Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 10 November 2025 01:50 - - {{hitsCtrl.values.hits}}

President and Finance Minister Anura Kumara Dissanayake pauses to smile at Opposition during his 4-hour presentation of the 2026 Budget in Parliament on Friday

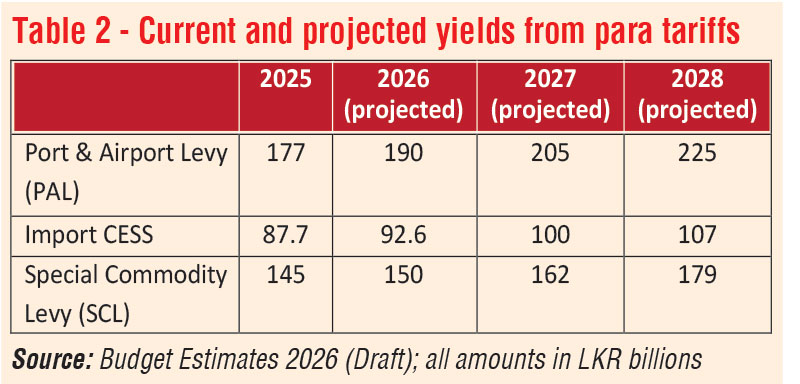

The Government’s praiseworthy statements about phasing out para tariffs are contradicted by the ever-increasing revenue yields projected by the Treasury (shown in Table 2 above). “Progressive elimination” promised by the Secretary to Treasury must be reflected in decreasing yields from each of the anti-growth para tariffs. Instead of general statements with no timelines, what is needed is a specific schedule for the phasing out of these counter-productive taxes with reductions starting now. If that process is started with this Budget, the people will gain relief. One of the biggest barriers to effective participation by Sri Lankan enterprises in global production networks will be removed

The Government’s praiseworthy statements about phasing out para tariffs are contradicted by the ever-increasing revenue yields projected by the Treasury (shown in Table 2 above). “Progressive elimination” promised by the Secretary to Treasury must be reflected in decreasing yields from each of the anti-growth para tariffs. Instead of general statements with no timelines, what is needed is a specific schedule for the phasing out of these counter-productive taxes with reductions starting now. If that process is started with this Budget, the people will gain relief. One of the biggest barriers to effective participation by Sri Lankan enterprises in global production networks will be removed

The NPP Government’s second Budget was a unique opportunity to make innovative public policy. Sadly, the opportunity may be missed. But there still is time.

The NPP Government’s second Budget was a unique opportunity to make innovative public policy. Sadly, the opportunity may be missed. But there still is time.

The Public Financial Management Act (PFMA), No. 44 of 2024, which extends the revenue and expenditure limits of 15.3% and 13% of GDP, respectively, beyond the duration of the Extended Fund Facility constitutes a disciplinary framework. Our Budget makers are not used to this kind of discipline. But such limits will keep us safe from the pain of a second default. Embracing them can also unleash our creativity.

The options of walking away from the IMF agreement, as President Gotabaya did in 2019, and rescinding or amending the PFMA, for which the NPP has the votes, exist. But in our current circumstances the price that would have to be paid for either action would be excessive.

The problem

It is broadly accepted that the people of this country paid a high price for the economic recovery. The micro and small enterprises that went out of business have not come back. The near-poor who got thrown into poverty are still below the poverty line.

Those whose professions allowed them to increase their incomes, ranging from doctors in private practice to plumbers, have done so. But the lost purchasing power of estate workers and Government employees has not yet been regained.

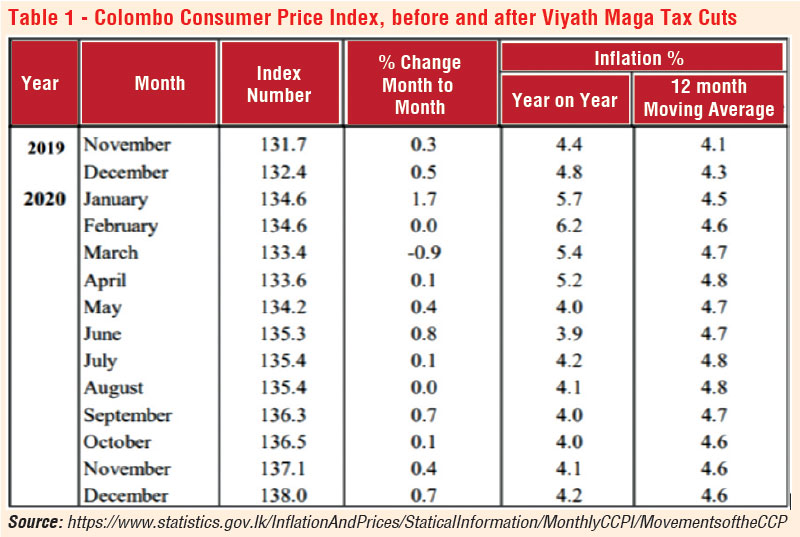

Given the difficulties of increasing salaries (as demonstrated by the convoluted mess which is the solution proposed for the problem of estate workers), the optimal solution would seem to be that of reducing the cost of living. Reducing the VAT rate appears an attractive solution but is impractical. When the ill-advised Viyath Maga tax cuts brought down the VAT rate from 15% to 8% in 2019, consumer prices did not decline

(See Table 1).

Similarly, it is unlikely that a reduction in the rate from 18% to 15% now will yield lower retail prices.

So, what can the Government do to ease the pain of the people of this country as the economic recovery gains momentum?

The solution

The Government derives most of its revenue from taxes on imports (40%). Revenue from taxes on domestic trade (primarily VAT) yields 32% and is likely to increase because the Government intends to lower the threshold from Rs. 60 million to Rs. 36 million. Personal and corporate income taxes yielded only 21% of total revenues. Non-tax revenues yielded only 7%.

It is well understood by all, including the President himself and the Secretary of Treasury, that para tariffs, which are a major component of taxes on imports, must be phased out. As stated in the Budget speech: “ . . . with the aim of boosting economic growth by increasing the competitiveness of external trade, we expect the gradual phase out of para-tariffs . . “

Most, if not all, of Sri Lanka’s exports require some inputs that are imported. When those inputs are subject to para tariffs such as the Port and Airport Levy, the competitiveness of the exports is necessarily diminished.

The para tariffs (and the revenues they currently yield; and the projections) that must be phased out are given in Table 2.

All of them directly impact ordinary people. For example, the SCL causes potatoes to be more expensive by Rs. 50-70 per kilo. Phasing out the PAL and the Import CESS will lower the costs of food and of the inputs that go into exports. Lowering para tariffs will do more to provide affordable housing for young people than the convoluted and under-resourced proposals to increase the country’s housing stock contained in the Budget proposals.

Start now

Currently, the Government’s praiseworthy statements about phasing out para tariffs are contradicted by the ever-increasing revenue yields projected by the Treasury (shown in Table 2 above). “Progressive elimination” promised by the Secretary to Treasury must be reflected in decreasing yields from each of the anti-growth para tariffs.

Instead of general statements with no timelines, what is needed is a specific schedule for the phasing out of these counter-productive taxes with reductions starting now. If that process is started with this Budget, the people will gain relief. One of the biggest barriers to effective participation by Sri Lankan enterprises in global production networks will be removed. We may at least have a chance of achieving the 7% growth the President likes to talk about.

It is broadly accepted that the people of this country paid a high price for the economic recovery. The micro and small enterprises that went out of business have not come back. The near-poor who got thrown into poverty are still below the poverty line. Those whose professions allowed them to increase their incomes, ranging from doctors in private practice to plumbers, have done so. But the lost purchasing power of estate workers and Government employees has not yet been regained

It is broadly accepted that the people of this country paid a high price for the economic recovery. The micro and small enterprises that went out of business have not come back. The near-poor who got thrown into poverty are still below the poverty line. Those whose professions allowed them to increase their incomes, ranging from doctors in private practice to plumbers, have done so. But the lost purchasing power of estate workers and Government employees has not yet been regained

The para tariffs (and the revenues they currently yield; and the projections) that must be phased out. All of them directly impact ordinary people. Phasing out the PAL and the Import CESS will lower the costs of food and of the inputs that go into exports. Lowering para tariffs will do more to provide affordable housing for young people than the convoluted and under-resourced proposals to increase the country’s housing stock contained in the Budget proposals

The para tariffs (and the revenues they currently yield; and the projections) that must be phased out. All of them directly impact ordinary people. Phasing out the PAL and the Import CESS will lower the costs of food and of the inputs that go into exports. Lowering para tariffs will do more to provide affordable housing for young people than the convoluted and under-resourced proposals to increase the country’s housing stock contained in the Budget proposals