Saturday Feb 21, 2026

Saturday Feb 21, 2026

Saturday, 21 June 2025 00:05 - - {{hitsCtrl.values.hits}}

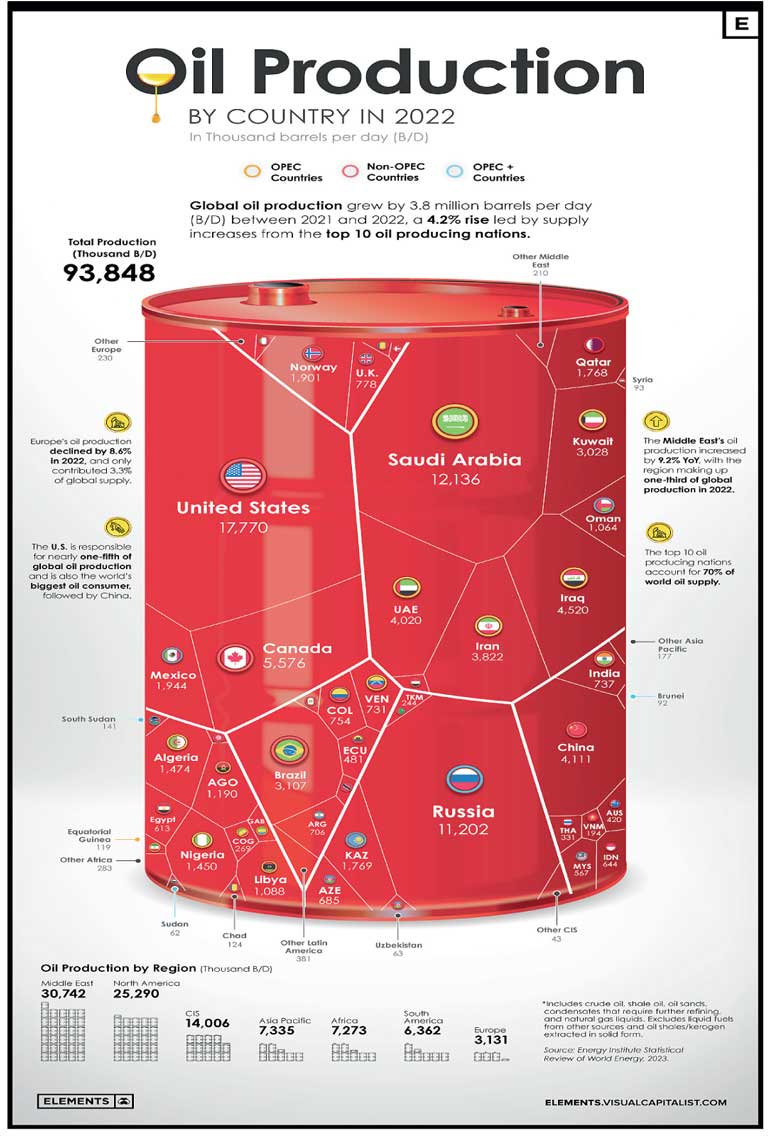

The countries of the Middle East play a vital role in the global economy and are often referred to as the engine of the global economy, as the region lies at the heart of the world’s energy system. It holds nearly half of the world’s proven oil reserves and about one-third of its natural gas reserves. Nations such as Saudi Arabia, Iran, Iraq, Kuwait, and the United Arab Emirates are key to meeting global energy demand.

The countries of the Middle East play a vital role in the global economy and are often referred to as the engine of the global economy, as the region lies at the heart of the world’s energy system. It holds nearly half of the world’s proven oil reserves and about one-third of its natural gas reserves. Nations such as Saudi Arabia, Iran, Iraq, Kuwait, and the United Arab Emirates are key to meeting global energy demand.

Key maritime routes, especially the Strait of Hormuz—through which one-fifth of the world’s oil supply passes—highlight the region’s strategic importance in both geopolitical and economic terms. Oil price stability is closely tied to the political and logistical conditions in this area. Any disruption in the region sends shockwaves through the global economy, affecting everything from fuel prices in Europe to manufacturing output in Asia.

The Middle East has historically been perceived as the world’s primary supplier of fossil fuels, often reduced to the moniker of the “global fuel station.” However, this view no longer captures the full breadth of the region’s multifaceted economic significance. Today, the Middle East represents a critical node in the global economy—one that connects continents, facilitates trade, channels financial capital, drives innovation, and influences geopolitical dynamics. In an era marked by geopolitical realignments, climate transition, and technological disruption, the Middle East is not only maintaining its relevance—it is evolving into a diversified economic powerhouse.

Strategic trade corridors and global commerce

The Middle East occupies a pivotal geographic location, bridging Asia, Europe, and Africa. Its strategic importance is underscored by major maritime trade routes such as the Suez Canal, the Strait of Hormuz, and the Bab el-Mandeb Strait. These waterways handle trillions of dollars in goods annually, forming the logistical backbone of global commerce.

Financial power and global investment

Beyond energy and trade, the Middle East wields substantial financial influence through its sovereign wealth funds (SWFs). Entities such as Saudi Arabia’s Public Investment Fund (PIF), the Qatar Investment Authority (QIA), and the Abu Dhabi Investment Authority (ADIA) collectively manage trillions of dollars in assets. These funds play a decisive role in shaping global investment trends, with allocations in infrastructure, technology, real estate, green energy, and even global sports leagues.

Simultaneously, countries like the United Arab Emirates are positioning themselves as international financial hubs by leveraging liberal investment laws, world-class digital infrastructure, and free economic zones. These reforms have attracted significant foreign direct investment (FDI), transforming the Gulf into an emerging centre of capital allocation and financial innovation.

Labour mobility and remittance flows

The Gulf Cooperation Council (GCC) countries are home to millions of migrant workers from South Asia, Southeast Asia, and Africa. These labour migrants are essential to the functioning of Middle Eastern economies, particularly in sectors like construction, healthcare, and domestic services. At the same time, they send billions of dollars in remittances back to their home countries—such as India, Pakistan, Bangladesh, Sri Lanka, Nepal, and the Philippines—supporting household consumption, foreign exchange reserves, and poverty alleviation.

This labour ecosystem has created a two-way economic dependence: while the Middle East benefits from an affordable, flexible workforce, several developing economies depend on this income for macroeconomic stability. Any disruption in labour markets—due to regional conflicts or economic downturns—can send economic shockwaves well beyond the Gulf.

Innovation and technological leadership

Although traditionally associated with hydrocarbons, the Middle East is increasingly making its mark in global innovation. Israel, often dubbed the “Startup Nation,” is a global leader in fields such as cybersecurity, biotechnology, agricultural technology, and water resource management. These innovations are exported across continents, addressing challenges from food security in Africa to climate resilience in Asia.

Meanwhile, countries like the UAE and Saudi Arabia are investing heavily in digital transformation, artificial intelligence, smart city infrastructure, and clean energy. These initiatives—anchored by programs like Saudi Vision 2030—aim to diversify economic output and elevate the region’s role in the global knowledge economy.

Tourism, culture, and soft power

As part of their economic diversification agendas, many Middle Eastern nations are turning to tourism and cultural diplomacy. Saudi Arabia has launched heritage tourism projects and relaxed visa restrictions under Vision 2030. The UAE has hosted global mega-events like Expo 2020 in Dubai. Qatar, after hosting the FIFA World Cup 2022, continues to invest in sports and entertainment as part of its broader nation-branding strategy.

These initiatives not only generate economic revenue but also contribute to the region’s soft power, influencing perceptions, attracting investment, and integrating the Middle East more deeply into global service industries and aviation networks.

Geopolitical weight and global market influence

The Middle East’s geopolitical dynamics continue to exert a profound influence on global economic stability. Conflicts involving Israel, Iran, Yemen, and Syria, as well as broader regional tensions, directly impact global oil prices, investor confidence, and diplomatic alignments. The region’s central role in OPEC+ also grants it the ability to influence energy supply and pricing, which in turn affects inflation, monetary policy, and industrial output globally.

Major powers—including the United States, China, Russia, and the European Union—maintain significant strategic interests in the Middle East, whether through military presence, energy dependencies, or diplomatic engagement. The region’s stability is therefore not just a regional concern, but a global imperative.

Regional conflicts and global economic repercussions

Current tensions between Iran and Israel underscore the extent to which regional conflicts can destabilise the global economy. Iran controls critical infrastructure, including its proximity to the Strait of Hormuz, through which nearly one-fifth of global oil flows. Israel, in contrast, represents a hub of technological and defence innovation.

Should these tensions escalate further, the global economy would likely face:

Asian economies are particularly vulnerable due to their dependence on Middle Eastern energy and remittances. Referring to the Middle East merely as the “world’s fuel station” is a significant understatement. The region is a complex, multi-dimensional driver of the global economy. It underpins energy security, facilitates vital trade flows, powers financial markets, sustains labour migration, and leads technological innovation.

As the global economy navigates structural transitions—such as climate change, digital transformation, supply chain realignment, and shifting geopolitical alliances—the Middle East will remain indispensable. Its ability to adapt and diversify will not only shape the region’s future but also influence the trajectory of the global economy for decades to come.

(The writer is a researcher in the legislative sector, specialising in policy analysis and economic research. He is currently pursuing a PhD in Economics at the University of Colombo, with a research focus on governance, development, and sustainable growth. He holds a Bachelor of Arts in Economics (Honours) from the University of Jaffna and a Master’s degree in Economics from the University of Colombo. His academic background is further strengthened by postgraduate diplomas in Education from the Open University of Sri Lanka and in Monitoring and Evaluation from the University of Sri Jayewardenepura. In addition to his research work, Muralithas has contributed to academia by teaching economics at the University of Colombo and the Institute of Bankers of Sri Lanka (IBSL), and has also gained industry experience as an investment advisor at a stock brokerage firm affiliated with the Colombo Stock Exchange.)