Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 9 February 2026 04:31 - - {{hitsCtrl.values.hits}}

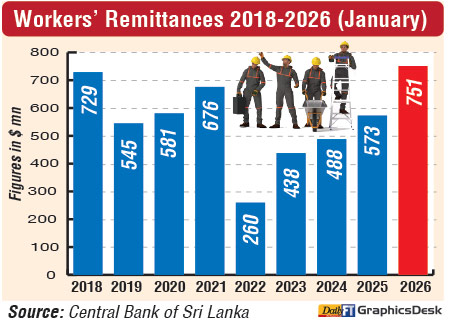

Sri Lanka’s workers’ remittances surged to a new high in January, with monthly inflows rising 31.1% year-on-year (YoY) to $ 751.1 million, as per the latest Central Bank of Sri Lanka (CBSL) data. This surpassed the previous monthly peak of $ 729.3 million registered in 2018 by 3%. However, January experienced a 17% decline compared with December 2025, reflecting seasonal variations in transfers.

Sri Lanka’s workers’ remittances surged to a new high in January, with monthly inflows rising 31.1% year-on-year (YoY) to $ 751.1 million, as per the latest Central Bank of Sri Lanka (CBSL) data. This surpassed the previous monthly peak of $ 729.3 million registered in 2018 by 3%. However, January experienced a 17% decline compared with December 2025, reflecting seasonal variations in transfers.

The latest figures suggest that, even as labour migration moderates, remittances are set to remain a critical support for external balances and domestic consumption as the country continues its recovery from the worst economic crisis in 2022.

The strong start to the year follows a historic performance in 2025, when full-year remittances climbed to $ 8.07 billion, a 23% increase from a year earlier and the highest annual inflow ever recorded.

The total exceeded the previous all-time high of $ 7.24 billion in 2016 by about 12%, firmly cementing remittances as Sri Lanka’s largest and most reliable source of foreign exchange during its ongoing post-crisis recovery.

CBSL data show that the rebound has been both sharp and sustained since the collapse in inflows during the 2022 economic crisis, when remittances fell 31% to a 12-year low of $ 3.78 billion amid acute foreign exchange shortages and the proliferation of informal transfer channels.

The turnaround began in 2023, when inflows surged 57% to $ 5.96 billion, marking the strongest post-crisis recovery on record.

Momentum continued in 2024, with remittances rising a further 10.1% YoY to $ 6.57 billion, supported by a wave of outbound labour migration as thousands of Sri Lankans sought overseas employment in the aftermath of the economic collapse.

Although overseas departures eased slightly in 2025, inflows continued to rise, pointing to higher average transfers per worker.

During 2025, a total of 310,915 skilled and semi-skilled workers left the country for foreign employment, including 190,609 men and 120,036 women. While total departures declined by 1.2% YoY, remittance inflows increased sharply, highlighting improved earnings abroad and greater confidence in formal transfer mechanisms.

Analysts attribute part of the sustained increase to policy shifts by the CBSL, including the abandonment of the parallel exchange rate regime, which reduced incentives to remit through informal systems such as Undiyal and Hawala. The move has encouraged expatriate workers to channel funds through the formal banking system, strengthening foreign exchange liquidity and improving transparency.

Historically, Sri Lanka’s workers’ remittances averaged around $ 7 billion a year between 2014 and 2018, or roughly $ 600 million a month, reinforcing their longstanding role as a stabilising pillar of the economy.