Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 27 October 2020 01:37 - - {{hitsCtrl.values.hits}}

The Colombo stock market yesterday suffered a near 2% decline as investors reacted negatively to the sharp spike in COVID-19 cases in the second wave.

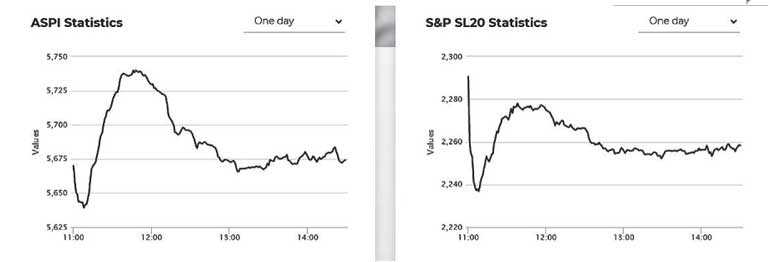

The All Share Price Index declined by 1.7% or 99.6 points and the S&P SL 20 Index was down by 1.9% or 43 points. The market managed to post Rs. 1 billion, safeguarding its track record of over a billion plus turnover for more than a month.

The market also lost Rs. 44 billion in value with blue chips JKH, Carsons, Ceylon Tobacco, Bukit and Distilleries as major contributors to ASPI’s dip.

Some analysts linked the lacklustre trading and sentiment to the quarantine curfew imposed in Fort and Pettah which caused a shutdown of offices and businesses in the area.

They said that the market fluctuated considerably but reflected some degree of maturity to avoid a sharp dip. The low interest rate regime is helping equity investors, they added.

First Capital said the surge of the COVID-19 wave continued to cripple investor sentiment, fuelling the downfall of the market for the second consecutive session.

“The index experienced a strong uptrend during the early hours of trading and thereafter recorded a gradual downwards movement till mid-day. Later the market recorded a sideways movement and closed at 5,669, losing 100 points,” First Capital said.

The Materials sector counter led the turnover for the session contributing 26% with the aid of Tokyo Cement, it added.

Asia Securities said turnover reached a one-month low as cautious investors took a wait-and-see approach as per the developments of the spread of COVID-19 emerged.

“Following media coverage of COVID-19 clusters throughout the weekend, the indices dropped immediately as the market opened. The ASPI reached 5,639.22 (-2.2%) before moving up, as panic selling was counterbalanced by buying interest on cheap valuations,” it added.

NDB Securities said high net worth and institutional investor participation was noted in Teejay Lanka. Mixed interest was observed in Expolanka Holdings, Tokyo Cement Company non-voting and Dipped Products, whilst retail interest was noted in Tokyo Cement Company, John Keells Holdings and Piramal Glass.

The Materials sector was the top contributor to the market turnover (due to Tokyo Cement Company non-voting and voting, and Dipped Products), whilst the sector index lost 3.17%. The share price of Tokyo Cement Company non-voting lost Rs. 2 (3.94%) to close at Rs. 48.70.

The share price of Dipped Products recorded a loss of Rs. 5.40 (1.72%) to close at Rs. 307.80, whilst the share price of Tokyo Cement Company declined by Rs. 2.70 (4.52%) to close at Rs. 57.10.

Transportation sector was the second highest contributor to the market turnover (due to Expolanka Holdings), whilst the sector index decreased by 2.80%. The share price of Expolanka Holdings decreased by Rs. 0.50 (2.81%) to close at Rs. 17.30.

Teejay Lanka was also included amongst the top turnover contributors, whilst the share price of Teejay Lanka moved down by Rs. 0.70 (2.33%) to close at Rs. 29.40.

Foreigners were on the sidelines though the market saw net selling of Rs. 20 million with year to date figure being Rs. 44.4 billion.