Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 16 January 2026 00:02 - - {{hitsCtrl.values.hits}}

By The Advocata Institute

By The Advocata Institute

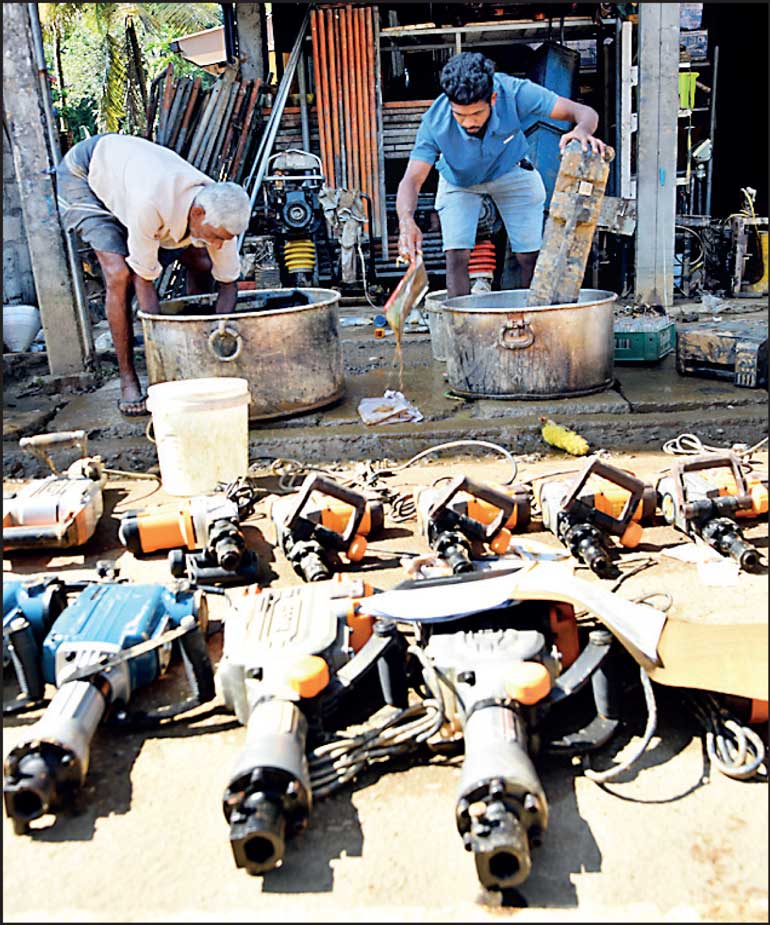

In the past weeks, newspaper headlines have brought to the forefront a growing narrative that banks are prospering while SMEs are struggling. This outcome has largely been attributed to banks overlooking the impact of external shocks on SMEs and to the current lending frameworks that govern credit markets. Such headlines call for independent statutory mechanisms to probe the fairness of cases leading to credit enforcement. Whilst such concerns are understandable on moral and ethical grounds, urging for artificial interventions in credit markets risks promoting policies that undermine the very mechanisms that enable growth, particularly at a time when economic recovery is urgently needed.

Credit is an avenue available for SMEs to fund their current economic activity based on expected future outcomes. It can be used for investment, as working capital, and to smooth out cash flow volatility. Increased access to credit plays a critical role in stimulating aggregate demand and supporting businesses, especially during periods of recovery.

Many of these sources argue that SMEs were viable before being subject to repeated external shocks in the Sri Lankan economy, such as the Easter Sunday attacks, shutdowns as a result of the Covid-19 pandemic, the economic crisis, which led to the collapse of the currency, and extreme interest rate volatility, as well as repeated climate related disruptions (for instance Cyclone Ditwah). Thus, their inability to service loans has not been attributed to poor entrepreneurship but the repeated exposure to such events beyond their control. While this claim carries weight, calling for the intervention in market mechanisms that govern financial and credit markets could potentially have an effect of worsening the very problems such interventions aim to resolve.

This is because credit inherently involves an element of risk. Repayment is uncertain, and therefore default is always a possibility. Risk varies by borrower, sector, and timing. Credit exists precisely because uncertainty exists. As a result, lending decisions are based on expected cash flows, collateral, sector risk, and macroeconomic conditions. Moreover, exogenous shocks to the economy are systematically taken into consideration. Interest rates and parate execution laws, and asset recovery mechanisms exist to balance risk and return. The higher the risk, the higher the price of the loan. This is necessary because if loans fail, it is ultimately the depositors and by extension the financial system that is compromised. Painting banks as villainous actors can have the opposite of the intended effect. Laws are in place to regulate the conduct of financial institutions for the benefit of all.

This is because credit inherently involves an element of risk. Repayment is uncertain, and therefore default is always a possibility. Risk varies by borrower, sector, and timing. Credit exists precisely because uncertainty exists. As a result, lending decisions are based on expected cash flows, collateral, sector risk, and macroeconomic conditions. Moreover, exogenous shocks to the economy are systematically taken into consideration. Interest rates and parate execution laws, and asset recovery mechanisms exist to balance risk and return. The higher the risk, the higher the price of the loan. This is necessary because if loans fail, it is ultimately the depositors and by extension the financial system that is compromised. Painting banks as villainous actors can have the opposite of the intended effect. Laws are in place to regulate the conduct of financial institutions for the benefit of all.

Sri Lanka is currently emerging from one of its major economic crises, and therefore, in such a precarious environment, banks cannot simply ignore risk without threatening their own survival and, by extension, the stability of the nation’s financial system. As the Governor of the Central Bank, Dr Nandalal Weerasinghe stated, “The banking system is the custodian of this money. If something happens to the system, the savings of the entire country could be lost». He made these comments at a seminar held on 20 December at Kandy City Centre, which was aimed at educating the SMEs in the Central Province on the assistance available from state and private banks to rebuild businesses damaged by national disasters.

Financial Repression Theory, developed by McKinnon (1973) and Shaw (1973), argues that government intervention in financial markets hampers economic growth in developing countries. Government policies such as interest rate ceilings, interference with market pricing of risk and directed credit, distort credit allocation. In this instance, interventions that are supported by such newspaper narratives risk reducing the pool of loanable funds in the market, thus reducing the amount of credit that is available for productive investment. This could also expand the informal sector in a country’s economy and increase illegal lending practices. Other potential drawbacks include an increase in financial exclusion, resulting in credible borrowers and first-time borrowers being unable to secure loan approvals, thus reducing both the quantity and quality of investment, ultimately stifling economic growth.

As the fourth pillar in a democratic society, a country’s media should definitely hold institutions accountable for malpractice. However, it should be noted that credit  markets do not function on morality alone and that they function based on economic incentives. Framing one side as a villain in one’s narrative maybe rhetorically effective but when interventions in capital markets are encouraged, this opens the door to further distortions and in the long run, it is often the most vulnerable who bears the costs of these changes. Moreover, banks and financial institutions that are absorbing the risks of such ventures should not be discouraged, especially in the current context of an economy such as Sri Lanka that urgently needs investment-led economic growth. Therefore, we must ensure that public discourse supports and not undermines the delicate balance that credit markets depend upon.

markets do not function on morality alone and that they function based on economic incentives. Framing one side as a villain in one’s narrative maybe rhetorically effective but when interventions in capital markets are encouraged, this opens the door to further distortions and in the long run, it is often the most vulnerable who bears the costs of these changes. Moreover, banks and financial institutions that are absorbing the risks of such ventures should not be discouraged, especially in the current context of an economy such as Sri Lanka that urgently needs investment-led economic growth. Therefore, we must ensure that public discourse supports and not undermines the delicate balance that credit markets depend upon.