Thursday Feb 26, 2026

Thursday Feb 26, 2026

Tuesday, 7 December 2021 01:52 - - {{hitsCtrl.values.hits}}

By Charumini de Silva

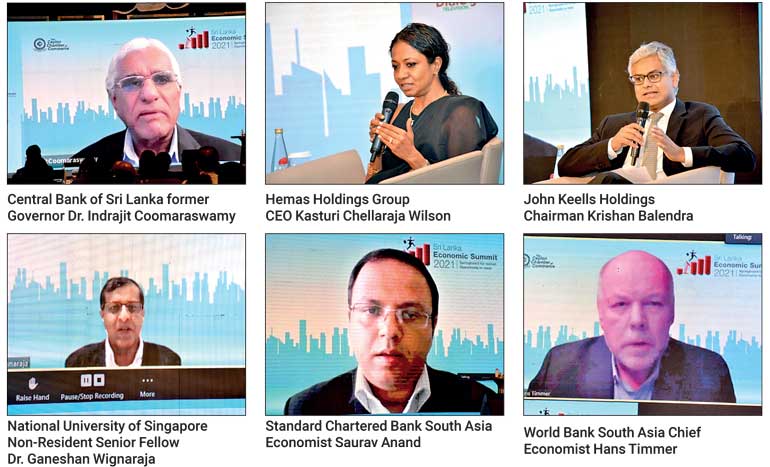

Top economists and private sector leaders yesterday shared key insights to ‘Sri Lanka’s Opportunity to Reset in the New Global Norm’ – the opening session of the Sri Lanka Economic Summit 2021.

Former Central Bank Governor Dr. Indrajit Coomaraswamy listed opportunities as Sri Lanka's strategic geographical location with Asia being the most dynamic in the world despite COVID-19, strong human resource base, advantageous time zones and living conditions to draw foreign investments and grow exports.

The challenges include the continuous macroeconomic stress experienced over decades particularly on the Government’s budgetary operations, negative balance of payments (BoP) and losses incurred by large State-owned Enterprises (SOEs).

“This toxic combination has led to high inflation, interest rates, whilst leading to an unsustainable current account of BoP and pressure on the exchange rate,” Dr. Coomaraswamy pointed out.

He said if these are addressed effectively the macroeconomic stress will not hinder building back better.

Dr. Coomaraswamy explained that the large-scale SOEs such as the Ceylon Petroleum Corporation (CPC) and the Ceylon Electricity Board (CEB) must be allowed to adopt cost-reflective pricing policy.

“These two institutions compromise the balance sheet of the two State banks and allow non-poor to benefit from subsidised pricing. For the vulnerable groups cash grants will make the subsidy process more targeted,” he added.

He said lack of structural reforms was a key issue that impacted the business climate, trade policy, trade facilitation, investor promotions and education, training and skill development.

“To reset the economy, we need to effectively implement these structural reforms,” he stressed.

In terms of the opportunities Sri Lanka can easily tap into as per Dr. Coomaraswamy were; digitalisation, global push to address climate crisis, proximity to large Indian economy and tapping on Chinese capital via the Belt and Road initiative.

He also said groups that were worst effected – children, women and SMEs – needs to be taken into account in going forward amidst challenges in addition to the climate change crisis and external debt servicing.

The Central Bank’s gross reserves stands at $ 1.5 billion while the net drain in the next 12-months is $ 7 billion.

In the event the Central Bank fails to fill this gap through the Road Map measures introduced, he called on the Government to consider an International Monetary Fund (IMF) program.

“There are no painless options left. We need to choose the least painful considering the scaring and adverse impact on the lives of the people,” Dr. Coomaraswamy said, acknowledging that it comes with conditions.

World Bank Chief Economist South Asia Hans Trimmer said Sri Lanka is among the most impacted economies in the post-pandemic region along with the Maldives, Nepal and Bhutan.

Although there are two silver linings for countries in the South Asian region from the reducing crude oil prices and more muted impact on second wave of COVID-19, he said it is difficult to navigate given the current BoP concerns.

He said short term interventions on BoP stress will not help and the focus should rather be on long term policies, pointing out that recent price controls and importation bans were not sustainable measures.

Trimmer said services exports are an opportunity for Sri Lanka too.

Standard Chartered Bank South Asia Economist Saurav Anand said global outlook for 2022 is good where most of the economies are growing above 2015-2019 average supported by the vaccination drive.

Despite the recovery, he said the risk has become hard to be ignored amidst the emergence of new variant of COVID-19 Omicron.

As per his prediction, most Central Banks are likely to hike the rates, where the FED is looking around 50 basis points, India with 75 and Sri Lanka by 100-150.

National University of Singapore non-resident Senior Fellow Dr. Ganeshan Wignaraja explained that China continues be a critical partner for Sri Lanka in post-pandemic revival.

Hemas Holdings PLC Group CEO Kasturi Chellaraja Wilson highlighted both maritime and air hubs, warehouses in terms of value added distribution and digitally supported trade are likely to be the best options for Sri Lanka in the current context.

John Keells Holdings PLC Chairman Krishan Balendra pointed out close proximity to India remains a major positive for Sri Lanka from a logistics, tourism and trade point of view.

Following HCL entering Sri Lanka, he said some of the other top global companies are looking at Sri Lanka particularly from India and Philippines to setup bases.

Amidst the COVID-Omicron variant emergence, he said the tourism industry did not see any cancellations except for the South African countries that have travel restrictions.

Pix by Upul Abayasekara