Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 8 October 2019 00:00 - - {{hitsCtrl.values.hits}}

The lending rate cap recently imposed by the Central Bank of Sri Lanka (CBSL) on rupee-denominated loans extended by Sri Lankan banks may not improve loan growth in the short term, Fitch Ratings said yesterday.

To the extent banks cannot price for risk in order to make hurdle rates of return, they may extend less credit for riskier consumer and commercial loans that carry higher losses.

Lower lending rates may not be sufficient to spur credit demand to stimulate economic growth, given the nation’s weak borrower sentiment and subdued economic activity.

Banking sector loans contracted by 0.5% at the end of June 2019 from December 2018, driven by a reduced appetite for lending among banks and weakened credit demand against a challenging operating environment.

The CBSL directive to cap lending rates was a response to regulatory concern over deceleration in credit demand and continued increases in nonperforming loans (NPLs). The CBSL’s actions are intended to accelerate the effects of previous measures to reduce lending rates, including a reduction in policy rates, a decrease in the Statutory Reserve Ratio and a cap on rupee deposit interest rates that has since been lifted with the introduction of the lending rate cap.

Bank profits, already weakened by higher credit costs and effective tax rates, could see further pressure given our expectation of continued subdued loan demand. In the near term, the lending rate cap may have a limited impact on bank net interest margins. Yield pressure on loans from caps on incremental lending and when loans come up for renewal will be partially offset by lower funding costs given the progressive re-pricing of deposits, as the CBSL imposed a cap on rupee-denominated deposits in April 2019. However, the ultimate impact depends on several variables, including the composition of individual bank loan portfolios.

Banks are required to reduce interest penalties on delinquent loans to a cap of 400 basis points by 15 October, which may not be sufficient to facilitate a reduction in NPLs. The trend of rising NPLs continued into 2019, with the sector-wide NPL ratio climbing to 4.8% at end-June 2019 from 3.4% at 31 December 2018. Credit risks are likely to linger, reflected in an increase in restructured loans. The reduction in lending rates may help to alleviate pressure on the accretion of NPLs. However, asset quality stresses are expected to remain until economic activity resumes.

The Central Bank of Sri Lanka ordered banks to reduce the interest rates on all rupee-denominated loans and advances by at least 200 basis points by 15 October, from the interest rates charged at 30 April 2019. Banks do not need to reduce rates if the interest rate is currently at or below 12.5%. Rates on certain products, while reduced, remain high, with credit card annual percentage rates capped at 28%; leases and gold-backed loans are excluded.

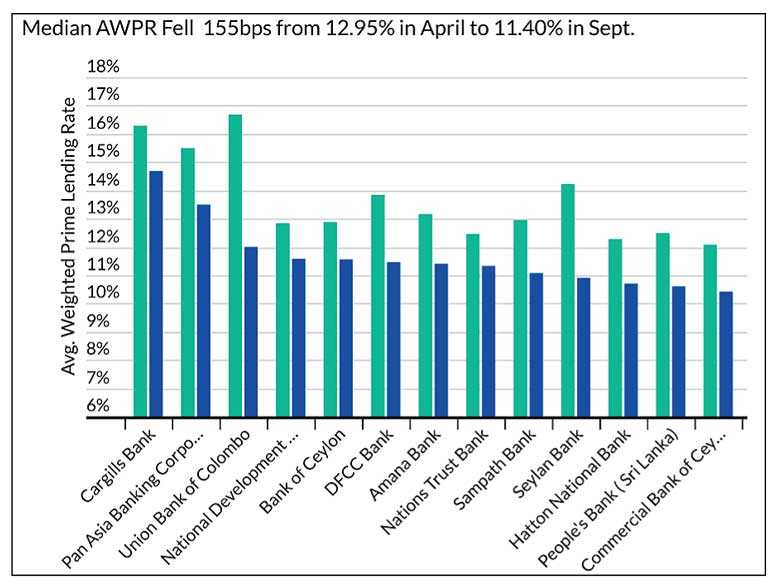

The CBSL also requires banks to reduce the weekly Average Weighted Prime Lending Rate (AWPR) by 150 basis points by 1 November and by at least 250 basis points by 27 December, compared to the AWPR at 26 April 2019. Banks with AWPRs at or below 9.5% are excluded. The AWPR of domestic commercial banks was already at least 100 basis points lower at end September 2019 than at April 2019. The CBSL indicated that it expects to review this order at end March 2020.