Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 16 December 2021 00:00 - - {{hitsCtrl.values.hits}}

Daily FT and ICC Sri Lanka, in association with Colombo MBA Association, China-Sri Lanka Business Council BCG and ACCA, organised a webinar with a rather broad-range topic which centred on the Budget proposals of the Finance Minister, for the year 2022. This webinar was intended to be quite different from other discussions or webinars on a similar topic, given that the focus needed to extend beyond the paragraphs in the proposals presented in Parliament.

Daily FT and ICC Sri Lanka, in association with Colombo MBA Association, China-Sri Lanka Business Council BCG and ACCA, organised a webinar with a rather broad-range topic which centred on the Budget proposals of the Finance Minister, for the year 2022. This webinar was intended to be quite different from other discussions or webinars on a similar topic, given that the focus needed to extend beyond the paragraphs in the proposals presented in Parliament.

The vast network of global business interests and also stakeholders within the corporate community in Sri Lanka and their constituents in business, trade and commerce, have expressed serious concern in the light of the many negative factors that have impinged on the current status quo of the country and its economy. With much that is speculated upon arising from the regularly emerging news of the parlous state of much-needed foreign reserves, and the serious curtailment in the facilities available for importers to operate their daily production and business activity.

There were three keynote speakers, starting with Central Bank Governor Ajith Nivard Cabraal. The Governor underscored the theme of ‘Projections, Possibilities, Policies and Opportunities’ that can be discovered in Budget 2022. Cabraal spoke of the surprising range of possibilities that are being actively taken on in the northern peninsula that would, in time, provide for import substitution, with vibrant agriculture and other industrial initiatives funded by loans given by the Central Bank. An example he quoted was of an entrepreneur who was engaged in exports centred on a completely homegrown supply of materials processed into an ‘exotic’ item that was eminently sellable overseas.

He continued saying that in the future, within what is envisaged in the proposals in the Budget, the economy will achieve a growth of 6%, even after having endured the impact of the global pandemic and the erosion in the economy in the past couple of years. He was confident that investments will be activated in Sri Lanka, even as better discipline will be leveraged on in the time going forward, which would lead to improvement in the fiscal aspects as well as in maintaining a good rate for the Lankan rupee in the overseas market.

“Further positive outcomes will accrue with the projected aviation hub, maritime hub, Port City, healthcare and other ‘massive’ projects that offer wider possibilities. Vast investments are being made for infrastructure such as 100,000 kilometres of roadways due for construction, and which will yield opportunities for commercial activity to flourish. This will initiate a ‘trickle- down effect,” he said.

Forex crisis

In his capacity as moderator, ICCSL Chairman Dinesh Weerakkody directed a question to the Governor about what would be done when the foreign reserves in dollar might run out by next year. The Governor responded by indicating that this was the same question asked with regard to 2020 and 2021, where it was said by some, that Sri Lanka would face a shortage of dollar in those years, but it proved to be different, and now they declare that we will run out of dollar in 2022, but in the end we should have survived without a serious outcome, and then in 2023, we shall face the same challenge and be successful with the cash-flow measures that are being taken and the solutions that are being brought to bear.

The Six-Month Roadmap has been set up for the time ahead. The Governor was confident that the Sri Lankan rupee will not see further depreciation in the next year. To the question as to the inability for LCs to be opened, the response was that the debate goes on as to what is essential and what is non-essential, but that the issue will be sorted out in the end when the dollar reserves return to a higher level.

He was also positive with regard to the tourism industry returning to normality soon, with the vaccination programs being in place adequately, and the structure of the hotels industry still intact, and there is every reason to be confident that these will generate the needed revenue the moment the tourists arrive in Sri Lanka.

In closing, he again reiterated that the Government will not be approaching the IMF for a solution. He added that he was not of a mind to add pain to the people, which was what the IMF measures would do. He preferred to follow the option of receiving the support of friendly governments and getting rid of unsustainable state assets and enterprises. He indicated that investors should be mature enough to see the potential in investing in the Colombo Stock Exchange.

Food crisis

Speaking next, Central Bank of Sri Lanka former Senior Deputy Governor W.A. Wijewardena offered a somewhat different point of view. He asked how effectively the budget has addressed the main burning issue faced by the country today. That, he observes, is the missing link in the budget. They are the possibility of facing a severe food shortage due to low production, inability to import essential medicines, fuel, and foods due to lack of foreign exchange, and the Government’s gradual movement toward bankruptcy.

A Government becomes bankrupt when it cannot finance its expenditure programs through normal tax channels and is forced to print money in excessive amounts to fill the gap. All these, except the last one, relate to the fragile external sector of the country. Offering an attractive income tax and value added tax concession resulted in a drop of revenue by a minimum of Rs. 500 billion in both 2020 and 2021.

Wijewardena stressed that the missing link in the budget is also the silence about the sickness of the economy. The budget has come up with expenditure proposals without a sufficient revenue base. There are some one-time revenue proposals made, but such temporary measures will not help the Government to continue the promised expenditure programs. He also expressed his lack of confidence that the Six-Month Road Map will be able to deliver what is envisaged. Wijewardena was of the firm opinion that seeking the restructuring via the services of the IMF was the prudent course.

Economic recovery

The third of the speakers was Subram Ramaswamy, a senior advisor with the BCG. He said that no one in reality expected the budget to be a panacea for all ills. Nevertheless, Subram picked out some of the strategies that were included in the proposals that were designed to drive the economic recovery, and cited some of those, such as the one-off tax to be levied to organisations that were earning large profits. Another being the setting up of technology parks that would invite investment. Digitalisation as an enabler and focussing on initiatives to meet climate change challenges. Another positive was the demand for KPIs in the provision of funding of State institutions or organisations. Such an ‘accountability’ structure being in place appeared to be the wiser course.

Subram did observe that the revitalisation of the tourism industry was vital, but hoped that there would be more assistance, counting it as urgent, and that solution was not built in, within the proposals. Another notable example in Subram’s commentary was the need for planning by the Government of Sri Lanka. This is very important, going forward.

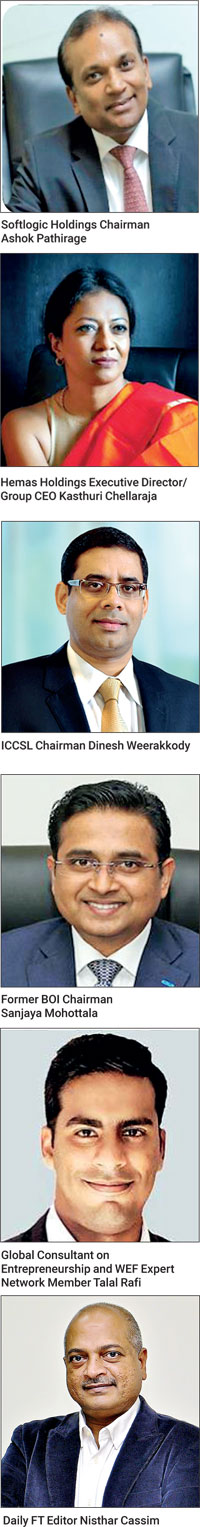

The panel discussion followed the presentation by the speakers. The panel comprised Softlogic Holdings PLC Chairman Ashok Pathirage, ICTA and Director General Telecommunications Regulatory Commission of Sri Lanka Chairman Oshada Senanayake, Member of Parliament Dr. Harini Amarasuriya, Tax Ernst & Young Senior Partner and Head Duminda Hulangamuwa, Hemas Holdings PLC Executive Director/Group CEO Kasthuri Chellaraja, Global Consultant on Entrepreneurship and Member of World Economic Forum Expert Network Talal Rafi, People’s Bank Chairman Sujeewa Rajapakse, Hatton National Bank CEO Jonathan Alles, and Diesel & Motor Engineering PLC Group CEO Gahanath Pandithage.

Policy consistency

Ashok Pathirage observed that the goals which were set by the Government to achieve progress and the development of both the economy and commerce and industry, were already identified. What was required was the way to overcome the hurdles and to go ahead and achieve results, and in this way, the budget has now addressed the way forward; he said that when a country is in difficulty then the private sector has to sacrifice and do what is needed to support the economy, and what else is to be done? The low margins in the profit area means that the tax will have to be passed on the consumer. There will be price increases.

Kasthuri Chellarajah noted that the budget was trying to be consistent but was also inconsistent. Generating revenue obviously is a key factor, but the approach has to be sustainable rather than ad hoc. She wonders how sustainable the proposal is with regard to the suddenly introduced taxes. Also, the budget has been drafted in the context of the country grappling with dwindling foreign reserves, but as it is, those proposals and taxation schemes do not inspire the external view. Alternate debt sources might not present themselves.

From the private sector perspective, she saw no clear demarcated productivity improvement provisions, that would succeed in generating the revenue that is vitally needed to reduce the growing deficit, which keeps expanding year on year. With taxation, she too was of the opinion that low margin industries and their middlemen (SMEs) will face difficulty. Further, there is no clarity, she says, in how the monies extracted from the private sector profit were going to be used, by whom and where spent.

BOI Exporters Chairman Sanajaya Mohottala said we needed peace of mind with regard to what exactly was possible to achieve within the provisions proposed in the budget. The idea of export manufacturing locating to different areas and purpose-built parks (away from the Western Province) is a good one, and those provisions when rolled out will make for better business for small and medium scale exports and also very large ones. However, there will not be an inflow of foreign exchange in the short term with such recommendations.

There is a great deal of back and forth with understanding how the approval process will be expedited, given that there is now a ‘banned exports’ factor to contend with. When asked about Port City development, Mohottala was confident that, although there is slowness in its take off, there will be development such as would enable or invite FDIs.

Cost of living

Dr. Harini Amarasuriya MP was asked about the Budget not offering any relief to those that have to grapple with a high cost of living. She responded, saying that the budget failed to address the serious issues being faced by the national economy, with either short term or long term, workable proposals. The issues are not new, but have been manifest over decades of not being adequately dealt with, and now the emerging situation does not augur well with rising inflation, the bad situation that has come up in the agricultural sector and possibly a very dark period of instability that will accrue with food shortage compounding the issues.

These facts are not confronted in the proposals for 2022, and she felt that it would be a bad year starting. Especially for the vulnerable. She commented on the political culture that prevails, where the public service sector is expanded for the aggrandisement of the political agendas of individuals and are rendered subservient. If there are remarks that indicate that the public service is a burden, then the question begs to be answered on how it is that they became a burden.

Way forward

Oshada Senanayake expressed the thoughts that it would be an exercise in futility to try and build an economy in the same manner and with the same responses as prevailed pre-COVID. Rather, Senanayake said that there needs to be a frank analysis of the strengths and weaknesses and to then engage in building on a fresh approach taking those strengths into consideration without pining for what is now firmly in the past. All countries are now needing to strategise on the existing realities. This means that Sri Lanka needs to move into technology as a principal facilitator.

His view was that the idea of Lanka being a technology hub that reaches out to offer services in the Asian region is one that needs working on. In this regard successive governments have failed to recognise the strength and the need for the telco industry. This is not about telephony, it is about connectivity in the most significant and all-encompassing sense, and investments need to continue in this industry. For that, he said, the tax policy has been beneficial.

Since the budget does allude to moving forward with 5G in the future, he said that new revenue options have to be considered to be able to fund the adjustment to embrace the fresh avenues in technology that will prevail. Auctioning was recommended to offer spectrums to the highest bidder rather than handing over favours to political friends.

Talal Rafi underscored the need for human capital that has the skills to drive the next wave of growth.

Sujeewa Rajapakse, responded to the proposed tax surcharge and how it affects the banks. He felt that a substantial 60% of the revenue in the banks will be paid as tax, and in the case of the bank, unlike in the trade area, they cannot pass on the burden to customers. But the tax payable will be a sizable amount.

Gahanath Pandithage was asked about the motor trade and the impact of the budget and the parlous state of the foreign reserves that impact on imports. He replied with the thought that since there was a genuine difficulty that Sri Lanka faced, it made sense to refrain for some time from the import of passenger cars and SUVs. But commercial vehicles are vital for any economy for transporting produce and also for work in the construction industry. The panellist in general noted the serious impact the COVID-19 pandemic has had on business and livelihoods and has now combined with a mounting financial crisis to pose a serious threat to Sri Lanka’s development and future prosperity. Certainly, they noted 2022 would pose a huge challenge to the growth of the private sector.

The session was moderated by ICCSL Chairman Dinesh Weerakkody and Daily FT Editor Nisthar Cassim.