Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 13 July 2020 00:00 - - {{hitsCtrl.values.hits}}

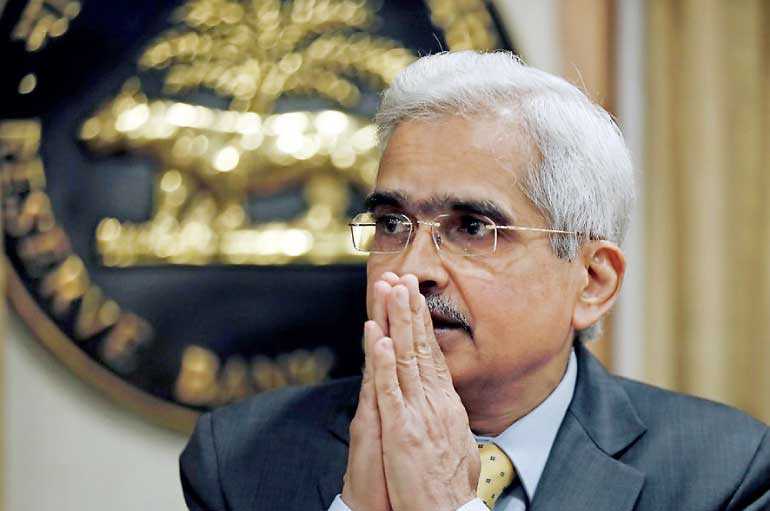

FILE PHOTO: The Reserve Bank of India (RBI) Governor Shaktikanta Das greets the media as he arrives at a news conference after a monetary policy review in Mumbai, India - Reuters

NEW DELHI (Reuters) - The medium-term outlook for the Indian economy remains uncertain with supply chains and demand yet to be restored fully while the trajectory of the coronavirus spread and the length of its impact remain unknown, Reserve Bank of India Governor Shaktikanta Das said on Saturday.

According to most estimates, the Indian economy will register a record contraction of over 4.5% in the current fiscal year that started on 1 April due to the pandemic.

Starting late March, the country was placed under one of the strictest lockdowns in the world for over two months. Since early June, the government has started easing restrictions to help some revival in the economy even though the number of infections in the country continues to rise.

“The Indian economy has started showing signs of getting back to normalcy in response to the staggered easing of restrictions,” Das said in an address to an online forum.

“It is, however, still uncertain when supply chains will be restored fully. How long will it take for demand conditions to normalise and what kind of durable effects will the pandemic leave behind on our potential growth?” he said.

Das said that the 2008 global crisis and the current crisis show that such economic shocks have “fatter tails” than generally believed, and that the country’s financial system should have larger capital buffers.

A recapitalisation plan for Indian banks is necessary as the economic impact of the pandemic may result in higher bad loans and erosion of capital for banks, the RBI governor added.

The central bank has cut policy rates by 115 basis points in response to the pandemic, resulting in a total policy rate reduction of 250 basis points since February 2019, along with providing liquidity of 9.57 trillion rupees ($127.28 billion).

It has also eased some bad loan provisioning norms and allowed loan moratoriums for retail customers.

Das said that the central bank has to carefully unwind the unusual monetary and regulatory measures taken to cushion the economic shocks in the post pandemic world, as the financial sector should return to normal functioning without relying on the regulatory relaxations as the new norm.

India recorded 27,114 coronavirus cases in the last 24 hours, taking the total to 820,915 including 22,123 dead.

The RBI governor also said that inflation will continue to moderate going forward and investment activity will revive.