Monday Feb 23, 2026

Monday Feb 23, 2026

Saturday, 10 February 2024 00:51 - - {{hitsCtrl.values.hits}}

By Surya Vishwa

By Surya Vishwa

If there is one thing that could keep you alive in a desert barren of water and forget that you are parched, what would it be?

If there is one thing that could take you from point A to B without having you leave your seat and create in your mind the imagery of all the wonders of the world through nothing more complicated than a few dozen pages put together, could you adequately describe this journey?

Could you live in a place without that which give life to all of life, to the root of life, knowledge, whether that knowledge is about humans, animals, plant life or the universe and all things in it?

What is the difference of monetarily assessing books and writing, in comparison to most other things needed in life?

Could a person, family, community or a nation thrive if all other luxuries were obtained but devoid of access to books?

Can the monetary value of books be assessed in the same way as one does other commodities?

Is the same level of taxation imposed on books as with other goods akin to taxing the heartbeat of knowledge, i.e. reading?

These are some of the questions we will explore today.

This article is created to represent the views of those in the book publishing, writing, import and export industry. However, it is written with the understanding that the country is going through a tough transition where an economic rectification path is sought to get out of debt, mis-management of national resources and to set forth the growth and stabilisation of national revenue.

Creation of national revenue is at times easier said than done. It primarily requires commitment, innovation and investment in knowledge. All nations across the world realise this and some more than others appreciate the root of creation, books that directly and indirectly assist in creating a thinking, transforming, innovating the populace.

How does a nation appreciate books, writers, publishers and importers/exporters of the written word?

By making life easy for the reader, publisher and importer of books and either avoiding or minimising taxation on the book industry.

Lifeline for circulation of knowledge

Lifeline for circulation of knowledge

The book industry is a business like any other, but the difference lies in it being the lifeline for the circulation of knowledge vital for a nation’s mental health. A country where books are made scarce could be described as a thwarted plant deformed because it is kept away from the light needed for its growth. A book a day (to encompass diverse views) could keep crime and depression away alongside social vices such as communalism and racism.

All these descriptions and analyses was the base of arguments placed before the nation and its administrators by the island’s publishing industry last week.

Local book publishers, printers, book importers, authors as well as academics on 2 February called upon President Ranil Wickremesinghe and the Government to cancel the VAT on the industry that was hitherto exempted but activated from this year.

“From 1 January 2024 the 18% VAT came into effect crippling the publishing sector and the knowledge sector. Even we academics who used to buy about 10 books a month earlier can now afford to purchase just one or two book if at all. Having this tax added in the overall context of economic hardship and VAT taxation imposed on all other essentials would transform this country into one deficit of knowledge and literary aesthetics. Such a nation will merely breed an intellectually and aesthetically dead populace if books are made into luxuries,” literary critic and anthropologist, Prof. Praneeth Abeysundara said addressing the press briefing organised by the Sri Lanka Book Publishers Association (SLBPA) held at the Sri Lanka Foundation Institute.

"We acknowledge that economic challenges spanning multiple government terms have led to a situation where the broader population has been required to shoulder the financial implication,” SLPBA General Secretary Dinesh Kulatunga said stating however that there should be a means to prevent VAT taxation on the book related industry. Kulatunga and the SLBPA officials explained that the charging of 18 % VAT was directly contravening the 1950 UNESCO Florence Agreement that holds that the knowledge and publishing industry should be safeguarded so that it reaches the masses,

https://www.unesco.org/en/legal-affairs/agreement-importation-educational-scientific-and-cultural-materials-annexes-e-and-protocol-annexed

Call for reversal of decision to tax books at 18%

Overall, what was expressed by Sri Lankan authors and publishers was alarm over long-term consequences of making books more expensive for the common man that authors and publishers decried as needing immediate and serious rethinking and rectification.

They called for the reversal of the decision to tax the sale of books at 18% explained as putting the final burden on the reader and tantamounts to making reading unaffordable.

Individuals and groups representing local publishers, printers, booksellers, importers and writers as well as academics pointed to readership and the publishing industry not just as an education or knowledge focused segment of society but rather a representative of the whole of the intellectual and creative identity of a country.

"We acknowledge that economic challenges spanning multiple government terms have led to a situation where the broader population has been required to shoulder the financial implications of the gradual national recovery," the SLPBA General Secretary explained to journalists. He questioned if it was fair that this short-term requirement to boost Government revenue should have the longer-term destructive consequence of retarding the education, culture, intellectual progress and personal development of generations of Sri Lankans.

Dark future, breeding empty minds

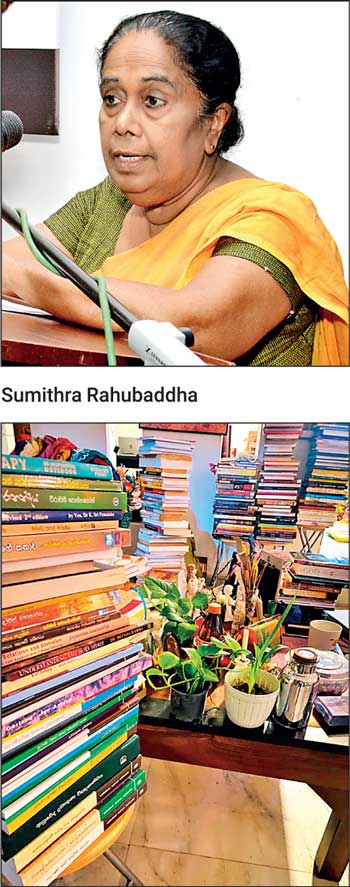

“We are on the brink of a dark future, breeding empty minds whose insight would not have been torched by the flame of joy, wisdom, information and ingenuity that a book has the power to unfold, veteran writer Sumithra Rahubadra said. She drew attention to Sri Lanka’s heritage of knowledge promotion where ancient monarchs that ruled this nation had always sought to support both knowledge generation and access.

“Even the British colonial government continued this tradition, using it for their own benefit publicising particular imperialism partial information it wanted the local population to mentally digest, nevertheless respected the need for the population to hone the reading habit,” she explained.

The author pointed out that in modern times the World Trade Organisation (WTO) had set in recommendations that encouraged nations to enable affordability of books.

“Taxation makes books a luxury. Man does not live by eating and drinking alone. He needs to intellectually, spiritually and emotionally sustain himself with that which is poetic, aesthetic, or intellectual,” author Kamal Perera stated.

The authors and publishers highlighted the fact that Sri Lanka was an early signatory to UNESCO Florence Agreement and continued to date to be a Contracting State. The UNESCO Florence Agreement is a treaty that binds Contracting States to not impose customs duties and taxes on certain educational, scientific, and cultural material that are imported.

Tax on a vital source of knowledge and information

“With the imposition of VAT on books, Sri Lanka attains the dubious distinction of becoming one of a very few countries that impose a tax on a vital source of knowledge and information,” the Sri Lanka Book Publishers Association President Samantha Indeewara said. “What this means is that while the rest of the world is trying to make knowledge more inclusive at the grassroots level, Sri Lanka is trying to use this industry to raise government revenue, heedless of the serious ramifications,” he said, adding that the indiscriminate taxation of books was a text-book case of killing the goose that lays the golden eggs.”

“According to the International Book Publishers Association, books are not a commodity like any other, but are strategic assets that activate the knowledge economy, facilitate upward social mobility as well as personal growth, and bring widespread medium and long term social, cultural and economic benefits,” he explained.

It was pointed out that the publishing industry already contributes over Rs 1 billion to the Government’s tax revenue via the VAT paid by importers that supply 90% of the raw material used in the production of school text books and other books. The imposition of VAT on books therefore results in an anomaly of double taxation for publishers, further aggravating a difficult situation, industry specialists pointed out.

The Government’s decision to impose 18% VAT on books has already generated concern internationally, with the International Publishers Association (IPA) and the European and International Booksellers Federation (EIBF) writing to the President of Sri Lanka, Ranil Wickremesinghe to voice their objections.

“Our member associations are united and have made efforts to engage with your office to explain the catastrophic consequences that such a tariff will have on the country’s book sector,” the two organisations said on 15 December 2023. “We stand in solidarity with Sri Lankan publishers and booksellers, and urge you to reconsider this measure for the benefit of the Sri Lankan literary landscape,”they wrote.

Among the Sri Lankan organisations and personalities that attended the news conference to call for the restoration of the VAT exemption on books were the Sri Lanka Book Publishers Association (SLBF), the Sri Lanka Book Importers and Exporters Association, the Sri Lanka Writers Association, and several leading writers, academics, educationists and author-publishers.

This page last week featured the Southern Book Fair organised by the Commonwealth Publishers Network, held in Galle and highlighted the importance of such events that promote literary focused tourism in an authentic manner by giving due recognition to authors writing in Sinhala, Tamil and English, representing the whole of Sri Lanka.

The Harmony page promotes knowledge in all its forms and holds that each day lived as a human being is a chance to grow and evolve for the better, with books being one key aspect of this growth. It is through books that we pass on to future generations traditional knowledge, environment/plant related knowledge, culture, art, history, modern technology and in short every sphere of specialisation.

The Harmony Page will continue to seek out Sri Lankan writers and artistes and especially those featured in events such as the Southern Book Fair and the Galle Concerto 2024 and promote the equal distribution and representation of knowledge for the uplift of humanity.