Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 19 July 2021 00:00 - - {{hitsCtrl.values.hits}}

Governments tend to keep the fuel price low irrespective of the price hikes in the international market if they feel that the increase would affect the people, resulting in budgetary pressure

There is a controversy regarding the increase of fuel prices.

There is a controversy regarding the increase of fuel prices.

It is a fact that the Sri Lankan governments and opposition political parties use the price of fuel to get political benefits. Prices were changed or kept constant by the governments based on political climate rather than economic situation. Therefore, when the Sri Lankan Government sought assistance from the International Monetary Fund, the Government was advised in May 2018 to introduce a price formula to the fuel prices so that the selling price of fuel is directly linked to the oil price in the world market.

The IMF suggested this formula to reduce the impact of the oil price to the Government budgets. The behaviour of the governments in this respect is twofold. On one hand the governments tend to keep the fuel price low irrespective of the price hikes in the international market if they feel that the increase would affect the people, resulting in budgetary pressure. On the other hand, they keep the local fuel prices high when the international prices were low if they feel that the people can afford it, and in this case, there is no pressure to the budget deficit and rather the policy of the price of oil facilitated the reduction of the budgetary pressure.

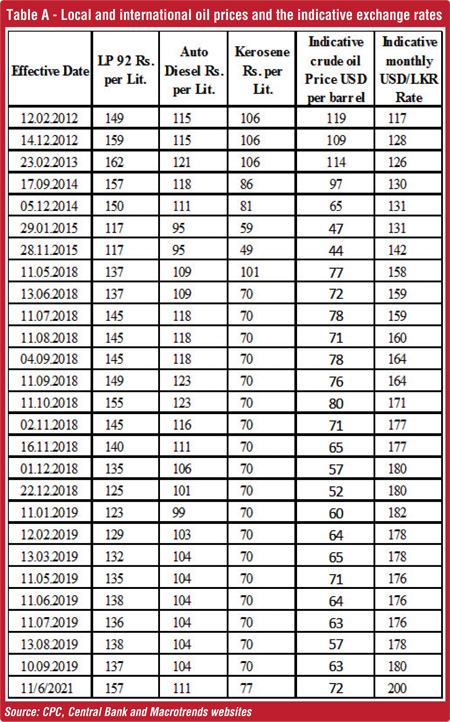

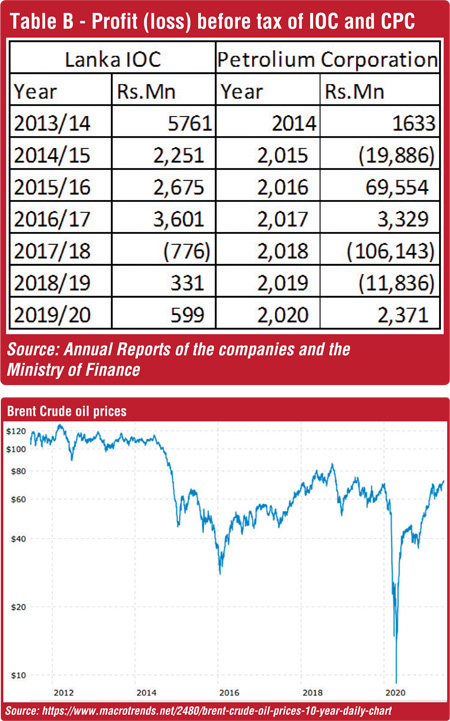

In order to examine these patterns, Table A was presented with the local fuel prices on the dates where the prices were changed along with the international crude oil prices and the relevant exchange rates. In a separate graph change of the international crude oil prices over a period is given. To assess the impact, profitability of the Ceylon Petroleum Corporation (CPC) and Lanka IOC PLC (IOC) are also given in Table B.

In February 2012 auto diesel price was Rs. 115 per litre whereas the indicative crude oil price was $ 119 and the relevant exchange rate was Rs. 117 per USD. In December 2014 auto diesel price was Rs. 111 per litre whereas the indicative crude oil price was $ 65. A reduction of 50% of crude oil price was reflected in just Rs. 4 of the auto diesel price. However, the exchange rate was Rs. 131 per USD and there was a 12% increase.

Up to 2014 July crude oil prices were over $ 100 per barrel and it started to go down from July 2014. It went down to $ 47 per barrel in January 2015.When the new Government came into power and reduced the fuel prices, LP 92 price went down to Rs. 117 from Rs. 150 per litre. There were further reductions of the international oil prices, but the Government did not give those benefits to the people. In January 2016 oil price per barrel went down to $ 30.

This is reflected in the annual reports of CPC and IOC. CPC accounts are maintained for the calendar year, the years ended 31 December and IOC accounts are maintained for the years ended 31 March. In 2015 CPC made a loss of Rs. 19 billion whereas IOC made a profit of Rs. 2 billion for 2014/15. The local fuel price reduction may have caused the losses of CPC. In the following year, both the companies were profitable taking the advantage of the reduction of oil prices in the international market which was not passed on to the people.

In 2017 there was an upward trend in the international market and by December 2017 price per barrel went up to $ 66. Since there was no price revision in the local market CPC profitability was reduced. IOC profitability cannot be compared since the period was different. The price formula was introduced in May 2018 and at that time the international price was $ 77 per barrel. CPC made a loss of Rs. 106 billion in 2018 which comprised of an exchange loss of Rs. 82 billion and a gross loss of Rs. 3 billion. The Annual Report of the Ministry of Finance reported that the formula did not cover the full cost of the CPC.

At the time of introduction of the price formula there was much controversy. The price formula introduced by the previous Government is as follows:

The maximum retail Price (MRP) = V1+V2+V3+V4

V1 = the landed cost, based on Singapore Platts price per barrel + weighted average premium per barrel + losses due to the evaporation + losses due to the exchange rate.

V2 = the processing cost + local port charges + transport cost +dealers’ margin including losses due to evaporation+ stockholding cost.

V3 = the administrative cost including personnel cost+ depreciation + other cost elements,

V4 = customs import duty+ excise duty + ports and airports development levy+ nation building tax+ any other tax

During the 52-day political crisis the formula was abandoned. It was not exercised during the time of the introduction of Budget 2019 in April 2019 and in October 2019 when the Presidential candidates were announced for the Presidential Election and in November 2019 when the Presidential Election was held. In certain months the price was kept constant or reduced despite the increase of prices internationally.

Soon after the President assumed office in November 2019 the price formula was abandoned and the oil prices started to decline from December 2019 and that benefit was not given to the people. Extent of that price reduction can be seen in the graph. Instead, the Government claimed that they would create a fund and the additional money collected from the people would be credited to that fund so that in case of a price increase increased price could be borne by that fund rather than passing it to the people. Now there are different comments about that fund. This shows how disorganised the Government is.

Oil prices is a key element of the economy and Government should not take undue profits from oil prices since there is a ripple effect of the fuel price to the economy. Now the oil prices are increasing in the international market amid the COVID-hit economy of Sri Lanka. Taking into consideration the Government finances, the Government has no other option than increasing the fuel prices. The prices might be increased further. I believe that if the price formula is applied the fuel prices would be higher than the current increased price, calculating it on the limited information available, especially with the current exchange rate.

This is the price the country has to pay due to the abandonment of the fiscal consolidation process by the present Government, which was started by the previous Government. If that was in operation, taking into consideration the plight of the people in this difficult time, the Government would have the capacity to postpone the price hike. Government sources think that the omnipotent Basil Rajapaksa is capable of giving a solution.

On the other hand, increased efficiency at the CPC would push the local fuel price down. V3 of the price formula can be reduced by this way. CPC efficiency would keep the price at certain level and as a result IOC can make super profits covering under the inefficiencies of CPC. It is visible in the financial accounts. Those who criticise the Government for the price hike should focus on this matter as well and demand that the efficiency of all the Government institutions be improved.

However, if the Government decides to keep the local prices constant due to political reasons while the international prices are going up IOC would be in a very difficult situation. This happened in 2018 prior to establishment of the price formula. It was reflected in IOC accounts. Hence, IOC also would have exercised pressure on the Government to increase the local prices.

In this type of situation all parties should support the Government. Responsible political parties should not give a wrong impression to the people that the Government is having the capacity to reduce the fuel prices. The Government as well as the Opposition should tell the truth of the economy to the people rather than giving false promises to them. All of them should show by example that they are reducing the waste.