Friday Feb 20, 2026

Friday Feb 20, 2026

Saturday, 24 January 2026 04:53 - - {{hitsCtrl.values.hits}}

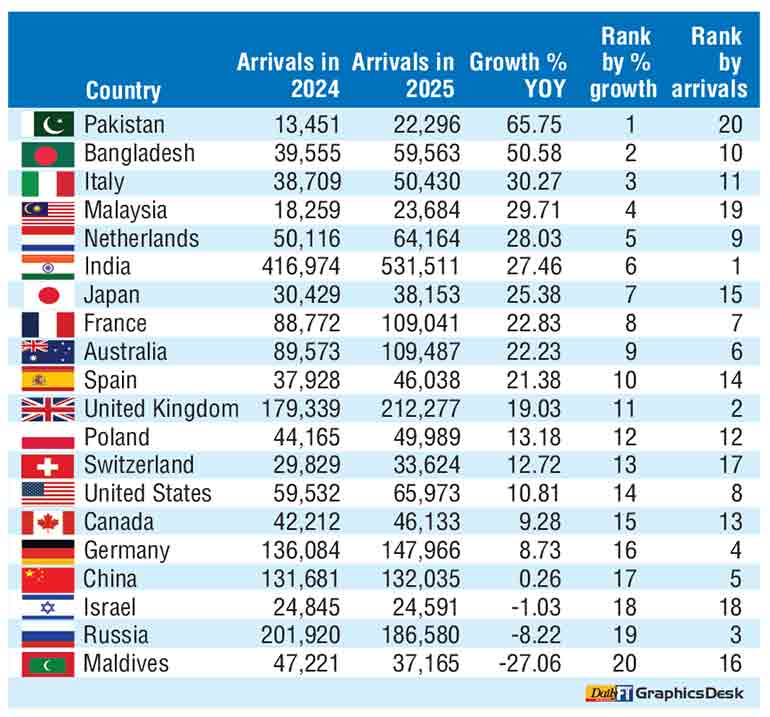

Sri Lanka’s tourism industry experienced record-breaking growth in 2025 with over 2.36 million arrivals, as unconventional markets outpaced traditional powerhouses in growth.

Despite traditional markets like India, the UK, and Russia retaining their dominance in terms of total arrivals, a deeper analysis of year-on-year (YoY) growth trends revealed intriguing shifts, with new markets showcasing noteworthy increases.

Pakistan emerged as the standout performer, recording a staggering 65.75% YoY increase in visitor numbers. Despite ranking 20th in terms of total arrivals, Pakistan’s performance highlights its untapped potential in the South Asian market and growing significance within the country’s tourism mix. Similarly, Bangladesh posted an impressive 50.58% YoY growth, securing its position as the second fastest-growing market, although ranked 10th in total arrivals last year.

Italy, long considered as a key generating market, registered a robust 30.27% YoY increase, placing it third in growth rankings and ranking as the 11th largest source of tourists to Sri Lanka.

“We have noticed a uptick in Pakistan inquiries, particularly for Meetings, Incentives, Conferences, and Exhibitions (MICE) and leisure travel, while for Bangladesh, it’s mostly leisure visitors,” Sri Lanka Association of Inbound Tour Operators (SLAITO) President Nalin Jayasundera told the Daily FT.

Malaysia followed closely with a 29.71% YoY increase, reflecting a renewed interest in the island nation, while Netherlands rounded out the top five with a 28.03% surge in growth during 2024.

He said the Malaysian boost is through the free-visa policy, noting that increased footfall in Italian visitors in 2025 was notable. “Italians love to explore and the numbers over the years have increased,” he added.

Other markets also demonstrated substantial YoY growth. India saw a 27.46% YoY rise ranking sixth whilst maintaining its stronghold in arrivals as top source of tourists to Sri Lanka in 2025. Japan registered a 25.38% YoY increase, highlighting the diversity of emerging tourist markets. France, Australia, and Spain followed suit, registering a 22.83%, 22.23%, and 21.38% YoY growth, respectively.

“Australia is definitely a market to target and with new budget airlines starting operations, we hope to see a remarkable boost in arrivals and earnings. Japan has a lot of potential too. Spanish nationals like to explore new countries and they doing round tours. If there are direct flights, the footfall from Spain will increase further,” Jayasundera added.

Traditional strongholds like the UK, Germany, and China posted more moderate growth rates.

The UK, Germany, and China which ranked second, fourth, and fifth in total arrivals, grew by 19.03%, and 8.73% and 0.26% YoY, respectively.

Resurgence of non-traditional markets such as Poland, Switzerland, the US, and Canada reflected evolving travel patterns, registering 13.18%, 12.72%, 10.81%, 26.63%, and 9.28% YoY growth, respectively. Switzerland was the only country that retained its arrivals and growth rank at 12th.

The SLAITO President said the trend signals promising future for industry as it reduces dependence on legacy sources.

Interestingly, Russia – the third-largest source market in 2025, which drew 186,580 arrivals – experienced only a negative 8.22% YoY dip. Israel and Maldives also saw contractions of 1.03% and 27.06% YoY, respectively.

Industry analysts note that the diversification of the source markets enhances resilience, reducing over-reliance on a few dominant countries. This trend is expected to accelerate in 2026, with the Government preparing to roll out the long-delayed free-visa regime for over 40 countries in the first quarter, alongside a unified national tourism brand as confirmed by Tourism Minister Vijitha Herath on 5 January (https://www.ft.lk/top-story/Tourism-arrivals-grow-by-15-to-2-36-m-record-high-in-2025/26-786582).

The analysis also points to the country’s evolving market landscape not only boosts arrivals, but also provides resilience against unforeseen challenges, ensuring a robust and dynamic tourism industry.

Sri Lanka aims to woo a minimum of 3 million arrivals and $ 5 billion revenue this year. A long-term strategy is also in place to draw over 5 million visitors with an anticipated revenue range of $ 8 billion by 2030.

January arrivals rise 10% in first 3-weeks

Sri Lanka’s tourism sector has kicked off 2026 with solid momentum, recording a 10% year-on-year (YoY) growth in visitor arrivals during the first 22 days of January, reinforcing cautious optimism over a sustained recovery and a more resilient travel demand profile.

According to provisional data, the country welcomed 194,553 international visitors between 1 and 22 January 2026, compared to 177,400 arrivals during the corresponding period last year.

The performance translates into a daily average of 8,843 tourists, up from 8,064 in early 2025, signalling a steady improvement in arrival intensity rather than a one-off surge.

Arrival figures indicate a stable upward trajectory across the first three weeks of the year. The first week of January recorded 58,822 visitors, followed by 62,593 in the second week and 63,507 in the third week, reflecting incremental gains week-on-week. A further 9,631 tourists arrived on 22 January alone, underscoring sustained demand even beyond peak holiday travel days.

Industry observers note that such consistency early in the year is significant, as January typically sets the tone for the tourism calendar, particularly for long-haul and winter escape markets.

India retained its position as Sri Lanka’s largest source market, contributing 35,177 visitors, accounting for 18% of total arrivals during the period. Russia followed with 19,930 tourists, while the UK (19,893) and Germany (12,822) continued to be strong European contributors. France added 9,470 visitors, maintaining its position among the top five markets.

Other notable source markets included Australia, China, Poland, the United States and the Netherlands, highlighting a relatively diversified inbound mix, though arrivals remain heavily concentrated in a few key geographies.

Earlier this month, Sri Lanka Tourism concluded a major promotional campaign in India, covering key metropolitan centres such as Delhi, Mumbai and Chennai. As India is both the largest and one of the fastest-growing source markets, the initiative is strategically aimed not just at increasing volumes, but also at attracting higher-spending and year-round travellers, including leisure, experiential and special-interest segments.

Tourism officials view India as critical to smoothing seasonality, given its proximity, growing middle class and expanding outbound travel market. The recent roadshows and engagements are also expected to support diversification beyond traditional leisure travel into weddings, MICE and wellness tourism.

Although the near 10% growth signals a positive start to 2026, analysts caution that sustaining momentum will depend on pricing competitiveness, air connectivity, destination branding and service quality. Regional competition for tourists, particularly from Southeast Asia and the Indian Ocean remains intense, while travellers are increasingly value-conscious.

Sri Lanka aims to attract a minimum of 3 million visitors this year.