Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 10 October 2025 04:38 - - {{hitsCtrl.values.hits}}

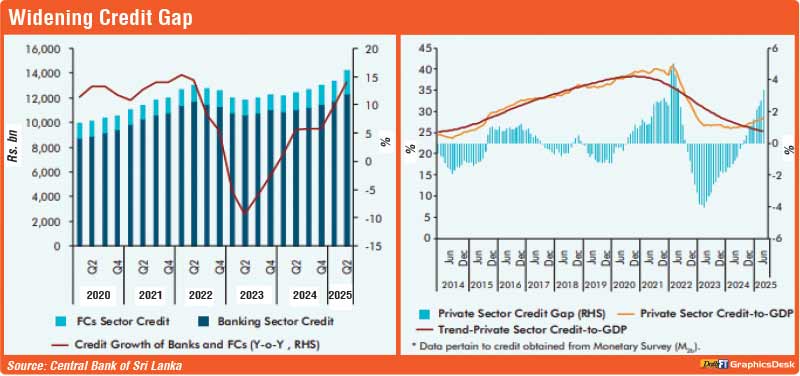

The Central Bank of Sri Lanka (CBSL) releasing its Financial Stability Review 2025 report yesterday said that despite the strong momentum in recent private sector credit growth, a widening private sector credit-to-GDP gap points to potential emerging risks in the financial system.

The gap, which turned positive in mid-2024, has continued to widen through 2025 amid sustained credit growth.

“This suggests a potential accumulation of systemic risk within the sector,” the CBSL said. “However, higher GDP growth in tandem with credit expansion would support a healthy expansionary phase conducive to financial stability.”

Credit-to-deposit ratios across the banking sector began to recover after remaining weak earlier in the year. The CBSL attributed this to a gradual improvement in bank lending and a stronger appetite for loans among businesses and households.

Survey data showed that banks’ willingness to lend and borrower demand both increased in the second quarter, supported by low interest rates, stable liquidity, and improved confidence in the economic outlook.

The CBSL said continued correction in the allocation of credit away from Government borrowing and toward productive private sector activity would be key to sustaining recovery and ensuring balanced financial intermediation.

The bank said that private sector credit remains below pre-crisis levels despite increasing banking sector loans and a steady slowdown in Government borrowing.

Total credit extended by regulated financial institutions, including banks and finance companies, grew by 14% year-on-year by the end of the second quarter of 2025.

The CBSL said this reflected an improvement in lending conditions and the impact of its accommodative monetary policy stance. Finance companies recorded a sharp 35.1% expansion in lending, while the banking sector grew by 11.4% during the same period.

The CBSL said credit to the private sector continued to expand, supported by lower lending rates and broad-based demand across key economic sectors. Household borrowing also increased, driven by gold- and vehicle-backed loans and stronger consumer activity.

However, private sector credit-to-GDP was still below pre-crisis levels.

“Private sector Credit-to-GDP, which stood at 28.6% at end H1 of 2025, remained well below pre-crisis levels, indicating room for further expansion,” the CBSL said.

It observed that the moderation in credit to the Government and public corporations has created space for private sector borrowing, but the recovery remains incomplete.

Exposure to the Government sector declined to 46.5% of total credit by end-June 2025, continuing a correction that began in 2024 when fiscal consolidation gathered pace.

“The tilt in exposure towards the Government and public corporations continued to decline, though there remains scope for further enhancement of private sector credit,” the CBSL said. It added that expanding private sector credit could support strengthening production capacity and contribute towards sustained economic growth.