Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 25 January 2019 00:00 - - {{hitsCtrl.values.hits}}

The parallel response from W.A. Wijewardena to my article (http://www.ft.lk/opinion/Ravi-K-alleges-W-A--Wijewardena-involvement-in-private-placements-of-Treasury-bonds/14-67099) which appeared in the Daily FT of 17 January is a welcome gesture.

|

Power, Energy and Business Development Minister

|

|

Former Central Bank

|

It would have been better if I had the same luxury when he carried out unsubstantiated and baseless personal attack on me for many years. My intention was not to discredit anyone, however to bring about the unknown hard facts to the public and expose why Wijewardena wants to attack me. I expected him to have substantiated his response with proper facts rather than bluffing it off as a personal attack.

His hasty denial of facts presented in the above paper shows lack of comprehension. I suggest he should read it carefully and understand the facts and arguments prior to replying. I invite readers to compare facts in both articles and understand the difference.

Attempt to defame late A.S. Jayawardena

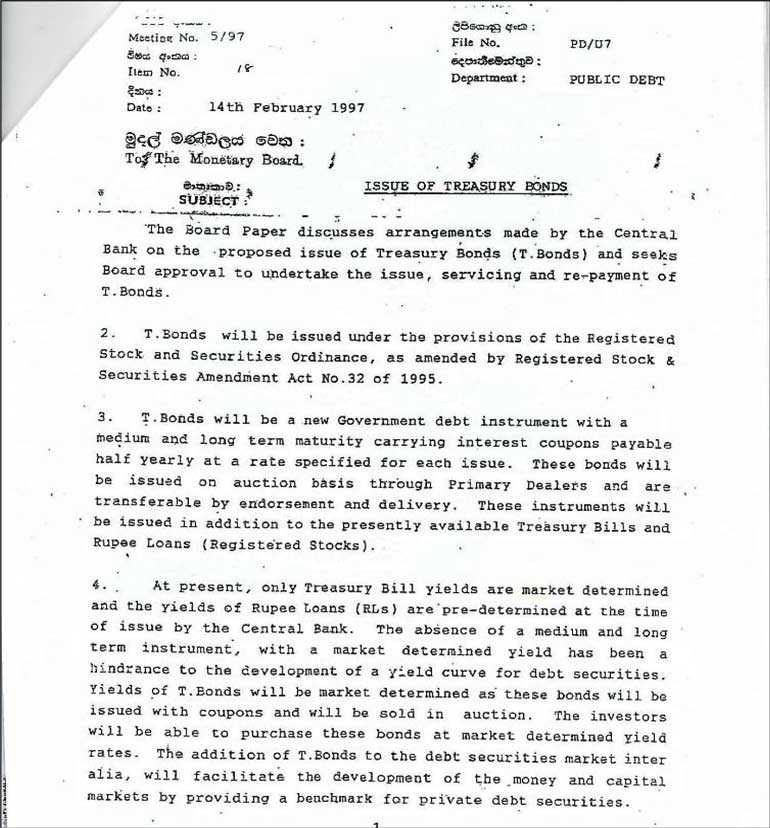

Wijewardena stated that the private placements were product of late A.S. Jayawardena in 1997 when the Treasury bonds (T-bonds) were introduced for the first time in Sri Lanka. He always like to pass the responsibility to deceased people who can’t respond about the matter. It would have also been better if he could produce documentary evidence for his argument to assign the responsibility to late A.S. Jayawardena. However, the documentary evidence produced in my last article clearly exposes his involvement in disastrous private placements.

At the time of introduction of T-bonds, it was clear that the intention of the Monetary Board was to issue T-bonds via public auction (please refer scanned copy of the Board paper dated 14 February 1997). I feel sad about his appalling attempt to vilify visionary economist late A.S. Jayawardena, for whom I have a lot of respect. He introduced T-bonds in 1997 to develop the local debt market to the level in the developed world. At the same time, India initiated debt market reforms, introducing similar market instruments and they are far more ahead of us today in terms of the market development.

Acceptance of the correct term – Private placements

The positive development of Wijewardena’s response is the acceptance of the term “private placements” as the correct name, though he had purposely misled the public in the past with an incorrect term “direct placement”. Although Wijewardena denied, the Monetary Board paper dated 7 October 2008 tabled by him used the correct terminology “private placements”.

The term “private placements” is used when T-bonds are issued at a yield that was not based on any competitive auction and decided by the issuer and the buyer based on their requirements. The Securities and Exchange Commission (SEC) does not recognise “private placements” as a market friendly method of issuing equity securities in comparison to public issues and requires special approval under exceptional circumstances.

Wijewardena introduced this notorious private placements without proper Monetary Board approvals while serving as the DG supervising Public Debt Department. Please refer the Board papers in my previous article. The term “direct placements” is used when T-bonds issued to the buyers after a T-bonds auction at an average yield of that auction within a limited time period. Contrastingly, the rate discretion is much higher in private placement when compared to direct placements.

Certain countries use direct placements but not the private placements. Private placements prevents the development of bond market and participants can easily manipulate the market to engage in fraudulent activities because there is no transparent market-driven rate to compare.

Deceiving readers with cheap tactics

As usual, Wijewardena tries to confuse readers asking how he could steal Rs. 1,000 b since total T-bonds issued by the Government in 2008 is Rs. 1,281 b. Average reader might say ‘Wow! What a brain?’

Wijewardena states in the Bond Commission that the loss caused by bond auction dated 27 February 2015, over the 30-year period was Rs. 10 billion (page 166). For argument’s sake, if T-Bond issue of Rs. 10 b can cause a loss of Rs. 10 b, why can’t private placements worth of Rs. 1,281 b make loss of Rs. 1,000 b?

He, being a former DG and a professional writer, can understand the argument very well. However, he tries to deceive the average reader by using a cheap tactic without professionally answering. If he is a professional as he and his friends claim, he should disprove this with valid arguments.

As explained in my article, the practice of private placements continued for eight years till 2015 without proper internal controls and contrary to the objective of introducing T-bonds, causing colossal losses. The President has revealed in front of media, the losses amount to Rs. 1,000 billion for the period (2008-2014). Undoubtedly, Wijewardena rubbished the figures quoted by the President in this occasion. We should commend the President for his courage and conviction for standing bravely against the bunch of rouges when nobody is even dare to touch them.

It is clear that Wijewardena attempts to confuse the readers, concealing his involvement in causing the above loss. I recall that not only he, his clique in the Central Bank hastily refuted the losses amounting to Rs. 1,000 b, quoted by the President.

Loss quantification

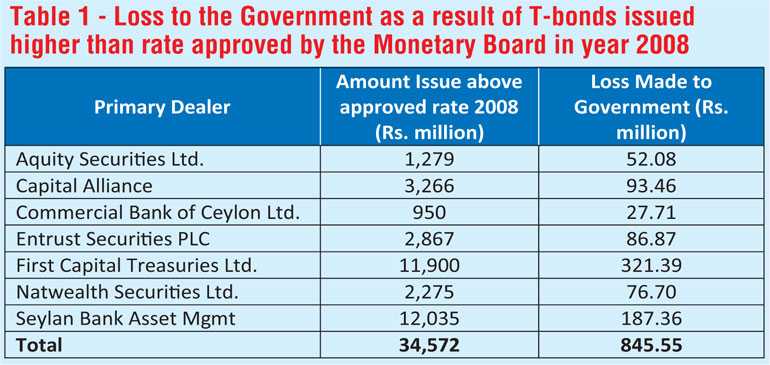

If we calculate the instant direct loss to the Government (or instant profit to the private parties) due to unauthorised action of Wijewardena in year 2008, it was Rs. 845 million. (Table 1). I can show the same calculation for the period 2009-2014 as well.

Malicious intention to defraud EPF money

Wijewardena defends his action to alter the Board paper with malicious intention. If the alternation of the Board paper dated 7 October 2008 is not a fraudulent attempt to intentionally mislead the Monetary Board, he should explain the purpose and reason for rushing it. Wijewardena should also explain why the DG submitted a paper on behalf of the PDD to dictate the terms of investment by the EPF, which is not a Central Bank property.

The said Board paper was not circulated to members of the Monetary Board in advance and it was tabled in hurry. Generally, a Board paper is tabled when an immediate action is required to respond a crisis situation. He should explain the reason for rushing such a decision without giving time for appropriate decision making process to follow when there is no such a crisis.

Selling the war

As he and his network claim, he should disclose the names of the persons and nature of advice he received for raising funds at the time of war by altering a Board paper by hand. The fact is there was no such intimation from the Government. This is his own deliberate decision to exploit the situation.

When our soldiers were fighting the war, sacrificing their lives, in the guise of helping the Government, his attempt was to create a system to benefit private parties in the market. If there was such an urgent financial need, he should have instead sought permission to issue private placements to everyone. The report of the Auditor General clearly presents facts to identify the beneficiaries of his action. His apparent connection to those parties is a well-known secret in the bond market.

Needless to explain how Wijewardena shall respond if such a decision was taken by someone else other than him. Such a decision means the decision to allow corrupt private placements instead of the worldwide accepted auction system.

I shall urge Wijewardena to answer to the question raised in the article as a professional economist without dodging the questions and asking his friends to write about gossip.

Forensic audit

The Bond Commission recommends the Central Bank to carry out a forensic audit. The Commission report states: “Therefore, we recommend that, an appropriate investigation be carried out to ascertain whether there were significant irregularities in the acceptance of direct placements by the Public Debt Department during the period 2008 to 2014 and, if so, to identify the officers of the Public Debt Department and the superior officers of the CBSL, the Primary Dealers and any other persons who were responsible for such irregularities. Such an investigation should also seek to compute the losses, if any, which may have been incurred by the Government as a result of any such irregularities. A forensic audit may be appropriate;”

Wijewardena and his clique within the system will control the selection process of the forensic audit firm. The Bond Commission report accused Dr. Nanadal Weerasinghe, the present Senior Deputy Governor, for his negligence and breach of responsibilities as a Deputy Governor of the CBSL (please refer page 890, 896, 927 and 930 of the report). Surprisingly, the same accused is leading the selection process. Knowing Weerasinghe is a close ally of Wijewardena, I warn upfront about an attempt to cover up the actions during 2008-2014.

It is also reliably learned that the Central Bank had purposefully delayed the procurement process of obtaining services of a forensic auditor, citing a hilarious reason – lack of funds. Therefore, I insist the Central Bank should hand over the selection process of international forensic auditor to an independent party respecting the proclamation of the President without delay. The forensic audit must be conducted to the period of 2008-2014 as recommended by the Bond Commission.

Since the purpose of forensic audit is to investigate the misconduct of certain Central Bank officers in the notorious private placements during 2008-2014, the same officials involving in the selection process will allow them to cover up their misdeeds in the past.

Reportedly, there was an instance where a judge was changed hearing a case related to Central Bank because of his spouse is employed in the Central Bank, the same principle should apply in this case. Under no circumstance should the alleged senior officials, who could suppress the truth, be allowed to be involved in the above selection process.

While welcoming the decision to conduct a forensic audit from 2008-2014 period as a step towards exposing the real culprits if properly done, I should say it can be simply calculated as described below.

The report of the Auditor General lists out all the bonds issued via private placements from 2008-2016 with details of the buyer, price and yield rates with corresponding market yields. It is not a difficult task to analyse those bonds one by one and calculate the direct loss to the Government, as demonstrated in table 1. However, the aforementioned loss of Rs. 1,000 b could be established by a forensic audit, calculating indirect loss to the economy.

Being and living as economist

Wijewardena played down my exposure of his retirement package, citing it is way below his actual package. I should say the stone hit the target. A retirement package of a recently-retired Deputy Governor of the Central Bank comes close to that figure. They are eligible for pension, Provident Fund and lifetime health/other benefits. This package is totally tax free. No one in the public sector receives such a lavish retirement package. This benefit package is way above the retirement package of any public officer. It is certainly higher than the retirement benefits of a ministry secretary, a university professor, and consultant doctor and even the Chief Justice.

As a believer of the capitalist system, I don’t see any issue of paying higher remuneration to a suitably talented person based on contribution, not on seniority. But it is doubtful whether such nourishment of talents could happen within a traditional organisation of the nature of the Central Bank.

Being a public servant, his retirement package should not be private property. As he is being paid from public funds, I believe it is a right of the public to know his retirement package. If he intends to be as transparent as he preaches, he can disclose his retirement package including all the benefits.

The point I tried to raise by disclosing his lavish retirement package is to prove the difference of his policies and his personal life. Someone who benefits from the public funds disproportionately to what an ordinary public servant received at the time of retirement, advised against the salary increase of Rs. 10,000 given to the public sector employees in 2015. That was a small relief to struggling lives. Moreover, salary increase was part of the relief package announced to seek the mandate in January 2015. An elected government has no right to deviate from the mandate.

Lack of internal controls

I questioned why Wijewardena, who served as the DG for Public Debt Department and the Employees’ Provident Fund for nearly a decade, didn’t introduce basic voice recording system for these institutions. Our public debt market is underdeveloped compared to neighbouring India although we started our primary dealer system in the same period. Our country was not able to introduce developments such as electronic trading and central clearing system although India introduced these changes decades ago. The private placements system introduced by Wijewardena completely inhibited the development of our debt market.

Infamous failure of the Government in 2002-2004

I should be thankful for Wijewardena’s acceptance about his involvement in advising the Government during 2002-2004. We all know, thanks to their advice, people sent our Government home well before the term ended. Again the point I try to prove, we as politicians convince the people to vote us for certain policy framework, but our leaders rely on advisors like Wijewardena, thinking of them as professional economists, not knowing their real identity. Economic hit-men try to propagate the agenda of their masters not of the government elected by the people. (I will explain this in a separate article in the future).

He mentioned that I invited him as a very first person to have a one-on-one discussion on the economic policies to be adopted by the Government. True, as a politician who likes to get advice from the professionals, I called him for a discussion. Because I used to believe he was a professional economist who could assist the Government to bring economic prosperity to the general public. Unfortunately, it took time to understand the reality.

As he explained, contrary to his advice “reduction of fuel price is not a good policy because fuel price can increase in the future,” we decided to reduce fuel prices to offer relief to the suffering general public. As an elected politician, my duty is towards the people and we should balance between economic theory and practice in addressing the grievances of the people. Therefore I didn’t listen him on that occasion and reduced fuel prices.

Finally, I wish to remind Wijewardena that he should engage in a professional debate on the subject supported by hard facts and arguments without resorting to cheap tactics to deceive ordinary readers.