Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 8 September 2021 00:30 - - {{hitsCtrl.values.hits}}

Despite intermittent recovery the Colombo stock market closed down sharply yesterday due to profit taking as well as concerns over currency instability amidst high turnover.

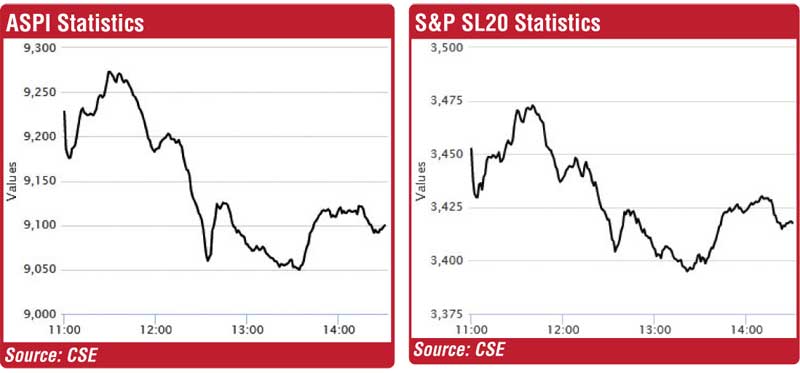

The All Share Price Index finished the day down 135 points or 1.46% and the S&P SL20 lower by 1% or over 34 points. Turnover was Rs. 8.6 billion, higher than Monday›s Rs. 7.7 billion. However, volume wise it was lower at 505 million shares in comparison to 874 million on Monday.

The biggest contributors to ASPI›s dip yesterday were dominated by Ishara Nanayakkara-owned companies – LOLC (22 points), Browns Investments (19 points), Commercial Leasing (16 points) and LOLC Finance (7 points). Dhammika Perera›s Vallibel One chipped in with 6 points. Most profitable and valuable corporate Expolanka proved its mettle by being solid. It closed up 1.4% or Rs. 2.50 to Rs. 183.50 with 15 million shares traded for Rs. 2.7 billion. Browns Investments topped the volume league with 185 million shares traded for Rs. 2 billion. The share price was down by 5.5% to Rs. 10.40.

Stock market...

Some analysts linked the dip in LOLC Group company shares to panic selling on rumours that an alleged visit by the Chinese Prime Minister to launch new developments at the Port city has been delayed. Neither the Sri Lankan Government nor the Chinese Government have announced any plans of such a visit to Colombo. Others opined the illiquid shares had gained too high too fast hence the correction. Year to date as of 2 September LOLC had gained by 352%, Browns Investments by 167%, Commercial Leasing by 434% and LOLC Development Finance by 867%.

First Capital said the bourse continued to remain in the red zone for the third straight day as the market heated up causing inflating selling pressure.

“Index hiked to an intraday high of 9,277 as soon as the session opened and started to take sideways as investors urged to take profit in selected counters, leading the index to drop to an intraday low of 9,047. Afterwards, the index displayed a slight recovery and ended up closing at 9,093,” First Capital said.

It said turnover was led by the Transportation sector, followed by the Food, Beverage and Tobacco sector collectively accounting for a total contribution of 57%.

Asia Securities said the market witnessed another profit-taking session as both indices moved downwards despite recording a strong turnover.

“Following a 52-point gap down opening, the ASPI witnessed a brief recovery during early hours and reached an intra-day high of 9,273 (+97 points) before shedding its early gains due to profit-taking in selected heavyweight counters,” Asia said.

“While EXPO recouped some of its previous session’s losses, price declines in LOLC group companies weighed on the ASPI throughout the session. Turnover improved marginally from yesterday’s levels on the back of retail and HNI activity in EXPO and BIL, which collectively generated 54.0% of turnover,’ it added.

It said foreigners recorded a net outflow of Rs. 90 million while their participation declined to 0.8% of turnover (previous day 8.6%). Net foreign buying topped in LWL at Rs. 7 million and net foreign selling topped in RHL at Rs. 40 million.

NDB Securities said high net worth and institutional investor participation was noted in Hatton National Bank nonvoting, ACME Printing and Packaging and Vallibel Power Erathna. Mixed interest was observed in Expolanka Holdings, LOLC Holdings and Royal Ceramics, whilst retail interest was noted in Browns Investments, SMB Leasing voting and nonvoting.

It said the transportation sector was the top contributor to the market turnover (due to Expolanka Holdings), whilst the sector index gained 1.36%.

The Food, Beverage and Tobacco sector was the second highest contributor to the market turnover (due to Browns Investments), whilst the sector index decreased by 1.59%.

Hatton National Bank nonvoting, LOLC Holdings and Royal Ceramics were also included amongst the top turnover contributors. The share price of Hatton National Bank non-voting moved up by Rs. 2 (1.56%) to close at Rs. 130. The share price of LOLC Holdings recorded a loss of Rs. 20.75 (3.39%) to close at Rs. 591.50. The share price of Royal Ceramics declined by Rs. 2.10 (4.65%) to close at Rs. 43.10.