Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 12 January 2026 03:55 - - {{hitsCtrl.values.hits}}

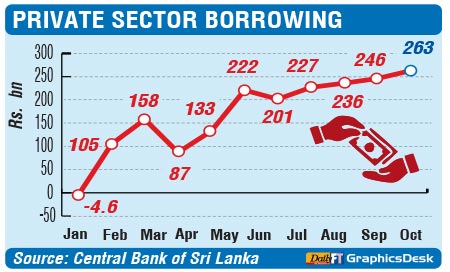

Total private sector borrowings in November 2025 peaked to Rs. 262.6 billion, the highest monthly figure yet for 2025, before the devastating Cyclone Ditwah hit the island.

Total private sector borrowings in November 2025 peaked to Rs. 262.6 billion, the highest monthly figure yet for 2025, before the devastating Cyclone Ditwah hit the island.

October 2025 was the second highest at Rs. 246.10 billion, followed by Rs. 236 billion in September, and Rs. 227 billion in August.

According to the latest Central Bank of Sri Lanka (CBSL) data, domestic banking sector credit to the private sector in November amounted to Rs. 262.6 billion, taking the outstanding private sector debt stock to Rs. 10 trillion, up 26% from a year ago, with the debt stock from domestic banks increasing 27.9% year-on-year (YoY) to Rs. 9.43 trillion and up 1.1% to Rs. 595.3 billion from overseas banking units.

The outstanding credit stock to the Government grew 0.1% YoY to Rs. 8.11 trillion as of end-November 2025, with credit from domestic banks down 0.7% YoY to Rs. 6.18 trillion.

Total credit to public corporations was down 11.3% YoY to Rs. 584.8 billion, with the domestic banking sector debt stock at Rs. 531 billion, down 12.6% from a year ago.

In end-November 2025, the CBSL, delivering the sixth and final Monetary Policy Review for 2025 announced that rates would remain unchanged at 7.75%.

That was before the devastating Cyclone Ditwah hit the country in the last week of November and early December 2025.

Post-Ditwah, CBSL Governor Dr. Nandalal Weerasinghe said the CBSL expected supply chain disruptions from the cyclone to cause only a brief increase in inflation to about 3%.

He said inflation should revert once bottlenecks clear. “Over a period of time, once supply chain issues are addressed, I would say we will come back to the normal inflation trajectory,” he said. “We will maintain stability going forward, as we have been doing so far under the framework.”

However, an International Monetary Fund (IMF) staff paper suggests that inflation could exceed the CBSL’s 5% limit on account of Ditwah.

The CBSL had announced several measures to help businesses affected by the Ditwah disaster to access bank credit at concessionary rates and terms. At the regulatory level, the CBSL has directed licenced banks to roll out targeted debt relief and concessional credit for borrowers affected by the recent cyclonic disaster.

The measures include suspending capital and interest repayments on existing facilities for three to six months on a case-by-case basis, extending new loans with capped interest rates, waiving penal charges and fees until end-January 2026, and easing access to credit without automatic rejection based on adverse Credit Information Bureau (CRIB) records. The relief is to be granted on request by affected borrowers by 15 January and is intended to support households and businesses while preserving financial system stability.

The Government subsequently announced a concessionary loan scheme with 3% interest for Ditwah-hit businesses, which will be disbursed by the banking sector.

Earlier this month, President Anura Kumara Dissanayake had instructed officials to roll out the scheme expeditiously but also instructed them that small and medium business enterprises needed to be registered in an attempt to bring the informal sector into the fold and lure tax evaders into the net.