Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 16 December 2021 00:05 - - {{hitsCtrl.values.hits}}

The future response to the country’s budding digital trends will depend on their ability to create tailored offerings – both in terms of campaigns and products – and debottleneck the barriers to digital purchase by identifying and addressing the root cause in an agile manner

Boston Consulting Group’s Center for Customer Insight (CCI) administered a consumer survey in Sri Lanka with over 1,200 respondents. Natarajan Sankar, Managing Director and Partner, BCG; Prateek Roongta, Managing Director and Partner, BCG; Chilman Jain, Principal, BCG; and Kanika Sanghi, Partner and Associate Director, Center for Customer Insight, BCG, share key insights in part three of a series of four curated articles. In this article, they share the nuances of digital behaviour among diverse demographics of Sri Lankans.

|

| Natarajan Sankar |

|

| Prateek Roongta |

|

| Chilman Jain |

|

| Kanika Sanghi

|

Sri Lanka has been relatively slow to adopt digital platforms and next-gen technologies, be it corporates, individuals, or public sector entities. However, trends are changing as a consequence of rising incomes, exposure to new ideas and technologies, and the influx of innovative start-ups. People are spending more time and resources on becoming tech-savvy and using the digital products at their disposal.

These shifts are underscored in our consumer study. The findings have implications for a wide variety of B2C companies that want to succeed. The study revealed both well-known and lesser-known trends, of which we present to you the four most action-oriented ones.

High internet penetration, even in rural areas; affluent, millennials significantly ahead on the digital curve

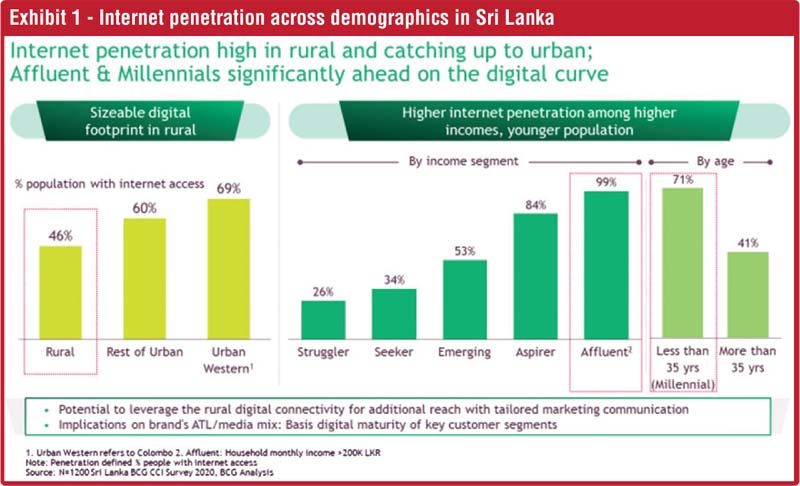

The overall internet penetration i.e., percentage of people with access to internet, is in the range of 50-55% in Sri Lanka – at par with other emerging economies such as India, Indonesia, and Thailand. The interesting part is that this figure is ~45% in rural parts of the country, not far behind urban areas (60-70%). Hence, there is potential for marketers to leverage the rural digital connectivity with tailored marketing communication and targeted campaigns for rural consumers. These can open up a much larger customer base for brands.

We also studied the digital footprint across other demographics such as income segments and age groups. We observed a strong correlation between income and access to the internet and an indirect relation with age. This has implications on the brand’s Above-the-Line (ATL) advertising and media mix. Marketers should design and target campaigns based on the digital maturity of key customer segments.

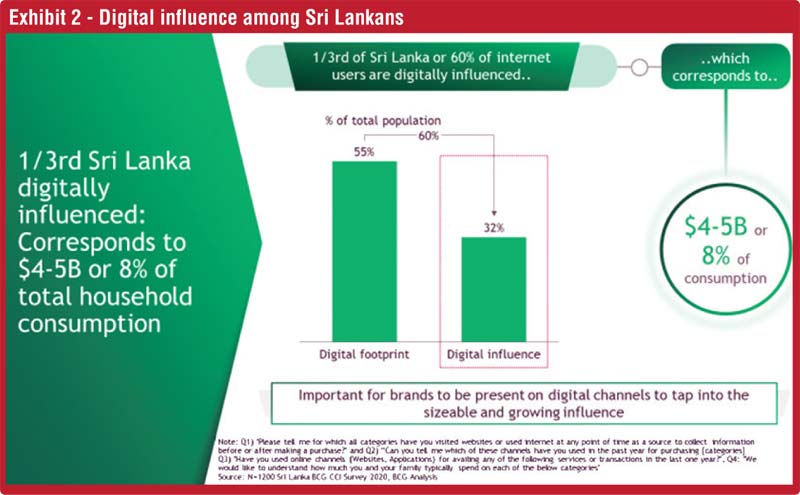

One-third of Sri Lanka’s population is ‘digitally influenced’

Over 30% of the respondents were digitally influenced, meaning they surfed the internet to collect information about a product/service before making a purchase. Such goods and services were valued at $ 4-5 billion which is equivalent to 8% of the total national spending in 2020. Nearly 60% of Sri Lanka’s population that has access to the internet is also ‘digitally influenced’. Hence, brands need to establish a presence on online channels (e-commerce, social media, search engines) to leverage the growing influence of digital platforms.

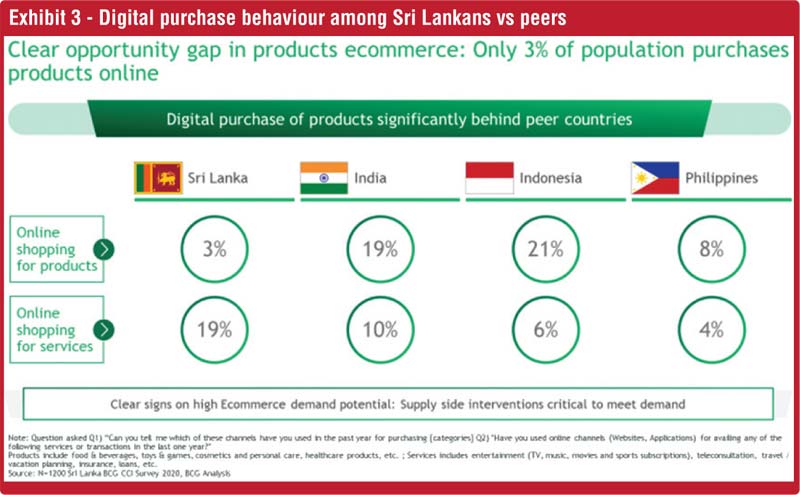

Only 3% of the total population purchases products online with significant room for growth

We studied the online shopping behaviour of the respondents and compared the outcome with other emerging economies such as India, Indonesia, and Philippines that have similar internet penetration. In Sri Lanka, only 3% of the population buys products online vs ~20% for peers like India, Indonesia, Philippines, etc. In the services category, penetration is much higher in Sri Lanka (19% vs ~10% for peers like India, Indonesia, Philippines, etc.) This indicates a clear gap in products e-commerce in the country. E-retailers must urgently undertake supply side interventions to address the unmet needs of the consumers and bridge the demand gap for products.

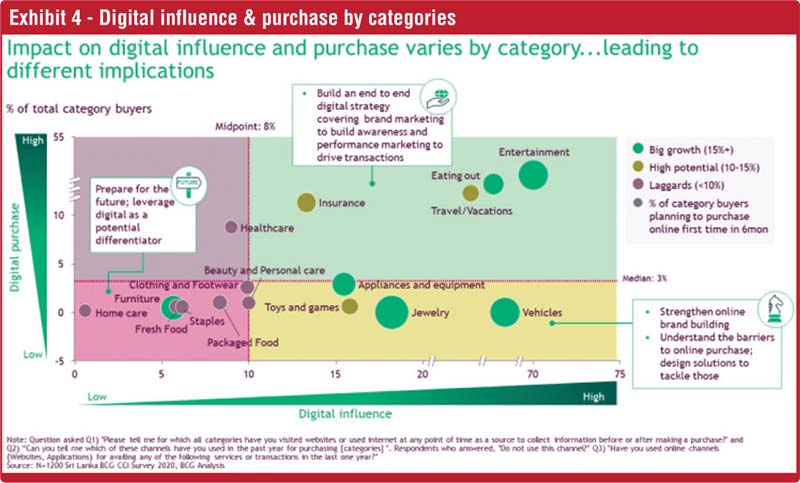

Extent of digital influence and digital purchase varies by product category

The action plan for marketers depends on the positioning of the category in the 2x2 matrix for the two parameters – digital purchase vs digital influence:

For high digital influence, but low digital purchase: Strengthen online brand building; understand the barriers to online purchase and design solutions to tackle them. For example, jewellery, vehicles, appliances.

If both are high: Build an end-to-end digital strategy covering brand marketing to awareness building, and performance marketing to drive transactions. For example, entertainment and eating out.

If both are low: Prepare for the future; leverage digital as a potential differentiator. For example, home care or fresh food.

It is critical for companies to understand that there is no one-size-fits all strategy that can be applied across categories.

For Sri Lankan companies and multinationals operating out the country alike, the future response to the country’s budding digital trends will depend on their ability to create tailored offerings – both in terms of campaigns and products – and debottleneck the barriers to digital purchase by identifying and addressing the root cause in an agile manner. Standing pat, however, isn’t an option, as digital is the future of shopping.

(Our sampling framework ensures that the study is truly representative of the country’s population. Over 1,200 Sri Lankans were interviewed in-person, with respondents spanning across four districts and diverse demographics (SECs, gender, and age). Consumers from urban as well as rural regions were part of the sample set.)

(Boston Consulting Group is a premier global management consulting firm founded in 1963. BCG partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities.)