Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 9 February 2026 04:43 - - {{hitsCtrl.values.hits}}

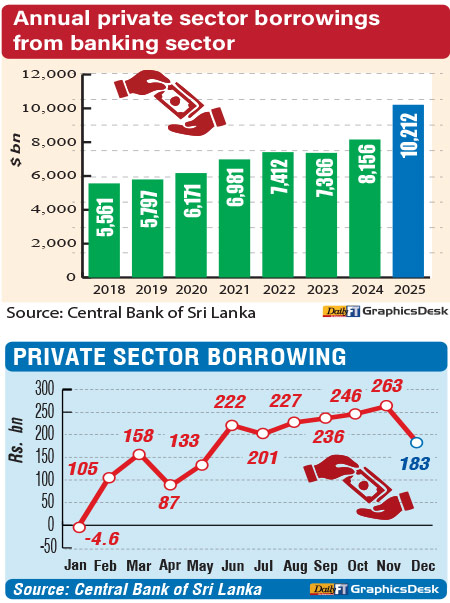

Total outstanding private sector borrowings increased 25.2% to an eight-year high of Rs. 10,212 billion in 2025, nearly doubling from touching Rs. 5,561.4 billion in 2018.

Total outstanding private sector borrowings increased 25.2% to an eight-year high of Rs. 10,212 billion in 2025, nearly doubling from touching Rs. 5,561.4 billion in 2018.

According to latest Central Bank of Sri Lanka (CBSL) data, total outstanding private sector borrowings from domestic banking units increased 27.4% to Rs. 9,630 billion, with total credit from overseas banking units declining 2.4% to Rs. 581.8 billion.

Net credit to the Government was up 0.2% to Rs. 8,285.2 billion in 2025, with borrowings from the CBSL up 3.1% to Rs. 1,828 billion, and borrowings from the banking sector declining 0.6% to Rs. 6,457 billion.

Public corporations and State-owned enterprises (SOE) borrowings from the banking sector fell 20.9% to Rs. 520 billion.

As expected post-Ditwah, total private sector borrowings in December 2025 fell to Rs. 182.80 billion, a seven-month low after peaking in November 2025 at Rs. 262.6 billion, the highest monthly figure. October 2025 was the second highest at Rs. 246.10 billion, followed by Rs. 236 billion in September 2025, and Rs. 227 billion in August 2025.

New domestic banking sector credit to the private sector in December 2025 amounted to Rs. 196.30 billion, with credit from overseas banks declining Rs. 13.50 billion.

New credit to the Government amounted to Rs. 170.30 billion, with loans from domestic banks amounting to Rs. 180.90 billion while credit from the CBSL fell by Rs. 24 billion. Banking sector loans to public corporations and SOEs declined by Rs. 65 billion during December 2025.

CBSL Governor Dr. Nandalal Weerasinghe delivering the bank’s annual monetary policy address in January said: “Economic growth is expected to remain around 4-5% in 2026, supported by expanding private sector credit, easing financial conditions, and improved macroeconomic buffers.”

He said inflation, which remained below the 5% target for an extended period following deflationary pressures, is projected to gradually rise and converge to target by the second half of 2026, subject to risks linked to supply disruptions and post-cyclone reconstruction dynamics. Inflation measured by the Colombo Consumer Price Index (CCPI) remained unchanged at 2.1% in December 2025.

The CBSL in its first Monetary Policy statement on 28 January said credit disbursed to the private sector by commercial banks and other financial institutions continued its notable expansion in late 2025. “This reflects increased demand for credit amid improving economic activity and increased vehicle imports. Post-cyclone rebuilding is expected to sustain this momentum,” it said.

In 2025, net foreign exchange purchases by the CBSL during 2025 generated a sustained surplus of rupee liquidity in the domestic money market, while lifting gross official reserves to their highest post-crisis level, according to the Market Operations Report – December 2025.

On a value-date basis, the CBSL recorded net foreign exchange purchases of $ 1.99 billion during the year. The report states that “foreign exchange purchases and swap transactions contributed to injecting rupee liquidity amounting to approximately Rs. 788.9 billion, on a net basis.”