Friday Mar 13, 2026

Friday Mar 13, 2026

Friday, 30 January 2026 00:23 - - {{hitsCtrl.values.hits}}

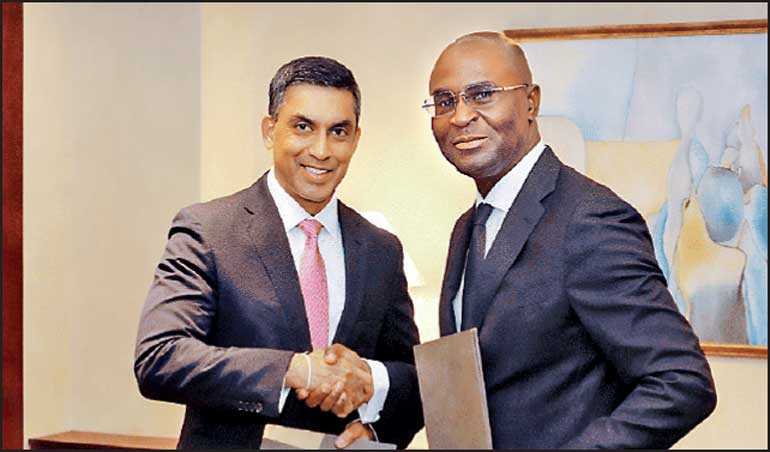

NDB Bank CEO/Director Kelum Edirisinghe (left) and IFC Regional Director – Financial Institutions Group (Asia and the Pacific) Allen Forlemu exchange the agreements

National Development Bank PLC (NDB) yesterday said that it has strengthened its strategic partnership with the International Finance Corporation (IFC), a member of the World Bank Group, on three distinct fronts, to support its journey forward as an impactful contributor to Sri Lanka’s banking and financial services landscape.

The bank said relationship between NDB and IFC, which dates back to 1998 having collaborated on multiple fronts over the years, will now be extended to cover a Risk Sharing Facility (RSF) and a trade finance facility focusing on small and medium scale enterprises (SMEs), and an Advisory Engagement to help the bank in elevating transaction banking, supply chain finance business, and enhance climate risk management practices.

The RSF, which is soon to be operationalised, is a part of the IFC’s Small Loan Guarantee Program (SLGP), under which the IFC will equally share risks with the NDB for all eligible facilities. The program has been designed with a greater focus on supporting lending for agriculture value chains, SME exporters, and women empowerment, amongst other social betterment causes. The IFC will also provide embedded advisory support which will further strengthen the NDB’s capacity to effectively deploy the facility through targeted training initiatives, while also enhancing the capabilities of the bank’s SME clientele.

The second agreement comprises a trade finance facility under the IFC’s Global Trade Finance Program (GTFP). This unfunded facility will be utilised to guarantee the NDB’s trade-related payment obligations, thereby supporting the bank’s international trade activities. Through this engagement, the NDB will collaborate with the IFC’s trade finance experts and benefit from the IFC’s strong credit standing and deep technical expertise in the said subject matter.

The IFC’s AAA-rated guarantee provides high-quality risk mitigation to participating banks, significantly reducing counterparty risk on covered trade transactions, optimising capital consumption through improved risk weighting, and enhancing the confidence of global correspondent banks in transacting with the NDB, ultimately enabling increased trade flows for the bank’s customers. By supporting the NDB’s role in connecting Sri Lankan businesses to global supply chains, this facility will help expand market reach for SMEs and exporters.

In addition to financing, the NDB also enters into a series of advisory initiatives.

With support under the Global SME Finance Facility (GSMEF), the IFC will provide technical assistance to the NDB to modernise the bank’s Transaction Banking (TB) and Supply Chain Finance (SCF) business. This partnership will support the enhancement of SCF and TB business operations, helping to optimise working capital management within corporate value chains and close the financing gap for SMEs, with a particular emphasis on women-led businesses.

Further, with support from the Government of Japan, the IFC will assist the bank in conducting a climate risk diagnostic and physical risk materiality assessment, forming the foundation for establishing a comprehensive climate risk management framework. This engagement will enable the NDB to formally identify climate risk as a key risk category and integrate it into the bank’s overall risk management framework and strategy. The project comes at a particularly timely juncture and will help reinforce the bank’s commitment to transparency, resilience, and sustainability.

NDB Bank CEO/Director Kelum Edirisinghe said: “We are very pleased to further strengthen our existing partnership with the IFC. The NDB is currently on a strong growth momentum, having just embarked on its new strategic roadmap and charting its course towards an ambitious 2030. This further collaboration with the IFC comes at this crucial juncture where the bank’s efforts will be further augmented with the IFC’s vast technical expertise and funding strength.”

“The bank will benefit from multiple fronts, including – amongst others – capacity building and knowledge enhancement for our staff on each of these distinct engagements, provide greater agility to support the needs of our SMEs more so in their now time of need and an enhanced ability to provide efficient and customised trade solutions for all our customers and, from a climate risk perspective, strengthen our related risk assessment capabilities. All in all, these tie-ups will collectively help the NDB in its efforts to play a greater role in supporting the country’s SMEs and its sustained economic growth agenda and better position the bank to deliver long-term sustainable value for the benefit of all its stakeholders including, amongst others, its customers and shareholders,” Edirisinghe added.

IFC Regional Director – Financial Institutions Group (Asia and the Pacific) Allen Forlemu said: “When SMEs thrive, entire economies move forward. Access to capital remains a critical priority for Sri Lankan entrepreneurs, and our partnership with the NDB is designed to address this by helping SMEs access the financing and the know-how needed to scale and grow. This reflects the IFC’s long-term commitment to Sri Lanka’s economic revival and growth ambitions, underscoring the private sector’s role in driving inclusive progress.”

Aligned with the World Bank Group priorities for Sri Lanka, this partnership aims to deliver targeted solutions for SMEs, helping businesses overcome challenges and supporting the country’s long-term economic resilience, he noted.