Thursday Feb 26, 2026

Thursday Feb 26, 2026

Wednesday, 13 March 2024 00:00 - - {{hitsCtrl.values.hits}}

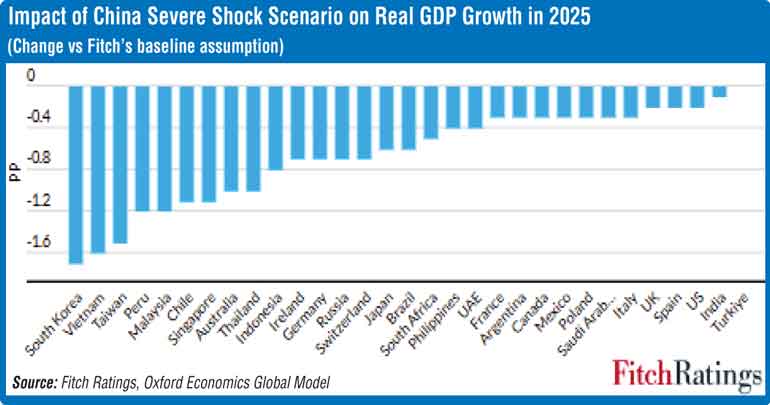

Fitch Ratings believes that economies in the Asia-Pacific (APAC) and commodity exporters would be particularly affected under a severe downside stress scenario in China. There would also be a dampening effect on international price pressures.

Fitch’s analysis released last week, based on internal modelling using the Oxford Economics Global Economic Model, sees vulnerabilities in Vietnam, Korea, Taiwan, Hong Kong, Malaysia and Singapore, through their strong economic linkages with China.

It also suggests Middle Eastern energy exporters, such as Bahrain, Kuwait, Iraq, Qatar and Oman, would see slower real GDP growth. However, this does not capture factors such as Qatar’s long-term LNG supply contracts, which we think should make its exports less sensitive to short-term shifts in Chinese demand, limiting the hit to its GDP.

Other commodity producers with exposure to Chinese demand would also be affected, including Peru, Zambia, Chile, Australia and Indonesia. Developed markets outside APAC are generally less affected.

More subdued Chinese demand would cool global inflationary pressure, opening up room for more monetary easing in some economies. Brent crude prices would be about 15% lower over 2024-2025 on average, compared with our baseline assumptions. World metal prices would be over 20% lower on average, compared with our latest projections, over the same period.

Fitch said the main impact of the scenario on ratings is likely to be felt by low-rated sovereigns that face tight external financing constraints and have high dependence on Chinese commodity demand. Some commodity importing economies could see external liquidity strains ease, benefiting credit profiles, with lower commodity prices more than offsetting weaker Chinese demand. Rating effects would also be influenced by other factors, including governments’ fiscal responses to the China slowdown.