Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 9 December 2025 00:26 - - {{hitsCtrl.values.hits}}

Moody’s Investors Service has warned that the recent climate-driven natural disasters across South and Southeast Asia pose its most significant credit impact for Sri Lanka because of the country’s limited fiscal capacity and high vulnerability to physical climate risks.

In a 5 December dated statement Moody’s said: “Since mid-November, countries in South and Southeast Asia have been pummelled by several tropical cyclones which, combined with unusually heavy monsoon rains, have caused severe flooding and landslides, and the tragic loss of

hundreds of lives.”

The agency added: “The economic, fiscal and credit impact of the disaster is likely to be most material for Sri Lanka (Caa1 stable).”

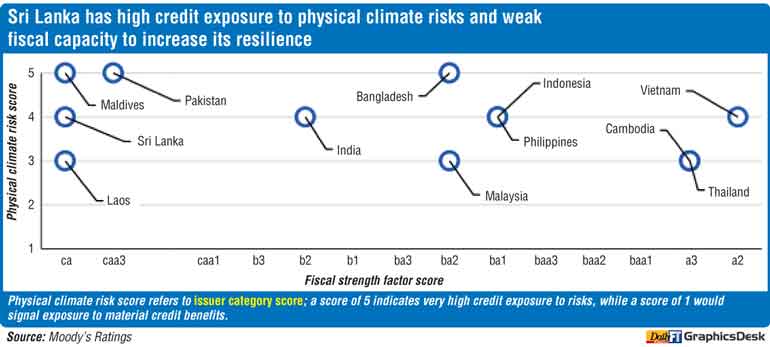

Moody’s places Sri Lanka in a group of highly exposed countries, noting that Sri Lanka, as well as Indonesia (Baa2 stable), the Philippines (Baa2 stable) and Vietnam (Ba2 stable) all have high credit exposure to physical climate risks.

“Sri Lanka has much weaker fiscal capacity to increase its resilience than its neighbours.” These conditions, Moody’s says, heighten the consequences of the current disaster for a sovereign still navigating post-default stabilisation.

The agency also connects climate risk outcomes to institutional capacity.

“Effective governance is also key in mitigating such risks and often correlates with lower physical climate risk vulnerability in regions of high exposure. While recent reforms have led to some improvement, both Sri Lanka and Vietnam have governance issuer profile scores of 4, indicating high credit exposure to governance risks.”

In its wider regional view, Moody’s says credit implications for other affected Governments will be more limited. Although Indonesia, the Philippines and Vietnam share similar climate-risk exposure, their stronger fiscal positions give them more room to respond.

However, Moody’s warns of broader structural vulnerabilities across the region, saying that the severity of the flooding highlights broader credit vulnerabilities to physical climate risks over the longer term, especially given limited natural catastrophe insurance coverage in the region.

Last October, Moody’s said Sri Lanka’s macroeconomic recovery remained broadly on track. It has had expected the current account to stay in surplus in 2025, supported by tourism and remittances despite a rise in vehicle imports. But it cautioned that Sri Lanka’s narrow revenue base and dependence on external financing remain key vulnerabilities if the global environment shifts.

It said Sri Lanka’s fiscal strength remained constrained by a high debt burden and very low debt affordability, even as reforms with development-partner support were beginning to show results. The stable outlook reflected balanced risks: further reforms could lift the rating, while weaker policy momentum or a deterioration in external buffers would put pressure on it.

The agency said sustained reform momentum under the IMF program could strengthen the credit profile, while any weakening of external buffers or reversal of reforms would raise downside risks.

In the aftermath of Cyclone Ditwah, Sri Lanka was compelled to request the IMF for additional relief. The IMF is reviewing a request for about $ 200 million Rapid Financing Instrument which is expected this year.

The Fifth Review under the Extended Fund Facility was to be finalised on 15 December resulting in the release of a $ 347 million tranche provided the 2026 Budget resonated with the program parameters.

However, the Government and the IMF have agreed to push the review to early 2026 on account of the emerging fiscal conditions post-Ditwah.