Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 23 January 2023 01:34 - - {{hitsCtrl.values.hits}}

Commercial and Industrial Workers’ Union and United Federation of Labour President Swasthika Arulingam

CBSL Governor Dr. Nandalal Weerasinghe

JAAF Secretary General Yohan Lawrence

SLAMERP Director General Rohan Masakorala

Apparel, tea and rubber exporters’ associations recently announced that they wished to ‘set the record straight’ on serious corporate fraud allegations made by the Central Bank (CBSL) on non-repatriation of export income and allegations of trade mis-invoicing and transfer pricing. In view of the exporters’ statements, the CBSL appears to be withdrawing its accusations, signalling a possible complicity in economically destructive corporate fraud.

It is also made abundantly clear by the misinterpretation of Sri Lankan monetary law by the CBSL Governor in an interview on 8 December 2022 stating that merchandise exporters can repatriate foreign exchange without having to convert such proceeds. The law of the land states that if funds are repatriated the conversion will happen through the local commercial banks by the first week of the following month after the date of repatriation (see Point 8 of CBSL FAQ on Gazette Extraordinary No. 2251/42, dated 28.10.2021). Only services sector exporters are authorised by law to repatriate proceeds without converting.

In the following account we will show that the arguments of the business elite to absolve themselves from their fraudulent conduct are only prevarications. Accordingly, we call upon the CBSL to undertake a detailed audit of its own procedures and the export sector dynamics and make arrangements to recover the lost foreign revenue.

Childish fables of Joint Apparel Association Forum (JAAF)

In a seemingly bold disclosure out of desperation under the weight of a collapsing economy, the CBSL Governor recently declared that apparel exporters repatriated only 14% of their export income while their value addition or residual income is around 55% of the gross revenue after meeting various foreign exchange obligations. To justify the gap of 41% non-repatriated export income, the JAAF claims that they paid the balance to local suppliers in foreign exchange, especially for petroleum purchases. Any sensible person would understand it is impossible for the garment factories to consume petroleum to the extent of 41% of their gross revenue. If their assertions were true, then out of Sri Lanka’s total petroleum expenditure of $ 4.16 billion during the first 11 months of 2022 the garment exporters alone would have consumed 54% or $ 2.24 billion worth of fuel, which is impossible.

Secondly, it is general knowledge that apparel exporters procure only a few inputs from local suppliers and the rest is all imported. Local suppliers’ inputs usually include knitted fabric, printing and packaging. They form part and parcel of the input cost of 45% from gross revenue. Therefore, even if all local inputs are procured using foreign currency, they need to be paid from 45% attributed to the input cost from gross revenue. Hence, export income after deducting the foreign exchange input costs and other foreign exchange obligations (which is called residual income) should be fully repatriated to prevent 55% value addition in the sector claimed by exporters becoming a ridiculous fallacy.

Garments constitute a technologically backward process resulting in low wages and physically destructive workday lengths and intensities for workers, in contrast to technologically progressive processes of producing inputs. Since the inception of garment manufacturing in Sri Lanka, businesses have failed to reinvest surpluses in producing inputs like yarn and machinery. On the contrary, they have largely siphoned away capital through trade mis-invoicing and destroyed what remains in the economy in conspicuous luxury.

Tea Exporters Association (TEA) fabricating facts on repatriation

Following JAAF’s misleading statement on non-repatriation, TEA also asserted a similarly disingenuous view. The CBSL Governor had underlined that the value addition ratio of the sector is 90% of the total output while the repatriation rate was only 23% from gross revenue. In response, the TEA claimed that they do not enjoy the luxury of keeping income outside the country as its costs constitute 75% of the gross revenue. This is a shameless distortion of facts by TEA.

In 2021 the unit production cost was Rs. 533.13 a kilo of tea whereas the average weighted export price was Rs. 920.76 (CBSL), as much as 72.7% above the cost of production. More importantly, the average weighted export price of tea shot up over 116% to around Rs. 1,990 a kilo in October 2022 from December 2021 (Sri Lanka Tea Board) due to the rupee depreciating over 80% and the increase in the world market price for tea. However, the unit production cost could increase no more than 20-30% given that the estates and exporters brutally suppressed wages that account for over 70-80% of the unit cost. Therefore, the collapse of the rupee, the increase in world market tea prices hand in hand with the suppression of wages multiplied the profits of estates and the franchised tea exporters in 2022, leading to the unprecedented boom in plantation stocks recently.

At current prices, it can be estimated that the unit production cost is only 32% of the average weighted export price of the sector, less than half of the 75% rate claimed by TEA. The export price is a staggering 210% above the unit production cost of the sector. In other words, the weighted average export price of tea is over three times its unit production cost in 2022! This enables them to retain a greater share of the export proceeds outside the country, contrary to what TEA wants us to believe and justifying the initial calculation of 23% repatriation rate in the sector by CBSL.

This means to say that suppression of wages in the export sector as a whole is the fundamental cause enabling the exporters to illegally retain incomes abroad. This in turn worsens the foreign exchange availability in the domestic financial system and hyper-inflation. We therefore demand the increase in export sector wages by the rate of currency depreciation.

Response of Masakorala and CBSL Governor on illegal capital outflows

Instead of reinvesting in expanding and transforming the production structure, the economy’s surplus is stashed away through non-repatriation and trade mis-invoicing to the tune of over $ 40 billion between 2009 and 2018 according to Global Financial Integrity, the widely cited Washington based think tank. Its report further notes that this figure is a gross underestimation of trade mis-invoicing in Sri Lanka given that it limited its analysis to trade based on Open Accounts and did not consider services and trade based on Letters of Credit. It is to be noted that the latter accounts for a large share of Sri Lanka’s total international trade.

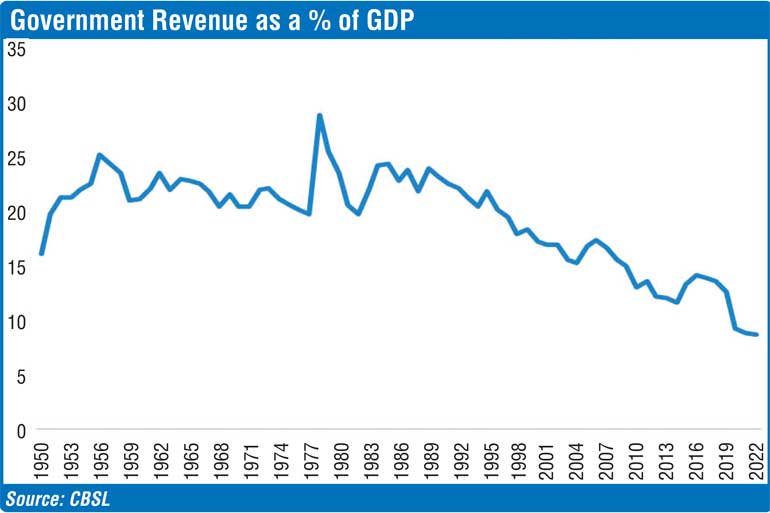

Illicit capital outflows also led to collapsing tax revenue over the past few decades, which corresponds with proliferating BOI firms in mid-1990s (see given graph), the primary agents of capital flight through transfer pricing and trade mis-invoicing. Sri Lanka’s tax revenue as a share of the GDP averaged between 22% and 24% until the mid-1990s. It collapsed to 8.7% by 2022 primarily as a result of under-invoicing exports and imports, and over-invoicing imports made possible by zero percent import tax on inputs for BOI firms and the other sweeping tax holidays they enjoy. Even after imposing draconian taxes on people through the 2023 Budget, the Government can only expect a 2.6% increase in the tax income to GDP ratio in 2023 to 11.3%.

This modest increase in 2023 compared to the enormous collapse of the ratio over the years is also projected to be highly unrealistic. The Government nor the CBSL, however, seem to have any intention of addressing corporate corruption leading to this colossal and catastrophic loss of tax revenue.

In this regard Rohan Masakorala, Director General of Sri Lanka Association for Manufacturers and Exporters of Rubber Products, states that no one can blame businesses for shifting capital out according to the law of the land. We thank Masakorala for admitting that businesses have shifted capital abroad and now it is up to Masakorala to specify the laws of the land that gave the right to transfer capital through trade mis-invoicing and transfer pricing.

The CBSL Governor Dr. Nandalal Weerasinghe stated that between 1994 and 2016 the law allowed businesses to stash their foreign exchange incomes out of the country (see his interview on 8 December 2022). What is the law that allowed businesses to illicitly transfer foreign exchange belonging to Sri Lanka and not generated by them, by means of fraudulent invoicing and transfer pricing?

In fact, it was the CBSL who warned us in 2006 in its own publication titled ‘Preventing Money Laundering and Combating the Financing of Terrorism’ that the country is suffering an outflow of funds through trade mis-invoicing. It states that “money launderers tend to use international trade to effect their laundering activities by the means of inaccurate pricing (mis-invoicing) of imports and exports to hide the transfer of funds. For example, over-invoicing of an import will permit the transfer of funds outside the country.” Even the Justice Minister Wijeyadasa Rajapakshe told the Parliament recently that $ 53 billion was transferred out by exporters in the last 12 years.

In this light, we demand both the CBSL and the Government to take immediate action to repatriate the illegally transferred funds and bring the perpetrators to justice. We demand the Government to setup a Parliamentary Select committee with competent persons without conflict of interest to investigate the matter and recommend strong punitive and remedial action.

Demand for debt cancellation

When national savings and external borrowings are illicitly siphoned out of the economy, the capacity of a country and its people to survive and let alone prosper would soon end. However, both international law and US domestic law hold that the burden of proof lies with the creditors when there is widespread evidence of chronic misuse of external borrowings. Creditors should reclaim the funds from those who are accused of misusing or embezzling it, and not from the people who suffered under their control.

The legal doctrine of odious debt makes an analogous argument that sovereign debt incurred which does not benefit the people is odious and should not be transferable to a successor government.

Applying this principle, Sri Lanka could declare that debts will be treated as illegitimate through an arbiter like the United Nations. Numerous African nations are already demanding the same in collaboration with the United Nations Conference on Trade and Development (UNCTAD) asserting that illicit capital flight through trade mis-invoicing and transfer pricing drained more capital from its region than it received through foreign debt and aid over the past decade.

The recently published statement signed by 182 eminent economists and academics around the world support this position on debt cancellation in Sri Lanka citing the impact of illicit capital flows through trade mis-invoicing and transfer pricing. They underline that illicit capital flight is estimated to be greater than Sri Lanka’s foreign debt during past 15 years. Instead, the government is pushing the cost of economic collapse solely onto the people by imposing unbearable indirect taxes, privatisation and slashing essential expenditures. This unjust and unsustainable status quo must end.

Swasthika Arulingam,

President,

Commercial and Industrial Workers’ Union and

United Federation of Labour

Signed on behalf of:

Ceylon Bank Employees’ Union, Ceylon Estate Employees’ Union, Ceylon Federation of Labour, Ceylon Teachers’ Union, Dabindu Union, Engineers’ Services Professional Association, Families of the Disappeared (Human Rights Organisation), Federation of Media Workers’ Trade Union, Mass Movement for Social Justice, Movement for Land and Agricultural Reform, National Fisheries Solidarity Movement, National Trade Protection Council, North South Solidarity Group, Professionals’ Centre for People, Protect Union, Satahan Media, Sri Lanka All Telecommunication Employees’ Union, Stand Up Workers’ Union, Textiles Garments and Clothing Workers’ Union, United Fishermen’s and Fish Workers’ Congress, Young Lawyers’ Association, Sugath Kulathunga – former Chairman of Sri Lanka Export Development Board, Prof. (Dr.) M. P.S. Magamage – former Chairman of National Livestock Development Board, Gratien A. Peiris – former Chairman of Sri Lanka State Engineering Corporation and Value Chain Expert, Kalpa Rajapaksha – Senior Lecturer in Economics and PhD Student, Amali Wedagedara – Political Economist and PhD Student, Dhanusha Pathirana – Economist