Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 24 November 2025 05:54 - - {{hitsCtrl.values.hits}}

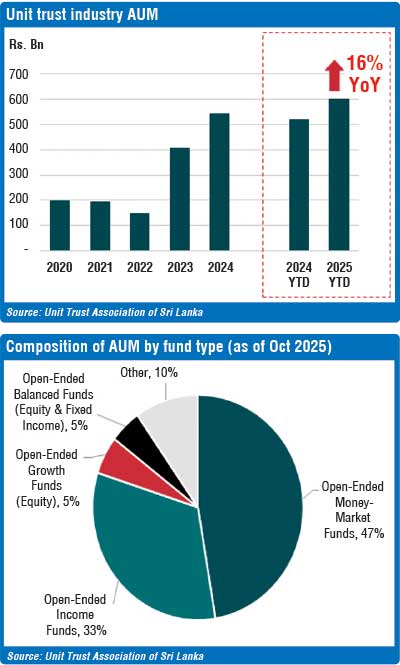

The unit trust industry of Sri Lanka has reported a 16% year-on-year (YoY) growth of its assets under management (AUM) to Rs. 603 billion by the end of October 2025, up from Rs. 592 billion in September.

The unit trust industry of Sri Lanka has reported a 16% year-on-year (YoY) growth of its assets under management (AUM) to Rs. 603 billion by the end of October 2025, up from Rs. 592 billion in September.

These assets are currently managed across 85 funds by 16 management companies.

The industry saw 3,628 new unit holders invest in the market during the month, bringing the total number of investors to 137,224 as of end-October. Year-to-date (YTD), the industry has added nearly 25,000 new investors. October also saw an influx of approximately Rs. 4 billion into equity-related funds. This reflects investors’ continued confidence in the growth potential of Sri Lanka’s capital markets and a growing appetite for long-term wealth creation through diversified investment portfolios, indicating a gradual shift away from traditional savings-focused methods.

Unit Trust Association of Sri Lanka (UTASL) President and JB Financial CEO Christine Dias Bandaranaike said: “The industry has performed remarkably in 2025, with AUM surpassing the Rs. 600 billion mark earlier this year. We continue to see strong potential for market growth, driven by increasing investor awareness and a broader range of fund offerings.”

“Our recently concluded ‘Investor Awareness Initiative’ held from the 27 to 31 October, which aimed to educate the public to build wealth through unit trusts, was a great success. 16 management companies participated in the event, each bringing their unique expertise and commitment to wealth building. As a part of the UTASL’s ongoing efforts to promote unit trusts, the initiative reinforced the importance of informed investing, bringing in both new and existing investors to make confident, long-term investment decisions,” she added.

Together with the Securities and Exchange Commission of Sri Lanka (SEC) and the Colombo Stock Exchange (CSE), the UTASL said it remains focused on strengthening financial literacy and investor participation across the country – particularly in unit trusts. While pooled funds are one of the most widely used and trusted investment tools globally, awareness and participation among Sri Lankan investors remain relatively low.

The UTASL is the representative body for the country’s licenced fund management companies, dedicated to upholding the highest standards of professionalism, integrity and transparency across the industry. Consisting of 16 member companies regulated by the SEC, the UTASL aims to popularise unit trusts and encourage Sri Lankans to prioritise long-term and professionally guided investing, in addition to short-term savings, whilst contributing to national economic growth.