Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 13 November 2025 00:22 - - {{hitsCtrl.values.hits}}

With demand forecast to rise sharply in coming years, the challenge is not merely to attract tourists, but to ensure that those who serve them are adequately trained, motivated, and retained

Sri Lanka’s hotel and tourism sector, a vital foreign exchange earner, faces a mounting labour shortage. A new study by the National Human Resource Development Council (NHRDC) warns that unless urgent measures are taken to address skills gaps, worker migration, and gender disparities, the sector’s growth prospects could be undermined.

Sri Lanka’s hotel and tourism sector, a vital foreign exchange earner, faces a mounting labour shortage. A new study by the National Human Resource Development Council (NHRDC) warns that unless urgent measures are taken to address skills gaps, worker migration, and gender disparities, the sector’s growth prospects could be undermined.

Key takeaways

Tourism recovery meets workforce shortages

The NHRDC’s Labour Market Trends in Sri Lanka – 2024 report places the hotel and tourism industry at the centre of the country’s economic recovery. Before the pandemic, tourism directly contributed around 4% to GDP and generated more than one-eighth of foreign exchange earnings. The sector also created significant indirect employment in linked industries such as transport, food production, handicrafts, and entertainment, amplifying its overall impact on the economy.

After years of shocks; from the 2019 Easter attacks to the COVID-19 pandemic, the sector began to rebound in 2022. Tourist arrivals more than doubled in 2023 compared to the previous year, and during the first nine months of 2025, arrivals reached 1.7 million, with foreign exchange inflows showing similar momentum. Yet, as demand rises, the supply of skilled workers is failing to keep pace.

The report highlights that the emigration of hospitality professionals to higher-paying markets in the Middle East, Europe, and Southeast Asia has left local hotels struggling to fill essential roles. The outflow is particularly high among experienced staff, weakening mentoring chains and reducing opportunities for knowledge transfer to new entrants.

Labour market gaps in the sector

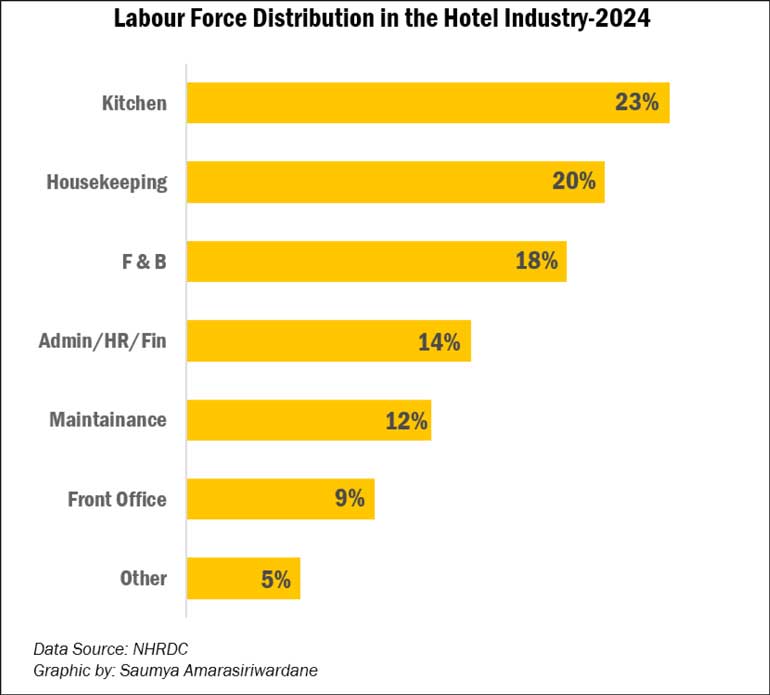

The report identifies several critical workforce challenges:

“Hotels are indeed seeing higher demand in these areas as tourism recovers,” noted a senior Human Resources Director from a leading hotel chain of the country. “These are the most operationally intensive departments, and as occupancy rises, the pressure to fill these roles has become more pronounced.”

While star-class hotels are able to absorb some of the impact by offering higher wages, small and medium-sized hotels, especially those in rural areas, face even greater challenges in retaining staff.

Training and skills mismatches

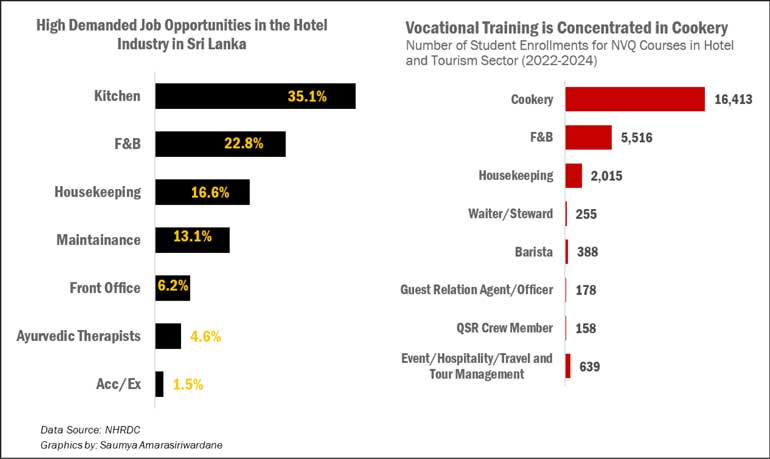

The NHRDC analysis reveals that while vocational training remains central to the industry’s labour supply, course enrolments are highly uneven.

This imbalance has created a clear skills mismatch, with oversupply in some trades and under-supply in others. Guest relations, travel management, and supervisory roles remain underrepresented, despite being critical to service quality and competitiveness.

“Most training still focuses on cookery because of strong overseas demand, leaving fewer professionals prepared for guest-facing and managerial roles,” the HR Director confirmed. “This imbalance makes it difficult to sustain service quality at the higher end of the market.”

The report further highlights that many vocational curricula are outdated and fail to address emerging industry needs. Areas such as multilingual communication, digital hospitality, and customer service excellence remain underdeveloped, leaving graduates ill-prepared for evolving expectations.

Why workers leave

The NHRDC’s survey of 108 hotels found that the majority of resignations between 2020 and 2023 were linked to better job prospects overseas, where hospitality roles offer higher pay, structured training, and more attractive benefits packages.

Other reasons for staff exits include limited career progression, particularly in smaller hotels with flat organisational structures; poor work-life balance due to long hours and irregular schedules; and inadequate benefits and incentives. For women, the lack of flexible hours, insufficient support systems, and safety concerns were cited as key barriers to remaining in the industry.

“Women find it difficult to balance personal and professional responsibilities, especially after marriage,” the HR Director added. “Unless we make the workplace more inclusive and supportive, we will continue to lose a valuable segment of the workforce.”

Policy and industry recommendations

The NHRDC concludes with a series of targeted interventions to strengthen the hotel and tourism workforce:

1. Introduce competitive wage structures to stem the outflow of skilled workers to foreign markets.

2. Expand vocational training programs beyond cookery to include guest relations, eco-tourism, wellness tourism, and digital hospitality.

3. Strengthen public–private partnerships between hotels, training institutes, and government agencies to align curricula with industry needs.

4. Enhance female participation through flexible work policies, safer environments, and childcare support.

5. Implement apprenticeship schemes to provide youth with hands-on training in hotels and restaurants.

“What the sector urgently needs are structured career pathways, diverse training options, and inclusive workplace practices,” the HR Director emphasised. “If we fail to address these areas, we risk undermining the very foundation of tourism’s recovery.”

A critical juncture for tourism

Tourism’s contribution to GDP and foreign exchange earnings underlines its strategic importance to Sri Lanka’s economic recovery. Yet, as the NHRDC cautions, growth will be unsustainable without a skilled and stable workforce.

The sector’s competitiveness will depend on reforms that close skills gaps, improve talent retention, and expand workforce participation. With demand forecast to rise sharply in coming years, the challenge is not merely to attract tourists, but to ensure that those who serve them are adequately trained, motivated, and retained.

For Sri Lanka, retaining and developing talent is no longer a secondary issue, it is the missing link that will determine whether tourism can truly drive the country’s recovery.

(The writer is an Economist at The Ceylon Chamber of Commerce.)