Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Thursday, 28 August 2025 02:36 - - {{hitsCtrl.values.hits}}

|

| Deloitte Sri Lanka and Maldives Director - Corporate Secretarial Disna Perera |

Deloitte Sri Lanka views the Companies (Amendment) Act No. 12 of 2025, which was officially certified and passed into law on 4 August 2025, as a major milestone for the country’s corporate sector and a critical step in strengthening the governance framework.

With 21 amendments introduced, the legislation improves the regulatory framework for business operations, enhances transparency, and aligns Sri Lanka with international standards such as those set by the Financial Action Task Force (FATF) and the Asia-Pacific Group on Anti-Money Laundering (AML). These reforms are not only about compliance, but also about building investor confidence and helping Sri Lanka position itself as a trusted and competitive business hub.

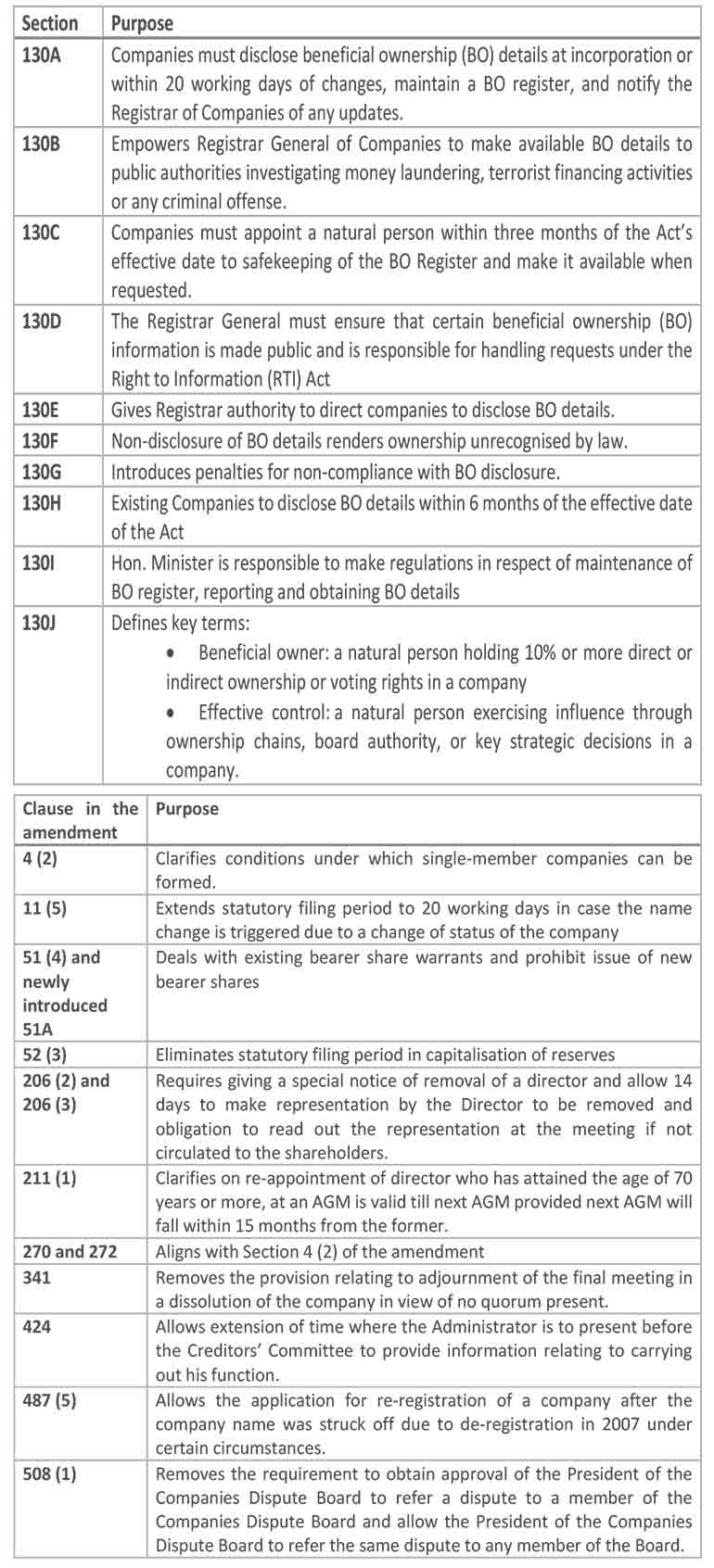

The most transformative update is the introduction of beneficial ownership disclosures under sections 130A to 130J. This requires companies, including offshore and overseas entities registered locally, to disclose and maintain up-to-date records of their beneficial owners. Deloitte observes this move strengthens accountability and aligns Sri Lanka with international anti-money laundering standards, creating a more transparent environment for investors.

Beneficial Ownership (BO) Disclosures

From a practical perspective, businesses will need to have a proactive approach. Deloitte highlights that companies must establish reliable systems to capture beneficiary data, manage records securely, and ensure compliance with reporting obligations under the Registrar of Companies. While these requirements may initially seem demanding, they ultimately support a healthier business climate and prepare Sri Lanka for the FATF mutual evaluation scheduled for 2026.

Among the other key changes are updates to long-standing ambiguities in the Companies Act No. 07 of 2007. Deloitte notes that these clarifications will bring more consistency to corporate law, giving companies a clearer framework to operate within.

Clarification and Resolution of Ambiguities in the Companies Act No. 07 of 2007

Other amendments also reflect a push towards stronger enforcement. These include new provisions (Section 484A) allowing extensions of time to furnish information requested by the Registrar, along with the introduction of a general penalty clause (Section 513A) for cases of non-compliance where specific penalties are not already in place. Deloitte views these changes as essential to ensuring that the reforms are not just legislative intent but are backed by structured enforcement.

As Sri Lanka moves towards reforms implementation, the success of these reforms will depend on digital infrastructure, inter-agency collaboration, and strong stakeholder engagement. Companies will need to balance transparency with privacy, following the Personal Data Protection Act (PDPA) to handle sensitive data responsibly. Deloitte advises businesses to adopt digital tools to streamline data collection, automate compliance processes, and identify potential risks, such as Politically Exposed Persons (PEPs), within ownership structures.

For listed entities, tracking beneficial ownership of foreign investors will be a particular challenge. Deloitte notes that solutions can be drawn from regional practices, such as India’s approach with the Securities and Exchange Board requiring updates through Designated Depository Participants. Similar mechanisms could be considered in Sri Lanka to strengthen oversight in capital markets.

Deloitte Sri Lanka and Maldives Director - Corporate Secretarial Disna Perera said: “Transparency and governance are no longer optional, they are the foundation for sustainable business. These reforms will challenge companies to raise their standards, but they will also create a level playing field that benefits the entire economy.”

Deloitte sees the Companies (Amendment) Act No. 12 of 2025 as more than a regulatory shift, it is an opportunity to embed trust and accountability into the way Sri Lankan businesses operate. By making compliance an integral part of governance, companies will not only meet international expectations but also unlock greater long-term value. Deloitte remains committed to guiding organisations through this transition, helping them turn regulatory requirements into strategic advantages for sustainable growth.