Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 28 September 2021 01:58 - - {{hitsCtrl.values.hits}}

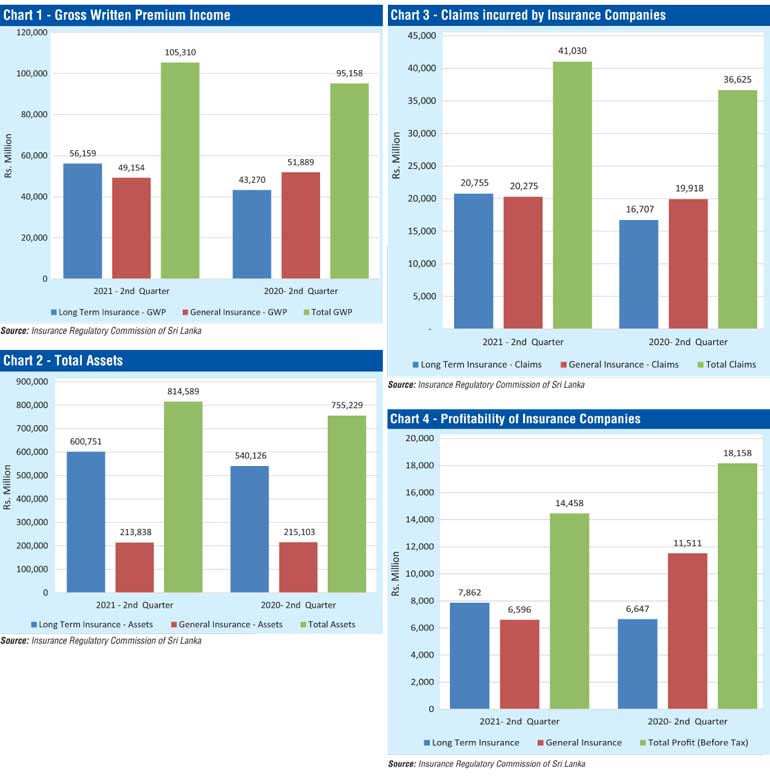

Following is the review of the performance of the insurance industry by the Insurance Regulatory Commission of Sri Lanka. The Q2 2021 information represents insurance companies’ information excluding National Insurance Trust Fund (NITF) and the comparative information of Q2 2020 represents insurance companies’ information including National Insurance Trust Fund (NITF). Total assets of the insurance brokering companies represent all insurance brokering companies excluding 12 brokering companies due to non-submission of quarterly returns.

Gross Written Premium

The insurance industry was able to achieve a growth of 10.67% in terms of overall Gross Written Premium (GWP), during the first half of 2021, recording an increase of Rs. 10,152 million when compared to the same period in the year 2020. The GWP for Long Term Insurance and General Insurance Businesses was Rs. 105,310 million compared to the first half of 2020 amounting to Rs. 95,158 million.

The GWP of Long-Term Insurance Business amounted to Rs. 56,159 million (first half 2020: Rs. 43,270 million) recording a growth of 29.79%. The GWP of General Insurance Business amounted to Rs. 49,154 million (first half 2020: Rs. 51,889 million) recording a decline of 5.27%

SEE CHART 1

Total assets

The value of total assets of insurance companies has increased to Rs. 814,589 million as at end of 1st half of 2021, when compared to Rs. 755,229 million recorded as at end of the first half of 2020, reflecting a growth of 7.86%. The assets of Long-Term Insurance Business amounted to Rs. 600,751 million (first half 2020: Rs. 540,126 million) depicting a growth rate of 11.22%, mainly due to increase in business volume which is represented by investments in government debt securities and corporate debts. The assets of General Insurance Business amounted to Rs. 213,838 million (first half 2020: Rs. 215,103 million) indicating a slight decline of 0.59%.

SEE CHART 2

Investment in Government securities

Investments in Government Debt Securities amounted to Rs. 241,254 million representing 45.33% (first half 2020: Rs. 224,179 million) of the total investments of Long Term Insurance Business and increased by 7.62%, while such investment of the total investment of General Insurance Business amounted to Rs. 50,631 million representing 37.14% (first half 2020: Rs. 57,286 million) and decreased by 11.62%. Accordingly, the total investment in Government Securities in the two businesses amounted to Rs. 291,885 million (first half 2020: Rs. 281,465 million), showing an overall increase of 3.70% respectively.

Claims incurred by insurance companies

The claims incurred by insurance companies in both Long Term Insurance Business and General Insurance Business were Rs. 41,030 million (first half 2020: Rs. 36,625 million) showing an increase in total claims amount by 12.03% year-on-year. The Long-Term Insurance claims, including maturity and death benefits, amounted to Rs. 20,755 million (first half 2020: Rs. 16,707 million). The claims incurred in General Insurance Business, including Motor, Fire, Marine and other categories, amounted to Rs. 20,275 million (1st half 2020: Rs. 19,918 million). Hence, during the first half of 2021, there is an increase in claims incurred by 24.23% and 1.80% for Long Term Insurance and General Insurance Businesses respectively, when compared to the same period in2020.

SEE CHART 3

Profit (before tax) of insurance companies

The profit (before tax) of insurance companies as at end of first half of 2021 in both Long Term Insurance Business and General Insurance Business amounted to Rs. 14,458 million (first half, 2020: Rs. 18,158 million) showing a significant decrease in total profit amount by 20.38%. The profit (before tax) of Long-Term Insurance Business amounted to Rs. 7,862 million (first half 2020: Rs. 6,647 million), while the profit (before tax) of General Insurance Business amounted to Rs. 6,596 million (first half, 2020: Rs. 11,511 million). Thus, profit (before tax) of Long-Term Insurance Business has increased by 18.28% and General Insurance Business has decreased by 42.70%.

SEE CHART 4

Insurers

Out of 27 insurance companies (insurers) in operation as at 30 June 2021, 13 are engaged in Long Term (Life) Insurance Business, 12 companies engaged in General Insurance Business and two are composite companies (dealing in both Long Term and General Insurance Businesses).

Insurance brokers

Sixty-eight insurance brokering companies were registered with the Commission as at 30 June 2021. Total assets of insurance brokering companies have increased to Rs. 7,189 million as at the end of the first half of 2021 when compared to 6,154 million recorded as at first half of 2020, indicating a growth of 16.82%.