Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 19 November 2025 00:02 - - {{hitsCtrl.values.hits}}

President and Finance Minister

Anura Kumara Dissanayake

Chandra Jayaratne

Good governance activists and former Chairman of the Ceylon Chamber of Commerce Chandra Jayaratne has written an open letter to President and Finance Minister Anura Kumara Dissanayake with several submissions on Budget 2026 and investments and growth optimisation taking account of the sustainable long-term interests of the Government, Sri Lanka and its people. The letter has been copied to the Prime Minister, Deputy Minister of Finance and Planning, Secretary to the President, Secretary to the Treasury, Governor Central Bank, Senior Advisor to the President, Chairman, Board of Investment, Chairman, Committee on Public Finance, and Country Director, IMF.

The Budget speech 2026 recently delivered by you highlighted with much emphasis the critical need for visionary thought leadership driven timely change management; leading optimisation of investments, sustainable growth of at least seven percent per annum and the assurance of corruption and waste eliminated equitable good governance; optimising factor productivity and enhancing greater value addition to benefit all citizens in all parts of the country in the long term.

It appears, however, that little or no emphasis, nor even a reference, was made to the most obvious sector of the economy to be focused on in strategically and effectively implementing with leadership commitment, to secure in the longer-term the greatest opportunities for sustainable growth, investments and significant economic and social value creation.

Therefore, it is recommended that You, the Cabinet and your advisors strategically address urgently, the challenges in optimising the sustainable exploitation of undersea untapped resources in a manner compliant with the United Nations Convention on the Law of the Sea (which Convention sets out the legal framework within which all activities in the oceans and seas must be carried out).

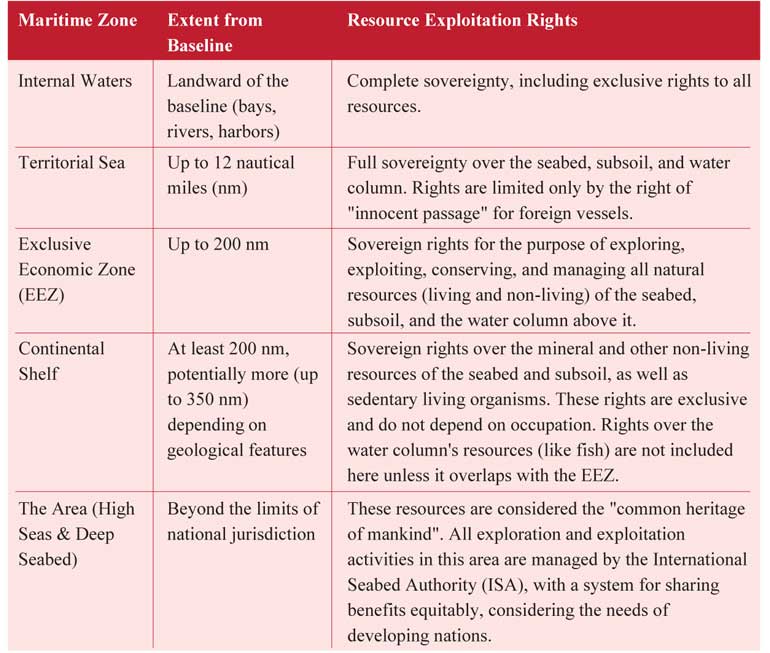

Sri Lanka can inter alia exploit all valuable sea resources within its territorial jurisdictional rights, including those secured under the United Nations Convention on the Law of the Sea (UNCLOS), which paves the way for the rights of nations to exploit under-sea resources, of course varying by maritime zones.

In summary, as a coastal nation, Sri Lanka has exclusive control over resources in its internal waters, territorial sea, EEZ, and continental shelf. Beyond these limits, the International Seabed Authority regulates resource exploitation.

In addition to the exploitation of the coastal belt and territorial sea for under seas resources, (such as minerals, sand, gravel, oil, and gas found on the ocean floor, including polymetallic nodules, seafloor massive sulfides, and cobalt-rich crusts, which contain valuable metals like copper, nickel, cobalt, gold, and rare earth elements), Sri Lanka’s share once our rights under UNCLOS are duly settled in respect of the Bay of Bengal undersea resources, as well as the cobalt-rich resources on the seabed, specifically in an area of the Afanasy Nikitin Seamount falling within Sri Lanka’s recent extension of its continental shelf beyond the standard 200

nautical miles of its Exclusive Economic Zone (EEZ), would expand its jurisdictional rights over the seabed and subsoil resources,. This is possible post competing claims made by other countries, including India, Myanmar, and African country are duly resolved.

It would be essential that the best available Sri Lankan resources team with integrity, expertise and commitment be mobilised by the Government (irrespective of where they reside) and to be duly engaged to develop a strategic plan covering abovementioned value creation opportunities.

This team must address inter alia in its strategic plan the following:

1.Clearly identify what are the exploitable resources within Sri Lanka’s current endowed extents of the seas, as well as all other options as available under UNCLOS and any others not exploited to date (eg. Mannar Basin and other strategic areas of the North, East and South).

2.Clearly identify what remains to be done to secure optimum rights for Sri Lanka under UNCLOS and other treaties, together with an action plan and associated time plan, to ensure optimum rights are acquired by Sri Lanka on a timely basis

3.A thorough competitor analysis and timely gather intelligence and information on the strategic steps the competitors are pursuing and identify any consequential risks as well as risk mitigation strategies

4.Develop strategic plans with associated time plans and identified resources requirements to exploit sustainably Sri Lanka’s entitlements, conscious of the consequential international/geopolitical challenges, other sensitivities and risks also being identified along with mapped mitigation actions

5.Clearly agree a strategic risk mitigated approach to be adopted in seeking, selecting and negotiating with international partners in exploiting the resources and the best options for marketing post optimum value addition and including partner remuneration /sharing of resources/profits/cash flows outcomes

6.Identify the best option organisational and operational structures for envisioning, project implementation and management, management information systems, resource management, decision making, oversight and leadership

In the backdrop of giving attention to the above, it is essentially important that all new and presently approved and future to be approved Strategic Development Projects, Colombo Port City Economic Commission Projects and all Board of Investment Projects engaged in strategically important economic activities and those above set limits for investments and grant of concessions be subjected to the following legal and regulatory reforms:

1.All such projects and their management are bound under contractually agreed good governance codes of conduct and ethics (say like that applying to listed Companies) with associated non-discriminatory practices, anti-monopoly practices, sustainability, and consumer protection guidelines

2.All such projects and their management be placed under scrutiny and be subject to strict reporting requirements of the Financial Reporting Act with oversight by the Financial Intelligence Unit; thus assuring compliance with Anti-Money Laundering and Terrorism Financing Regulations, Financial Action Task Force rules and beneficial ownership regulations

3.Accounts, Operations and Financial Statements of all such projects are required to be subjected annually to a compulsory Transfer Pricing Audit and local Economic Value Addition Certification and further required to submit agreed management information to the approving authority

4.Projects engaged in development, marketing and servicing tradable goods and services which optimise local value addition become a priority requirement for grant of tax and other concessions

5.Introduce effective regulatory mechanisms for early identification of any emerging operational sensitivities of these projects, any emerging challenges of geo-political and international relations and any risks of unacceptable communications by third parties damaging investments and investees

6.Remove forthwith all monopoly licencing and exploitation rights granted by previous regimes governing the exploitation of maritime and undersea resources

I stand ready to clarify and expand on any of the submissions and recommendations set forth above.