Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 21 April 2022 02:13 - - {{hitsCtrl.values.hits}}

Total value of Sri Lanka’s Most Valuable 100 Brands a mere 1%

Brand Finance Lanka, the pioneering brand valuation and strategy firm, has released its 19th annual review of Sri Lanka’s most valuable brands.

While the total value of Sri Lanka’s most valuable brands in the year under review increased slightly by Rs. 6 billion or 1%, it still falls short of the total value recorded in 2019.

Sri Lanka’s economic activity and consumer spending power waned over this period and the big established brands have benefited, as consumers have migrated to those that are familiar and trusted.

How we do it

Our methodology is fact based. We use both consumer sentiment measured through what is one of Sri Lanka’s most extensive multi sector market research studies and an analysis of the financial reports of the companies listed on the Colombo Stock Exchange.

Our valuations follow a process that tracks how marketing and other corporate managers’ specific actions result in changes to the perception of a brand (i.e., quality, price, positioning, personality, availability, etc.).

Through the research, we measure how much a brand’s action has impacted its familiarity, consideration and recommendation and how increased or decreased consideration leads to stakeholder behavioural change, ultimately leading to a favourable or unfavourable financial output due to purchases.

This process flow can be used in the opposite direction too, where changes in brand value can be used to explain what actions need to be taken by marketing and corporate managers to strengthen a brand’s ability to build value.

So, this is both a comprehensive summary of all activities performed during last year and a highly actionable tool for brand guardians on the way forward; the crucial point being that brands should never be viewed as solely an output of advertising, but a tool to leverage brand and business value.

A brand is an asset that impacts all stakeholders with the ability to influence the entire business and can be directly linked to building business value.

Overview

The year under review was, by all accounts, even more tumultuous than the previous COVID-19 year, due to the gradually worsening economic situation. The future looks even bleaker as the country battles an unprecedented economic disaster which will have significant impact on consumer purchasing power and buying habits amidst shortages and rocketing prices.

In such circumstances, brands that a company owns are arguably, now even more critical than ever before to sustain and grow the business.

Brands can take decades to build. However, once built they are resilient and can sustain a business during difficult times; this is what we see in this year’s results. Our analysis shows that those businesses that have systematically and strategically built strong brands have withstood the vagaries of uncertain times, performing significantly better than their weaker counterparts.

The winning brands

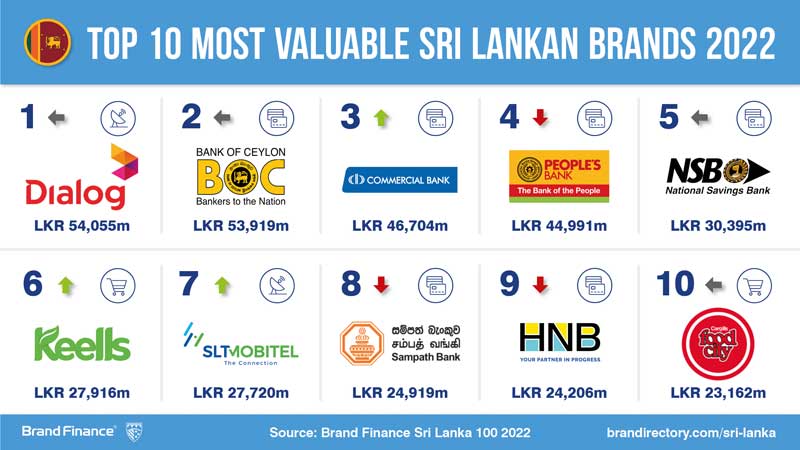

In this volatile environment, Dialog has retained its enviable position as the most valuable brand in Sri Lanka for the fourth consecutive year. However, it now has a serious competitor to contend with in SLT-Mobitel, which is making progress up the table and is now ranked at 7th place. Dialog is only slightly ahead of the No. 2 brand Bank of Ceylon with just Rs. 136 million separating them. Commercial Bank has moved into third position by displacing People’s Bank which now sits at fourth place.

As part of our process, in addition to brand value, we measure brand strength. Dialog has been able to retain its position at the top of the value table because it is still one of the strongest among the 100 brands. The simple equation is that stronger the brand (which operates in a particular sector) greater the potential to grow future value. However, the strongest brand this year is Keells supermarket, which is indicative that it has potential for future brand value growth.

Keells being the strongest brand in the top 100 with a AAA brand rating is based on more recent progress it has made, having doubled its physical presence to more than 120 retail outlets over three years. It has also ramped up its on-line capability with a fully revamped platform, enabling more diverse offerings and real-time stock availability, amongst other features, to enable a faster and better shopping experience.

Commercial Bank moves up in ranking primarily due to being the strongest banking brand (with a AAA rating) which it has had for several years now. The Bank’s attempt to differentiate their product offering through digitally driven banking environment such as ComBank Q+, the first GR code-based app coupled with other digital transformation strategies with its strong network of branches are a big contributor to its strength.

Sector analysis

The Most Valuable 100 Brands is still dominated by banks which contribute 44% of the total value of the index. This year sees a growth in value for banking brands of 3% despite the turbulent economy as they continue to make efforts in meeting the fast-growing customer demands.

Building materials saw phenomenal growth in brand value by 23% and emerges as the fastest growing sector in 2022. Import restrictions of non-essential items including building materials and favorable interest on housing loans combined to drive steady demand for these brands in the domestic market. Brands that responded swiftly to this increasing demand through timely investments in technology, developing infrastructure and production capacity emerged as winners in this year’s brand valuations.

Tourism related sectors, hospitality and airlines, continue to be among the weakest, with decline in brand value when compared to pre-pandemic levels. New COVID-19 variants, border and mobility restrictions to control the spread of the virus and limited international tourist arrivals continued to hinder the financial performance of these brands.

Most Loved Brand Index

This is a supplementary table that we publish in order to provide a more holistic picture of Sri Lanka’s brand landscape. This index has now been revamped to reflect the sectoral analysis which is the basis of this listing. The top 3 brands are identified by individual sectors, following which we publish a consolidated table of the 50 most loved brands which are those with the highest ratings from all the sectors.

Future challenges

During times of uncertainty, building resilient brands should be what drives marketing decision making. This requires a long-term view by adopting a brand blueprint or a well-defined brand platform and better brand management processes with strategic decision-making where investments are made in only those areas that will result in superior returns.

One of the major challenges for marketers is to be more accountable to its stakeholders. In a dynamic environment this is difficult due to such significant external changes around consumer purchase habits in situations of shortages and increased prices. However, it is precisely at these times where stronger marketing investment justification is required. By linking marketing investments with financial impact, greater marketing accountability is established at the level of the board.

Although Sri Lanka is no stranger to rough patches, the road to recovery and hopes are pinned no longer on COVID-19, but on fiscal consolidation with an eye on the Ukraine-Russia war which is already leading to escalating oil prices. Brands that survive this crisis unscathed should essentially be even more resilient in the years ahead.

The complete list of the most valuable brands and detailed analyses can be found in LMD’s Brands Annual 2022 and for online report: www.brandirectory.com.