Saturday Mar 07, 2026

Saturday Mar 07, 2026

Monday, 22 June 2020 00:00 - - {{hitsCtrl.values.hits}}

Former Finance Minister Mangala Samaraweera has written an open letter to President Gotabaya Rajapaksa on his castigating Central Bank officials last week, demanding results. Following is the letter:

My dear Prime Minister and Minister of Finance,

|

Former Finance Minister Mangala Samaraweera

|

The hysterical manner in which your brother, the President, acted last week in blaming the Central Bank for all our country’s present economic woes prompted me to pen this open letter. In my capacity as your predecessor at the Ministry of Finance, I write to you today not only as the Prime Minister but also as the Finance Minister, under whose purview all aspects of the economy fall.

As the Minister of Finance, Economy and Policy Development, the Central Bank and Treasury – the two State institutions charged with monetary and fiscal policy, respectively – are under your charge. Constitutionally, you are the superintendent of our country’s economy. Of course, this authority is itself subservient to the constitutional provision that the Cabinet of Ministers, not the President or Prime Minister, is “charged with the direction and control of the Republic”.

The tongue-lashing the Governor and other senior officials of the CBSL received from the President, later released to the media by the Presidential Media Division, is unprecedented. Never in the seven-decade long history of our Republic have either the Government or Opposition ever spoken to the Central Bank in such a manner.

Under the full glare of cameras, the President’s outburst publicly humiliated the institution and its officers in a most disgraceful manner. To publicly castigate public officials in such a crabby and aggressive manner is nothing less than an act of bullying. It reflects an inner callousness and meanness of spirit that sets an unfortunate example to our nation’s children.

As ministers who have served for many years, you know as well as I do that from time-to-time a few miscreant officials need a good dressing-down. You and I have put our fair share of officials in their place. But we have always done so in private. In public, we have always defended the honour and reputation of the institutions and officers that silently serve the public. However, we have always resisted the temptation ‘to play to the gallery’ by humiliating government officials in public.

As your predecessor who was in charge of the subject of finance until November last year, I believe it is my duty to defend the Central Bank against the petulant charges that have been unfairly and ungraciously been hurled at them, especially because of your deafening silence. Since you will not speak-up, for obvious reasons, it is my duty to enlighten the public as to the truth.

Sri Lanka’s current economic woes are fundamentally fiscal, not monetary. Therefore, there is only a limited role for monetary policy in this crisis. Even so the Central Bank has undertaken a number of major stimulus activities.

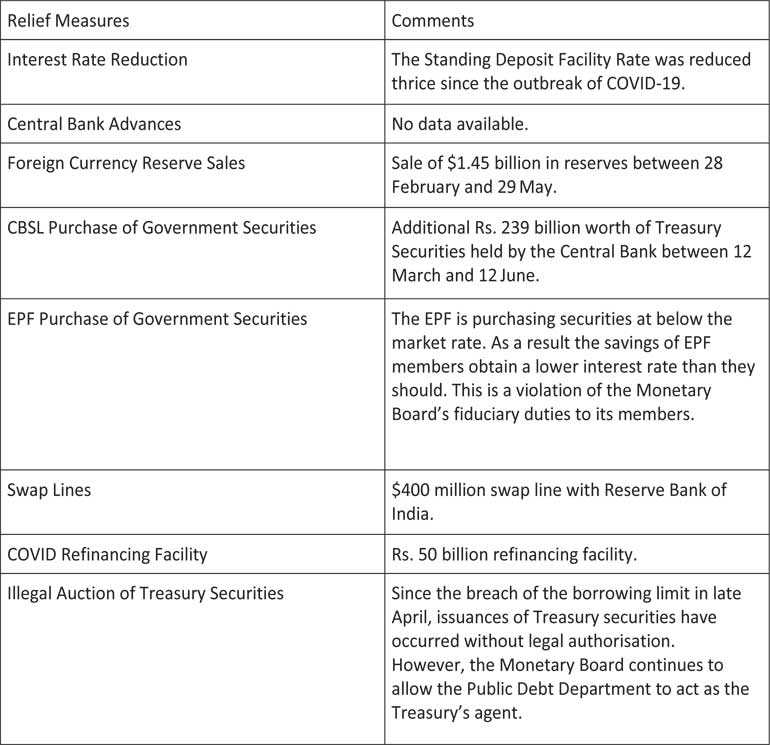

Some of them are well beyond the call of duty – so much so that members of the Monetary Board and Public Debt Department have left themselves open to facing a court of law. As I am no longer a Member of Parliament, I cannot table documents in the House. Instead, I table this non-exhaustive list of measures taken by the Central Bank in the Parliament of Public Opinion.

The President’s accusations have no basis in fact. In fact, they suggest that he is unable to cope with the demands and strain of his great office. This comes as no great surprise considering that he has very little economic, political and policy-making experience.

If he did, he might be aware that your Government has now complete control over the Central Bank.

It lost any semblance of independence on 31 May. Your Government took the unprecedented and irascible step of asking two of five members of the Monetary Board to resign even though their six-year terms were not completed.

Unfortunately, probably mindful of the propaganda blitzkrieg that awaited them if they did not comply, they did as requested. As a result, the three members of the Monetary Board are all appointed by the President.

In fact, the majority (the Governor and Treasury Secretary) effectively serve at the President’s and Finance Minister’s pleasure. However, it is now an open secret that the Central Bank’s politicisation is initiated not by you, but by the true economic czar of the regime. A person once called an ‘economic assassin’ by a senior government minister.

The CBSL has done what was required of them in response to the crisis. They were quick to provide plenty of liquidity and to ensure the integrity of the payments and settlements systems during the worst of the crisis. They have been successful in bringing down interest rates and very quickly articulating the framework for moratoriums that provided breathing space to businesses for the next six months.

In addition, they enabled refinancing schemes to provide working capital loans for SMEs at 4%. This was done whilst provide some cushion for the banking system by relaxing liquidity and capital thresholds.

A Central Bank’s role is to manage the supply and cost of money in order to achieve price stability. The cost of money has come down dramatically, the supply of money has increased to a more than satisfactory level, and inflation remains under control. In other words – the Central Bank has done its job.

To shout and scream at the CBSL in this context simply reflects no understanding of the Central Bank’s role in the economy. The responsibility of driving economic growth and articulating the strategy for economic revival is the role of the Treasury and other arms of the Government.

The President, in his outburst demanded a ‘mechanism’; a monetary relief package, by the next morning. As everyone knows, the fundamental problem is fiscal. The Government needs to spend money or take on the risk for others to lend and spend. In any case, tantrums are not the way to make policy. The President should have appointed an inter-agency working group to study the situation and present a plan of action.

Even better appoint two and then let them pick holes in each other’s analysis so the best decision can be made. I have been asking the Government to enlighten the public as to its economic recovery plan. My pleas have fallen on deaf ears.

Also in response to the President’s demands the CB has further eased the Statutory Reserve Requirement – this simply provides even more liquidity to the system when there is already sufficient and in fact excess liquidity in the market.

The problem is not liquidity. The problem is credit risk. The banks do not want to lend to businesses that have become high risk due to COVID because a default in such lending can directly lead to the loss of depositors’ savings. On the one hand the CBSL is castigated for allowing finance companies to fail and on the other hand they are being asked to push banks to lend to risky businesses setting banks up for failure as well.

To solve this problem the Treasury must provide a partial guarantee of the loans provided by banks for COVID relief – this will ensure banks can lend freely knowing that there is some additional protection for depositor’s funds.

However the Treasury has no funds to provide such a guarantee, and this is not a surprise when the Government decided to slash one-third of Treasury revenue in December last year by implementing drastic tax cuts. The tax cuts had no impact on prices and cost of living and now the Treasury can barely pay salaries let alone provide funds for relief to SMEs. If the Treasury had some revenue they could have implemented the following:

1)A Corporate Bond Buying Program – where stressed corporates issue long-dated corporate bonds which the Treasury purchases and has the option of selling later in the secondary market once stability returns.

2) A Special Purpose Vehicle – for equity investment in SMEs – the SPV could have been set up with Treasury investment which can invest in equity in SMEs. Conditions could be set such as the beneficiary SME must list on the Empower Board of the CSE so that the equity can later be divested. To qualify the SME should be required to retain employment levels and/or get into the export sector.

3)Loan Guarantee Fund – a Treasury fund which provides partial guarantees for loans provided by private banks to share risk and ensure smooth flow of capital through the economy during this stressed time. Again, beneficiaries could be required to retain employment levels.

A government must build up reserves to respond to a crisis. Unfortunately, when the Government throws away all its reserves by slashing its revenue sources before the crisis, it leaves itself weak and helpless when the crisis hits. When this happens, there is no point running to the Central Bank and asking it to print more money.

The Central Bank, as an independent professional institution, has acted with responsibility thus far – but it is now being pushed to the brink. Today Zimbabwe reported inflation for May at 785% – soon it could be Sri Lanka.

Before I proceed to summarise the suggestions I and others have been making for some months, I must place yet another warning on the record. Countless companies and citizens are going to default on their loans.

The market expects the Government to default on its loans. This will place banks in a situation of unprecedented stress.

If further pressure is placed on the banks, it may lead to a banking crisis. And banking crises are much longer and much worse than other crises – including the dreaded case of sovereign default. This is all the more worrying because the Government doesn’t have the fiscal space for a bail-out.

This could all have been avoided. Much of our current woes arise from the unprecedentedly rapid deterioration in our foreign relations. If your Government maintained the ties we had repaired over five years, Sri Lanka would not be in these dire straits today. When you came to office, here is a summary of the economic relationships that we had established.

The largest grant in Sri Lankan history, worth $500 million, from the United States; GSP+ and fishing exports restored to the EU; Indian concessional finance and investments for airports and railways; a huge Chinese free-trade zone in Hambantota and FDI into the Hambantota Port; a free-trade agreement with Singapore; almost interest-free financing for the LRT from Japan.

The world was ready to help and wanted to partner with Sri Lanka. That goodwill was lost within months. The latest news from the Japanese Embassy on the suspension of the LRT is just one example. This is why our stimulus is probably less than 2% of GDP, in contrast to India’s stimulus of 10% of GDP.

There is still a narrow window of opportunity to avoid calamity. When I was your Foreign Minister during your first term, you had the wisdom and sagacity to send me to Washington DC to ensure that Sri Lanka received the MCC Grant. Your Senior Advisor was coordinating the project in Sri Lanka. Unfortunately, because your Government threw democracy and human rights in the dust-bin, the grant was suspended.

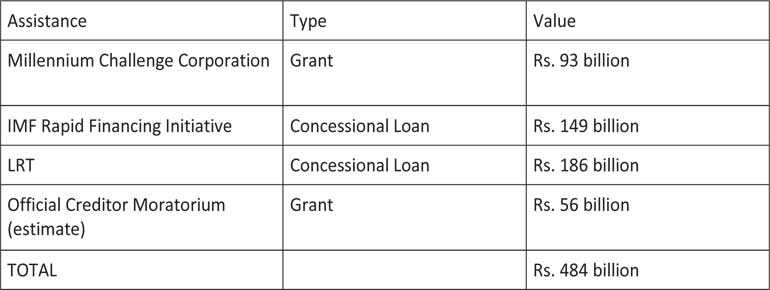

Do not make the same mistake today. If you present a credible economic restructuring plan, ensure human rights, democracy, reconciliation and the rule of law, you can create a COVID recovery fund that is many times greater than the Rs. 150 billion fund so far promoted. Here are my back-of-the-envelope estimates.

Although all of these facilities wouldn’t be able to be disbursed immediately, the IMF’s Rapid Financing Initiative alone would give the Government considerably more space to take on some of the risk of concessional COVID lending. Then there are the measures mentioned in my recent press statement titled ‘A New Deal for Sri Lanka’.

Allow me to conclude by looking to the post-election period. I am sure your advisors have told you that markets expect Sri Lanka to default late this year or next. It will be an unprecedented situation for us all. The rupee will have to be devalued. Our international trade, including exports, will be greatly disrupted. I hope you are preparing a solid plan with international experts who have worked on sovereign defaults before.

I hope you read this letter in the same spirit it was written.

With kind regards,

Yours truly,

Mangala Samaraweera