Saturday Mar 07, 2026

Saturday Mar 07, 2026

Wednesday, 13 October 2021 00:25 - - {{hitsCtrl.values.hits}}

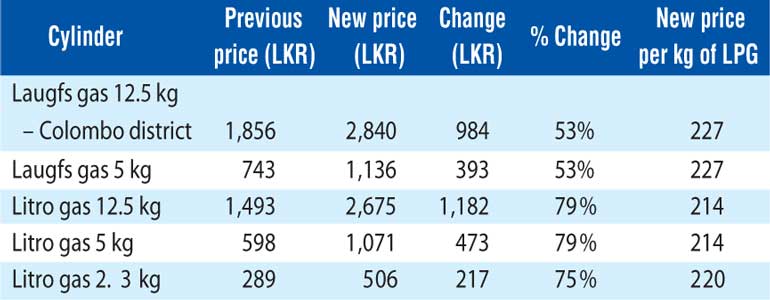

Capital Alliance Research (CAL) forecasts that the impact from Sunday’s hike in LPG prices will be over 1% on inflation.

“As per our estimates, a 65% average increase in LP gas may translate to a 1.4% month-on-month direct impact to inflation, providing everything else remains constant,” CAL said.

“The month-on-month inflation measured by CCPI could cross 7% for the month of October, from 5.7% measured in September 2021.”

CAL expects prices of bakeries and restaurants to adjust upwards to reflect the LPG hike although the impact on industrial manufacturers may remain largely unaffected as industrially sourced LPG in Sri Lanka moves in tandem with global prices and therefore the manufacturers have already been bearing the cost.

With regard to listed entity LAUGFS Gas PLC, CAL said it may turn profitable on an EBIT profit level with the recent price increase, if the earlier 20% market share was recaptured.

CAL said the profitability of the LGL domestic energy segment was heavily contingent on the movement in Propane and Butane prices as well as the LKR/USD exchange rate. Comparing the costs of Propane (45% increase YTD on USD terms) and Butane (50% increase YTD on USD terms) and the loss stemming from the LKR depreciation (10% YTD), the total raw material cost of a 12.5 kg cylinder has increased by Rs. 768 per cylinder YTD as of October to Rs. 2026/cylinder according to CAL estimates.

“We anticipate that this increase in selling prices may offset the problematic hikes in raw material costs and result in LGL offsetting and exceeding its direct cost of imports by Rs. 814.”

Following the price increase, which was authorised by the Consumer Affairs Authority on 12 August, LAUGFS resumed its domestic operations. CAL said while there may have been an erosion in market share during their halting of operations in late July of 2021, if the company is expected to recapture their market share (20% in 2020) LGL may be EBIT positive for 3QFY22.

In addition to the Propane and Butane prices, the gas manufacturer was also impacted by increasing freight rates during the current financial year (150% YTD increase in ocean freight rates) as almost 100% of their raw materials are imported. LGL recorded a negative NAV of Rs. 1.83 as at 30 June.