Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 5 January 2026 05:36 - - {{hitsCtrl.values.hits}}

Private sector lending rates remained elevated in 2025 as demand for credit improved even as returns on bank fixed deposits declined in line with benchmark Treasury Bill rates.

Private sector lending rates remained elevated in 2025 as demand for credit improved even as returns on bank fixed deposits declined in line with benchmark Treasury Bill rates.

While the Central Bank of Sri Lanka (CBSL) reduced its policy corridor by 25 basis points (bps) during 2025, the Average Weighted Prime Lending Rate (AWPLR) of the commercial banking sector increased by 17 bps year-on-year (YoY) to 9.07% in the week ending 2 January. In contrast, the Average Weighted New One-Year Fixed Deposit rate fell by 66 bps to 6.53% from 7.19% a year earlier.

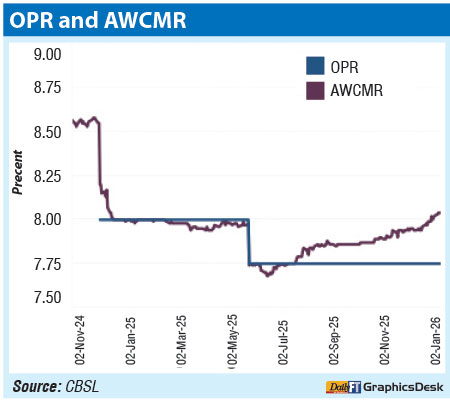

The Overnight Policy Rate declined by 25 bps to 7.75% over the year, while the Standing Deposit Facility Rate and Standing Lending Facility Rate were also reduced by an equal margin to 7.25% and 8.25%, respectively.

However, overnight interbank conditions showed mild tightening, with the Average Weighted Call Money Rate edging up to 8.04% from 8% a year earlier, suggesting that short-term funding costs did not ease in tandem with policy rates due to growing credit demand.

The divergence became more pronounced in the second half of 2025. As at end-June 2025, the policy corridor had been lowered by a cumulative 125 bps YoY, with the AWPLR easing 67 bps to 8.11%. Over the same period, the Average Weighted New Fixed Deposit rate fell more sharply by 110 bps to 6.78%. Subsequently, lending rates firmed again, even as deposit rates continued to adjust downward.

Short-term Government securities, which serve as a benchmark for deposit pricing, recorded broad-based declines. The 91-day Treasury Bill yield fell 81 bps YoY to 7.74% as of 2 January, while the 183-day and 364-day Treasury Bill yields declined to 8.27% and 8.45%, respectively, reinforcing downward pressure on deposit rates.

At the same time, private sector credit demand strengthened significantly. Total private sector borrowings surged to a record Rs. 246.1 billion in October 2025, pushing outstanding domestic private sector credit to Rs. 9.76 trillion, up 24.1% from a year earlier. This followed strong borrowing in September and August, amounting to Rs. 236 billion and Rs. 227 billion, respectively.

According to CBSL data, domestic banking sector credit to the private sector in October amounted to Rs. 247.7 billion. Outstanding private sector debt from domestic banks during the first 10 months of 2025 stood at Rs. 9.76 trillion, up 25.8% YoY, while borrowings from overseas banks remained broadly unchanged at Rs. 583 billion.

The data indicate that while monetary easing has been transmitted swiftly to deposit rates and Government securities yields, lending rates to the private sector have remained relatively sticky amid strong credit demand and lingering risk considerations within the banking system.