Friday Feb 27, 2026

Friday Feb 27, 2026

Wednesday, 18 June 2025 00:36 - - {{hitsCtrl.values.hits}}

Once a thriving local industry, it is now idling due to price distortions that make imported finished oils cheaper than domestically processed alternatives

Sri Lanka’s ban on palm oil imports, which began in 2021 due to environmental concerns, along with high taxes on locally made edible oils, is now causing serious problems for the country’s economy. The impact goes beyond cooking oil shortages—key industries like food, tourism, and manufacturing are also feeling the pressure, making it harder for the country to recover from its recent economic crisis.

Sri Lanka’s ban on palm oil imports, which began in 2021 due to environmental concerns, along with high taxes on locally made edible oils, is now causing serious problems for the country’s economy. The impact goes beyond cooking oil shortages—key industries like food, tourism, and manufacturing are also feeling the pressure, making it harder for the country to recover from its recent economic crisis.

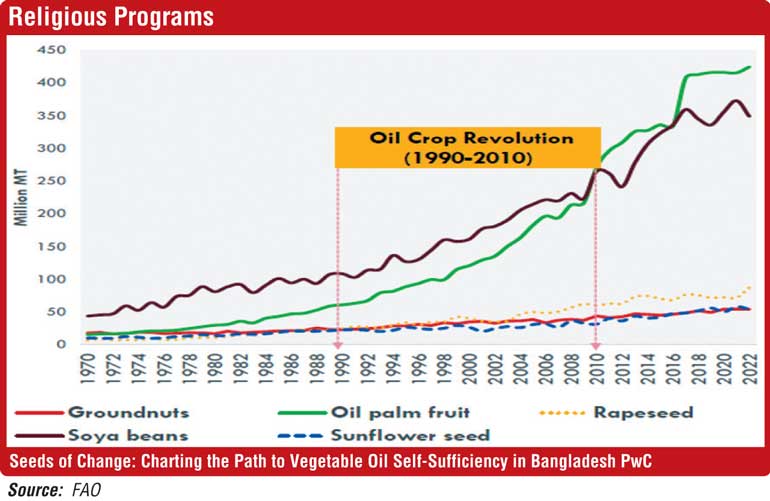

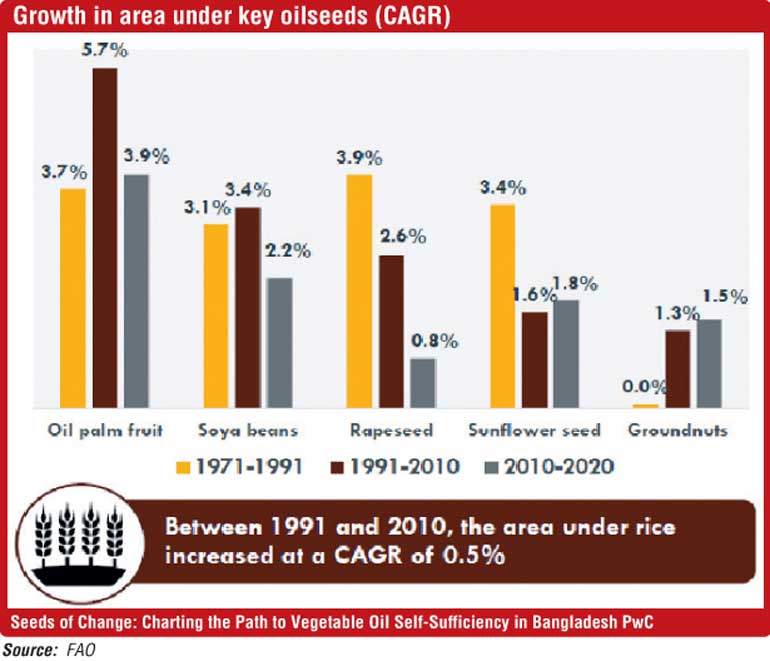

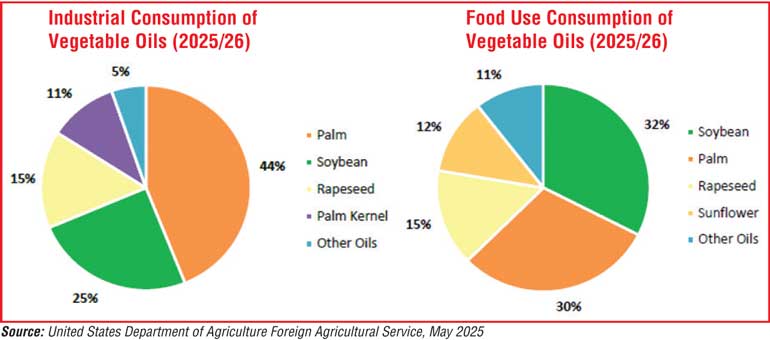

Palm oil holds the largest market share in the world

Among the vegetable oils, palm oil emerged as the largest segment (https://www.imarcgroup.com/vegetable-oil-processing-plant). Accordingly global prediction (https://www.custommarketinsights.com/report/edible-oil-market/), by 2034, the valuation is anticipated to reach $ 362.80 billion. Today, palm oil is produced in Indonesia and Malaysia, which account for more than 85% of the world’s supply. Other than that, there are 42 countries that produce palm oil. Sri Lanka therefore has a huge potential.

Several factors drive the strong demand for palm oil. Its low cost and high yield make it an economical choice for both consumers and industries. Palm oil is widely used in the food industry for frying, baking, and in processed products like snacks and sweets. Beyond food, it is a key ingredient in cosmetics, detergents, and biofuels, making it valuable across various sectors. Additionally, palm oil’s long shelf life and stability at room temperature make it easy to store and ideal for warmer climates, further boosting its popularity.

Palm oil ban: A double-edged sword – import ban and tax regime

The licensing requirement introduced in April 2021 under Gazette No. 2222/31 effectively blocked the import of crude palm olein, a critical input for domestic edible oil refining. In tandem, the Value-Added Tax (VAT) of 18% and the Social Security Contribution Levy (SSCL) of 2.5% were imposed on locally refined oils starting January 2024 and October 2022, respectively.

These changes have crippled Sri Lanka’s domestic oil refining sector. Once a thriving local industry, it is now idling due to price distortions that make imported finished oils cheaper than domestically processed alternatives.

Palm oil—one of the world’s most affordable and versatile edible oils—had been a staple in Sri Lanka’s food processing industries, ranging from cooking oil to confectionery and bakery production. Prior to 2021, local businesses imported crude palm olein, refined it domestically, and distributed it for both consumption and industrial use.

Due to current import licensing restrictions and the effective ban on palm oil, Sri Lanka now depends heavily on importing refined coconut oil, which is much more expensive. Industry estimates show that the global price difference between crude palm olein (World Bank: 981 USD/tonne in April 2025) and refined coconut oil (2483 USD/tonnes in April 2025) has increased to around $ 1,500 per metric ton. This leads to a foreign exchange loss of about $ 15–20 million every month—or $ 150–200 million per year.

Some may wonder why we don’t just meet the demand by producing more coconut oil locally. The answer is that the current capacity of Sri Lanka’s coconut oil industry is very limited—it can meet less than 20% of the total demand.

According to the Coconut Development Authority (CDA), Sri Lanka’s annual coconut oil requirement is approximately 240,000 metric tons. Of this, only about 40,000 metric tons are produced locally, accounting for roughly 16.7% of the total demand.

Furthermore, reports from the Coconut and Coconut Related Manufacturers Association highlight that more than 177,000 metric tons of coconut oil are being imported annually to bridge the gap between local production and demand. This heavy reliance on imports underscores the limited capacity of the domestic coconut oil industry.

Foreign exchange drain and revenue losses to the Government

The shift from crude palm olein to refined coconut oil has also affected Government revenue from customs duties. Crude palm olein carries an import duty of Rs. 255 per kilogram, while refined coconut oil is taxed at only Rs. 150 per kilogram. This means the Government loses Rs. 105 for every kilogram of substitution.

With Sri Lanka importing around 15,000 to 20,000 metric tons of edible oil each month, the estimated monthly loss in customs revenue ranges from Rs. 1.5 to 2.1 billion. Over a year, this adds up to a significant loss of Rs. 19 to 25 billion. When trying to fix budget shortfalls, policymakers must also consider the revenue losses caused by such poorly thought-out decisions.

Sri Lanka now spends an additional $ 15–20 million per month to import high-priced refined oils, compared to earlier when crude palm oil was imported and refined locally. This results in an annual foreign exchange drain of $ 150–200 million, undermining the country’s tight balance of payments and recent gains in rebuilding forex reserves.

Taxation anomalies threaten local industries

In a double blow to the local industry, a Value-Added Tax (VAT) of 18% was imposed on domestically refined edible oils starting 1 January 2024, on top of the 2.5% Social Security Contribution Levy (SSCL) that has been in place since October 2022. Although intended to support fiscal consolidation, these taxes have had a severe impact.

“These taxes have made local manufacturing completely uncompetitive,” said a spokesperson from a major oil refinery in the Western Province. “Imported finished products are not subject to these levies, but our locally refined oils are. As a result, many factories have shut down, and more than 5,000 jobs are at risk.”

Furthermore, the burden of high direct taxes is pushing many businesses into the informal economy -shadow economy-, negatively affecting overall economic stability and growth.

Ripple effects on the tourism and hospitality sector

Sri Lanka’s hospitality and tourism industry, a vital source of foreign exchange and employment, has been particularly affected. Many hotels, resorts, and restaurants—especially in coastal tourism hubs like Galle, Arugam Bay, Bentota, and Jaffna—depend heavily on affordable, high-quality vegetable oils for food preparation and service.

“We used to purchase locally refined palm oil for our kitchens, which was economical and efficient for large-scale cooking,” said the executive chef of a luxury hotel in the Southern Province. “Now we are forced to buy expensive imported alternatives like sunflower or refined coconut oil, which has increased our food costs by 30–40%.”

Impact on local food manufacturing and exports

The confectionery, bakery, and processed food industries—which heavily rely on palm oil for products like biscuits, chocolates, margarine, and shortening—are also suffering.

Several manufacturers who export products to South Asia and the Middle East have reported delays and cost overruns, undermining Sri Lanka’s position in regional export markets. Industry experts estimate a 20–25% drop in edible oil-based processed food exports in the last fiscal year.

“The government is unintentionally punishing an entire value chain—from small bakeries to multinational exporters—by making local raw material unaffordable or unavailable,” said a spokesperson from the Food Processing sector.

Packaging, transport, and ancillary industries affected

The decline in domestic edible oil production has led to downstream consequences for industries such as packaging, printing, logistics, and transport, all of which supported the once-robust edible oil sector.

In particular, local packaging companies that supplied containers, labels, and wrappers to domestic refiners have seen demand plummet. Some have shut down operations or laid off workers. This also affects rural employment, as many of these facilities were located outside urban centres and provided stable jobs for youth and women in less developed districts.

Food inflation and consumer impact

The shortages in locally refined oil have led to increased dependence on higher-priced imports, pushing up costs across the food sector. Items like biscuits, chocolates, bakery fats, and daily cooking oil have seen retail prices surge by 15–25% year-on-year, adding pressure to already burdened households amid high inflation and stagnant wages.

Environmental intent vs. Economic reality

Government officials had defended the import restrictions as necessary for environmental sustainability and to reduce reliance on palm oil plantations that pose threats to biodiversity. However, critics argue that without a parallel push for domestic oilseed alternatives or subsidies for local producers, the policy only deepens economic vulnerability.

While there may be long-term ecological benefits, no comprehensive transition plan has been introduced to fill the supply gap with sustainable alternatives such as sesame, sunflower, or soya oil cultivation. Nor has there been substantial investment in green refining technologies or smallholder support.

Risk of illegal imports and regulatory loopholes

This is another area concerned. It is common in Sri Lanka, with formal channels constrained, market insiders report a rise in informal smuggling of palm oil, primarily through ports in the Northern Province. These black-market operations not only undermine State revenue but also risk compromising quality and safety standards.

Call for policy reversal and tax reforms

Industry associations and chambers of commerce are urging the Government of Sri Lanka (GoSL) to reverse the import restrictions on crude palm olein and remove the VAT and SSCL on locally manufactured edible oils, reinstating the tax structure as it stood before October 2022 (SSCL) and January 2024 (VAT).

“We need to restart our idle factories before they shut down for good,” said one factory owner. “Not long ago, the Government encouraged this industry—then suddenly banned it, without considering the impact on those already involved. The Government must now choose between economic survival and poorly planned protectionist policies.”

In summary, as Sri Lanka struggles with rising food prices, low foreign reserves, and growing fiscal deficits, it is crucial to adopt a balanced and practical policy on edible oil imports and local production. The longer the current situation continues, the greater the economic damage—from lost Government revenue and unused factory capacity to job losses and increased hardship for consumers. Policymakers must realise that a poor decision can end up costing far more than any short-term gains from higher taxes.

(The writer is a Senior Professor of Economics specialising in policy analysis, entrepreneurship, industrial economics, economic development, microfinance, SME development, gender budgeting, Green SMEs, and the SDGs. He also has extensive experience in project planning. He can be reached at [email protected].)