GDP target envisaged in 2013 has been moved to year 2030. When the Act was initially approved in 2003, it was targeted to reduce the gross Government debt to 85% of GDP by the year 2006, and reach 60% by 2013. It was also expected to maintain the budget deficit at 5% of GDP.

In contrast, today’s debt to GDP ratio is 110% of GDP, and the budget deficit is likely to be over 12% of GDP this year.

Successive governments have never attempted to achieve the stipulated fiscal targets during the last 18 years. As a result, the fiscal situation has deteriorated over the years aggravating the debt burden so much that the Government has to seek assistance even from Bangladesh.

In attempting to avoid embarrassment caused, no politician has the right to claim now that the swap with Bangladesh is an investment but not a loan, as proved in this analysis.

All prescribed budget targets are now postponed by another 10 years, thus passing the much overdue fiscal adjustments to future generations happily!

(Prof. Sirimevan Colombage is Emeritus Professor in Economics at the Open University of Sri Lanka and former Director of Statistics, Central Bank of Sri Lanka, reachable at [email protected])