Friday Feb 27, 2026

Friday Feb 27, 2026

Wednesday, 30 September 2015 00:00 - - {{hitsCtrl.values.hits}}

Shares in commodity trading firms were hit hard and a Japanese shipper filed for bankruptcy on Tuesday, in the latest signs that tumbling energy and raw material prices are triggering a sector-wide crisis.

Mining and trading giant Glencore saw its London-listed shares fall 30% on Monday to record lows, while its Hong Kong stock slumped 27% on Tuesday, amid growing investor concerns over its debt levels.

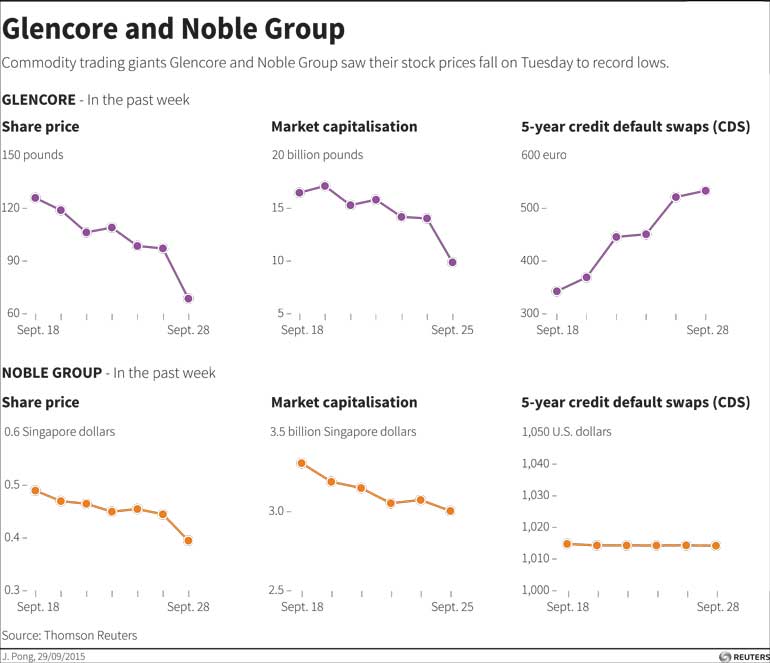

Glencore’s shares have fallen 87% since it listed in 2011, at the last high point of a long commodities boom, and its market capitalisation is now below 10 billion pounds ($15.16 billion) for the first time, with more than seven billion pounds in market value wiped out over the last week.

Asian commodity merchant Noble saw its stocks slide 15% on Tuesday to levels last seen at the height of the global financial crisis of 2008, with its shares trading around 40 Singapore cents apiece, giving it a market capitalisation of just S$3 billion ($2.10 billion).

“There is a crisis of confidence and people are continuing to de-leverage commodity stocks exposure,” said Benjamin Chang, CEO of hedge fund LBN Advisers, which manages about $600 million in funds.

Both Glencore and Noble Group have seen their Credit Default Swap (CDS) prices – the cost of insuring against the companies defaulting on their debt – soar this year.

Australian energy shares also tumbled, with Santos, Origin Energy and Karoon Gas down around 8% on Tuesday.

At the heart of the turmoil is a rout in commodity prices, which has seen crude oil drop almost 60% since June last year, thermal coal fall by more than 60% since the last peak in 2011 and iron ore prices tumble 70% from the last high in 2010. Copper is also near six-year lows.

Energy and commodity prices have fallen largely because of rising output following heavy investment into new assets while prices were still high, which has increasingly clashed with slowing demand in Asia, where China’s economy is growing at its slowest pace in decades.

“Over the last month, commodities have become much more vulnerable to macroeconomic headlines,” said Mark Keenan, head of Asia commodities research at Societe Generale.

“The correlation between prices of different commodities is rising because of the influences from macroeconomic data.” The crisis is also hitting the shipping sector, where dry-bulk merchant Daiichi Chuo Kisen Kaisha filed for protection from creditors on Tuesday, with the news slamming shares in rival maritime firms.

Daiichi Chuo, which has suffered four straight annual losses as Chinese demand for iron ore and coal has dropped, had liabilities of around 108 billion yen ($900 million) as of end-March. It has a market value of just $96 million.

Shares in major Japanese shipping companies tumbled on the news with Nippon Yusen losing 6.5%, Mitsui OSK Lines sliding 7.7% and Kawasaki Kisen Kaisha down 3.7%. The falls contributed to a 3.2% decline in the Nikkei 225.

Weakening commodities markets are also hitting currencies from countries that rely heavily on energy or raw material exports.

In Malaysia, a large producer of oil and natural gas, the ringgit currency fell 1% against the dollar on Tuesday to its lowest level since the depths of the Asian financial crisis in 1998, while in Indonesia - the world’s biggest exporter of thermal coal - the rupiah is languishing near 17-year lows.

Australia’s dollar, closely linked to the country’s commodity exports such as iron ore, coal, oil and natural gas, has also taken a beating, losing more than a quarter of its value against the greenback since June 2014, when the current oil price rout began.

Oil prices rose on Tuesday after evidence of tightening supplies in the United States, the world’s biggest oil consumer, outweighed concerns over the health of the Chinese economy.

China’s giant manufacturing sector is shrinking, economists say, as domestic demand falters, fanning concern that the economy may be slowing more sharply than feared.

Asian stock markets skidded to 3-1/2-year lows and the dollar sagged, pulled down by sharp losses on Wall Street after weak Chinese data.

But the outlook for the US economy looks brighter and oil supply there appears to be tightening with data estimating a drawdown of over one million barrels last week from the Cushing, Oklahoma delivery hub for US crude.

Brent crude oil LCOc1 was up 45 cents at $47.79 a barrel by 0440 EDT after dropping 2.5% on Monday. US light crude oil CLc1 was up 40 cents, at $44.83.

Oil prices have stabilised over the last month after more than a year of dramatic falls and rallies that have seen benchmark Brent swing between a high above $115 a barrel in June 2014 to a low of almost $42 in August this year.

Underlying the collapse in prices is a huge oversupply as Middle East oil producers have fought for market share with US shale producers, increasing stockpiles worldwide.

Global commodity prices have slumped, squeezing income for producers of key raw materials and triggering a sector-wide crisis. Shares in commodity trading firms, such as Glencore and Noble, have been hit hard.

“Growth concerns for China and the close to 30% drop in Glencore shares have helped to drive bearish sentiment,” said Bjarne Schieldrop, chief commodities analyst at SEB Markets.

Oil traders awaited official figures from the US government on Wednesday on supply and demand in the United States, the biggest domestic oil market.

Market intelligence firm Genscape estimates stocks at the Oklahoma delivery hub for US crude fell by more than one million barrels last week, traders who saw the figures said.

Lower oil prices may have begun to reduce production in the United States, but the world still faces an oil glut.

“The United States alone cannot rebalance the world market,” said Carsten Fritsch, senior oil analyst at Commerzbank in Frankfurt. “We are still waiting for concrete evidence that the oversupply is being reduced.”