Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 15 June 2021 01:36 - - {{hitsCtrl.values.hits}}

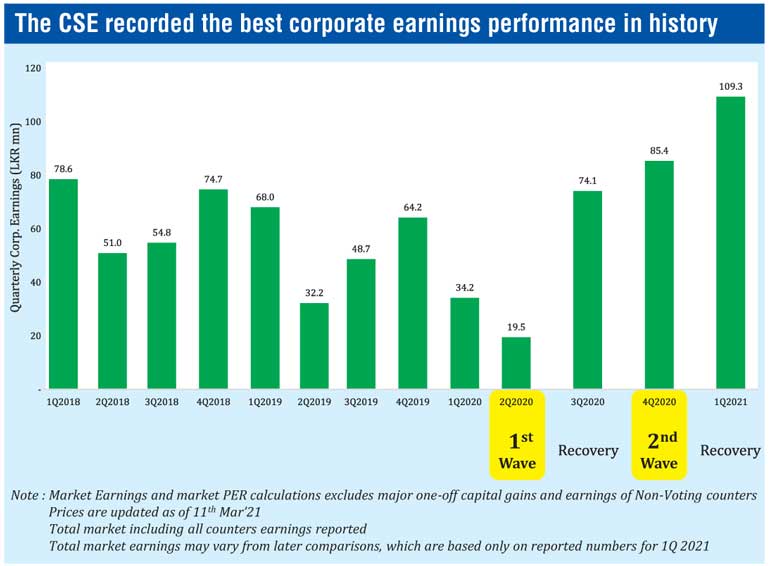

Sri Lanka’s listed companies witnessed another landmark, as first quarter earnings crossed the Rs. 100 billion milestone for the first time in the history of the Colombo Stock Exchange, as Softlogic Stockbrokers yesterday released their analysis of earnings in 1Q of the calendar year 2021.

Softlogic Stockbrokers said the growth was a monumental 189% YoY compared to the corresponding quarter the previous year.

Recording its best quarterly earnings performance in history of over Rs. 109 billion, the total reported earnings tally for the past six months reached Rs. 195 billion and Rs. 285 billion on a Trailing 12 months (TTM) basis.

“It is commendable that the growth momentum comes despite the period being stricken by two waves of COVID-induced lockdowns, which severely impacted mobility and overall economic activity,” Softlogic Stockbrokers said.

It said the growth is in testament to the favourable climate for local companies during the post-lockdown period backed by import protectionism, economic stimulus and USD depreciation, which proved to benefit local industries and export segments whilst pent-up demand helped play a further role in strengthening the earnings performance.

The broking firm also said earnings momentum continued from its depressed state during the first wave of COVID-19, to record a 462% growth 2Q 2020 and a 28% growth from 4Q 2020 – the quarter that was affected by the second wave.

The broking firm also said earnings momentum continued from its depressed state during the first wave of COVID-19, to record a 462% growth 2Q 2020 and a 28% growth from 4Q 2020 – the quarter that was affected by the second wave.

“A deeper analysis of earnings reveals confirms the thesis that corporates are becoming better equipped to handle lockdowns as it makes its transition into the new normal, whilst the opening up of the economy provides an instant boost following an extended lockdown period,” Softlogic Stockbrokers said.

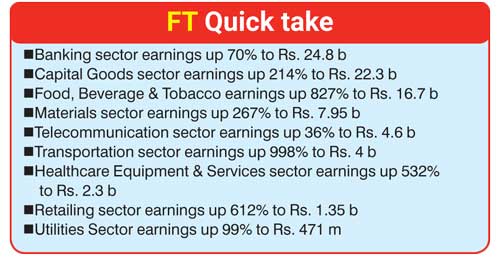

Following is a brief segmental analysis.

The Banking sector earnings shot up by 70% YoY to Rs. 24.8 billion (+33% QoQ in 1Q2021/4QFY21) amidst lower impairment provisioning compared to last year and a slight margin of improvement after bottoming out during 4Q2020.

Capital Goods sector earnings were up 214% YoY to Rs. 22.3 billion in 1Q2021/4QFY21 and up by 63% on QoQ basis, on the back of import protectionism, USD depreciation and revival in overall activity levels as the country adjusted to a new normal.

Food, Beverage & Tobacco saw phenomenal earnings growth of 827% YoY to Rs. 16.7 billion, displaying properties of giffen goods, as the country switched back to basics, whilst the palm oil price spike continued to benefit CARS in 4Q’21.

Materials sector earnings improved significantly (267% YoY to Rs. 7.95 billion) remaining broadly around the Q4 earnings mark (21% QoQ) to record a growth of over 160% on a TTM Basis, to be the best performing sector of the CSE.

The Healthcare Equipment & Services sector earnings improved significantly, 532% YoY, to Rs. 2.3 billion and 22% QoQ due to the surge in demand in the healthcare sector.

Telecommunication sector earnings surged 36% YoY to Rs. 4.6 billion in 1Q2021/4QFY21 on the back of improved data consumption, cost saving initiatives and reduced operational expenses.

Transportation sector earnings spiked 998% YoY to Rs. 4 billion on the back of the extraordinary earnings boost witnessed by EXPO, however on a QoQ basis earnings dropped 12%.

The Retailing sector witnessed phenomenal growth in earnings by 612% YoY to Rs. 1.35 billion (29% QoQ) driven by the strong pent-up demand which continued to be seen in 1Q2021/4QFY21, as mobility recovered to near normalcy.

Utilities Sector earnings grew 99% YoY to Rs. 471 million, in line with its seasonality despite falling 67% QoQ in 1Q2021/4QFY21 due to unfavourable weather conditions compared to 4Q’20.