Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 17 July 2020 00:00 - - {{hitsCtrl.values.hits}}

By R.D.R. Jayampathi

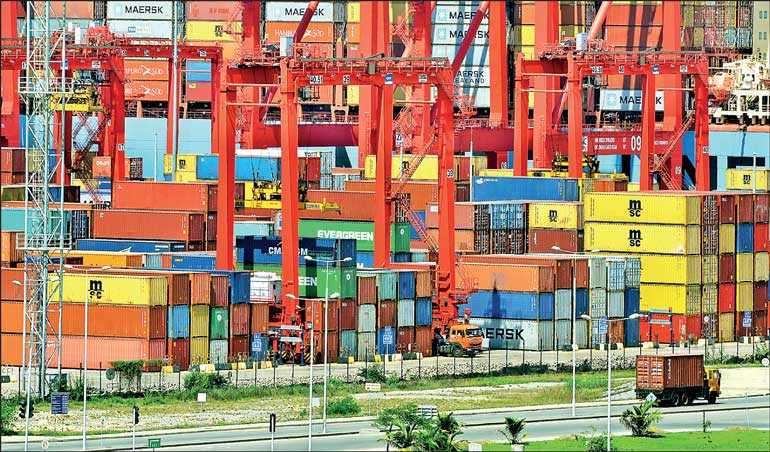

Sri Lanka has imposed increasing levels of controls on imports since March. While this was partly a reaction to a balance of payments crisis, the restrictions are also intended to promote domestic industrialisation.

A strategy of import substitution based on setting up domestic trade barriers can lead to a number of pitfalls resulting in grossly uneconomic practices. If such a policy is to be counted a success it must increase both economic output and

productivity.

The most important question is that of productivity. The inevitable result of protectionist policies is that it can lead to the formation of small-scale, inefficiently operated firms that survive only as a consequence of the prohibitive barriers imposed against competing imports. The inefficient firms become a drag on the economy causing long term harm. The more widely applied the policy, the greater the potential damage.

If we examine the impact of trade restrictions in terms of output, it initially causes a contraction in the import and distribution trade, hence a reduction in the output of that particular sector. The impact is not solely on the trade in goods however, the multitude of support services associated with imports will also face a decline including finance (banking, insurance), logistics (transport, warehousing), retail distribution and local ship/clearing agents. Even government revenue will suffer as imports slow; customs contributes a little over half of all revenue so other taxes will need to rise to compensate.

For the import substitution strategy to benefit there needs to be a net increase in economic output; the contraction in import related activities must be offset and result in a net increase in activity.

The decline in the import trade following the imposition of controls in April is slowly taking effect but it will take time for any offsetting impact of local production to take place.

Where the protected industries produce intermediate goods, further problems may arise. If the quantity of output is inadequate or is of low quality, industries that depend on these for inputs will suffer, leading to a loss of output, markets or both.

The full impact of these measures will only be evident in the longer run. As similar policies were used extensively between 1956 and ’77, reflecting on the past will be useful.

One objective of these measures is to prevent the erosion of foreign exchange. In the short run this will be achieved due to the reduction in the import trade but will this be sustained if domestic production takes off? In instances where domestic production is not possible the saving will be sustained, but at a price: shortages in the local market.

Where domestic production of finished goods is possible, it may nevertheless be dependent on imported capital goods, intermediate products and raw materials. In such instances the net savings in foreign exchange may be small. Sri Lanka’s past experiments with import substitution encountered this problem:

“The policy makers in Sri Lanka, like their counterparts in other developing countries, expected import-substitution industrialisation to set the stage for self-sustained growth by reduce the heavy dependence of the economy on imports. The reality was quite different, however. While consumer goods imports were reduced substantially, this was achieved at the expense of increased reliance on imported capital goods and raw materials, resulting, contrary to expectation, in an even more rigid dependence on imports” – Athukorala and Jayasuriya (2004)

Nor was this phenomenon confined to Sri Lanka; Jaleel Ahmed identifies it as a common problem in his survey of issues. (Import Substitution – A Survey of Policy Issues, 1978).

As per Central Bank statistics food imports in 2019 made up around 10% of total imports while imports of other manufactured goods made up approximately 34%. The bulk of the imports are made up of intermediate goods (including fuel) and capital equipment (including vehicles). This indicates a high dependence on imported inputs which means a widespread ban will choke local industry.

This is happening, for example Harischandra Mills an exporter of processed foods has said production is down 90% due to the lack of the key raw material, ulundu. The drought has affected local harvest and no imports are available so production is curtailed. Local liquor producers have complained that there is a 40% shortfall in the local production of ethanol, compared to market needs. Nor is it only businesses that will be crippled: the CEO of DIMO said that four ambulances were currently out of service – due to the lack of tyres.

Import controls had a similar impact on industry in the 1956-77 era and documented in the literature:

“Unanticipated import curtailments brought about by foreign exchange scarcity turned out to be the main constraint on industrial expansion since the late 1960s” – Athukorale, 1980.

“Ceylon encountered shortages of supplies in various categories of goods. Foreign exchange difficulties have begun to limit Ceylon’s ability to meet her full requirements of raw materials, machinery and spares, not only for accelerating development but also for fullest utilisation of existing capacity” – Central Bank Annual Report, 1964, quoted by Athukorale, 1980.

“Capacity utilisation in industry in Sri Lanka has been low throughout the 1970s. By 1974, largely as a result of foreign exchange shortages, it had dropped to 40%. It rose subsequently to 54% in 1975 and to 60% in 1976, but it was still a low 69% in 1977” – World Bank, 1979.

The constraint on inputs also resulted in slower economic growth.

“Similarly, the [Central] bank ascribed the main weight of the slowdown of economic growth during the period 1964-68 to meagre inflows of development inputs” – Central Bank Report 1969, quoted by Athokorala, 1980.

Another objective of import substitution is to diversify the structure of domestic production and reduce dependence on foreign sources of supply and demand. Sri Lanka small domestic market imposes a limitation on this strategy, a problem that was recognised as far back as 1965, which lead to attempts to promote export oriented production – Sriyani Dias, 1987.

“The potential for import substitution is already largely exhausted, and although there is scope for widening the product range, the small size of the domestic market will severely restrict demand prospects, even if rapid economic growth is sustained” – WB 1979.

Although tax concessions and a relaxation of foreign exchange restrictions were offered for export-oriented foreign ventures in 1966 (and reaffirmed in 1972) it was unsuccessful due to the unfavourable policy environment for private sector activities. The rapid increase in investment and exports only took place after various restrictions were removed in 1977.

The small market size also impedes achievement of scale economies which may mean that industries suffer structural inefficiencies necessitating long-term protection which is detrimental to productivity: “Limited market size means that the unit cost of production for the local market alone is unavoidably high for many products.”(WB, 1979).

It is rather ironic that yet another balance of payments (BOP) crisis has brought the country a full circle: to solutions that were tried in the 1960s. At that time there was no clear experience to draw on, many countries experimented with import substitution but the East Asian countries quickly abandoned them-and prospered.

Sri Lanka’s own experience was that ISI did not solve the foreign exchange crisis and actually lead to increased dependency on foreign inputs. Tight controls on exchange then strangled growth. The 1956-1977 era was characterised by a stagnant economy, unemployment, hardship and as a result; rising social tensions.

The pandemic is taking a heavy toll on the economy. The Government should not make matters worse by returning to policies that failed in the past.