Sunday Feb 15, 2026

Sunday Feb 15, 2026

Wednesday, 3 November 2021 00:30 - - {{hitsCtrl.values.hits}}

|

| JKH Chairman Krishan Balendra

|

John Keells Holdings Plc (JKH) yesterday announced impressive financial results, signalling its resilience has rebounded despite the prevalent COVID pandemic-related restrictions and resultant impact in the second quarter.

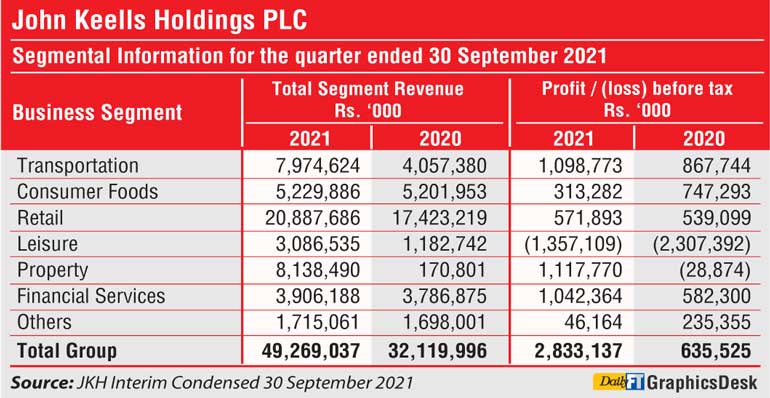

JKH Group earnings before interest expense, tax, depreciation and amortisation (EBITDA) rose by 93% to Rs. 6.41 billion from a year earlier; 2Q Group revenue was up 53% to Rs. 49.27 billion and the 1H figure was up 64% to Rs. 88.07 billion.

Group profit before tax (PBT) rose by 346% to Rs. 2.83 billion whilst profit attributable to equity holders of the parent was Rs. 2.86 billion as against Rs. 680 million a year ago.

JKH Chairman Krishan Balendra said the Group’s businesses, except for Consumer Foods and the Supermarket business, recorded strong growth in profitability compared to the second quarter of the previous year, despite the quarantine curfew which prevailed for a period of six weeks due to the third wave of COVID-19 cases which impacted business activity.

JKH said that the corresponding quarter in the previous year was a relatively more ‘normal’ quarter, with no COVID-19 related disruptions, where the country benefited from a faster recovery momentum post the outbreak of the first wave with most businesses reaching pre-COVID-19 levels.

However, Balendra noted that whilst the foreign exchange market witnessed significant volatility and uncertainty during the quarter, the strong balance sheet of the Group and cash reserves aided in navigating this period as operations and investments continued as planned.

In the first half, Group EBITDA amounted to Rs. 11.17 billion, a near four-fold rise from Rs. 4.12 billion a year ago; 1H PBT doubled to Rs. 4.14 billion from Rs. 1.79 billion.

Profit attributable to equity holders of the parent in 1H was Rs. 4.40 billion compared to a negative Rs. 978 million in the comparative period.

JKH Board also declared a first interim dividend of 50 cents per share to be paid on or before

3 December 2021. “The declaration of this dividend during this challenging environment reflects the cash generation capability of the Group’s diverse portfolio of businesses,” Balendra said.

JKH interim results were announced after the Colombo stock market was closed. Its share price gained by 2% to Rs. 150.

The Leisure industry group recorded a significant turnaround in performance with the Q2 2021/22 EBITDA almost at breakeven levels at a negative Rs. 46 million compared to a negative Rs. 1.19 billion in the corresponding quarter of the previous year.

Balendra said with the significantly improved healthcare situation in Sri Lanka, the authorities had relaxed the healthcare restrictions on arrivals into the country where travellers with a negative COVID-19 test result 72 hours prior to arrival did not need to quarantine or test on arrival.

“This is a significant step for setting the stage for the reopening of the country for tourism, which will be a key catalyst to drive the recovery momentum for the country, particularly in the context of the positive impact it will have on foreign exchange earnings,” he said.

The Maldivian Resorts segment continued its encouraging recovery momentum from the previous quarter where the occupancy at its hotels was higher than anticipated during this quarter, while the forward bookings for the upcoming season indicate a recovery to pre-COVID-19 levels.

The Consumer Foods industry group EBITDA in 2Q at Rs. 600 million was a 37% dip from a year earlier.

The quarantine curfew during the quarter under review significantly impacted the previously witnessed recovery momentum in volumes and same-store sales in the Consumer Foods businesses and the Supermarket business, respectively.

Balendra said the impact on profitability on account of lower volumes during the quarter was offset, to an extent, through selective price increases across SKUs in both businesses. In line with evolving consumer trends and lifestyles, the FC business expanded its portfolio with the introduction of a few products under its take-home range. The business is now witnessing a strong recovery momentum post the easing of restrictions and consumer activity returning to normalcy.

The overall profitability and margins of the businesses were also impacted by pressure on some raw material prices and the increased factory-related costs due to COVID-19 safety protocols, which were implemented to ensure uninterrupted supplies.

“These protocols have now been relaxed, in keeping with guidelines of the authorities and the completion of the vaccination drive at our factories. However, the pressure on product margins due to increasing raw material prices, which is largely a global phenomenon, is likely to continue over the next few quarters where all necessary measures to mitigate this impact will be undertaken to the extent possible,” the JKH Chairman said.

Whilst the Convenience Foods business maintained its overall volume in line with the corresponding quarter in the previous year, profitability of the business was impacted due to the above-mentioned pressure on margins.

The Retail industry group EBITDA of Rs. 1.33 billion in 2Q was down by 3% from a year ago. The Supermarket business EBITDA suffered a 46% dip to Rs. 578 million.

Balendra said the decline in profitability in the Supermarket business was due to the closure of outlets to the public for half of the quarter as a result of quarantine curfew where the online revenue could not fully offset the impact.

While same-store sales recorded a growth in the months of July and August, despite the imposition of curfew for two weeks in the month of August, same-store sales and profitability in the month of September was significantly impacted due to the outlet closures, resulting in a sharp decline for the quarter.

With the easing of restrictions on movement, outlets have now opened to customers, adhering to the strict safety guidelines issued by the Government and health authorities, and are witnessing a strong rebound in sales.

The mobile phones business, which is included under Retail, recorded a strong increase in profitability driven by a strong growth in volumes.

The Property industry group EBITDA in 2Q was Rs. 1.26 billion as against Rs. 12 million a year ago. The handover process of the residential apartment units at Cinnamon Life continued during the quarter, resulting in recognition of revenue and profits from sales in the project.

Revenue and profit recognition in Cinnamon Life will continue throughout the financial year as the handover of the residential apartments and commercial office spaces already sold will be completed, in addition to new sales recorded, Balendra said.

The Transportation industry group EBITDA rose by 29% to Rs. 1.20 billion in 2Q. The increase in profitability is attributable to the performance of the Group’s Ports business, South Asia Gateway Terminals (SAGT), and the Bunkering business, Lanka Marine Services (LMS).

“Although overall the Port of Colombo and SAGT witnessed a decline in volumes during the quarter due to disruptions in global vessel movement, the profitability at SAGT recorded an increase as a result of an improved volume mix and higher revenue from ancillary operations,” Balendra said. LMS however recorded an increase in profitability driven by a double-digit growth in volumes.

The second quarter saw the Build, Own and Transfer Agreement between the Sri Lanka Ports Authority and Colombo West International Container Terminal Ltd., the project company, executed for a lease period of 35 years. This was following the execution of a Letter of Intent to develop and operate the West Container Terminal in the Port of Colombo,

The Financial Services industry group EBITDA rose by 51% to Rs.982 million in 2Q. The Nations Trust Bank PLC recorded an increase in profitability driven by positive loan growth and lower impairment charges despite some pressure on net interest margins stemming from lower interest rates. Union Assurance PLC recorded an increase in profitability driven by a growth in gross written premiums. The new business premiums in particular recorded an encouraging increase.