Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 11 August 2023 02:14 - - {{hitsCtrl.values.hits}}

|

Group CEO Kasturi C Wilson

|

Hemas Holdings PLC has delivered a healthy performance for the first three months of the financial year 2023/24, effectively navigating the macroeconomic headwinds as the country moves towards an economic stabilisation phase.

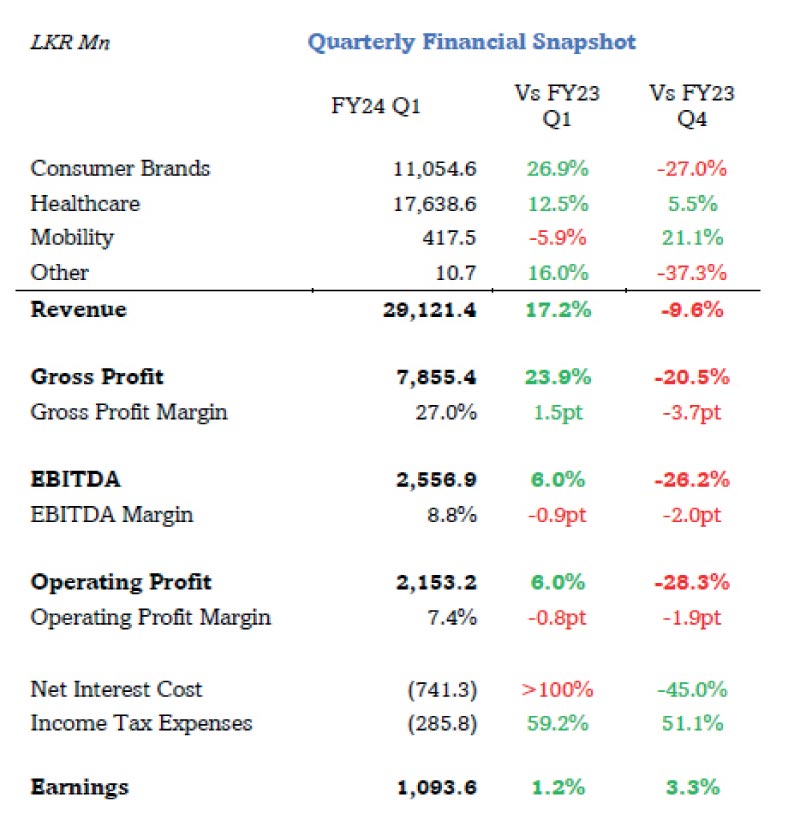

The Group posted a revenue of Rs. 29.1 billion, a 17.2% growth over previous year while the operating profits witnessed a growth of 6% to Rs. 2.2 billion. Amidst the increased finance cost, the Group's earnings growth was limited, witnessing a marginal improvement of 1.2% to Rs. 1.1 billion, said Hemas Holdings Group CEO Kasturi C. Wilson.

Hemas’ Consumer Brands Sector reported a revenue of Rs. 11.1 billion for the quarter, a growth of 26.9% over last year driven by relatively high market prices. In line with revenue growth, operating profit and earnings for the quarter improved by 62.8% and 84.2% to reach Rs. 1.1 billion and Rs. 919.2 million respectively. Continuous efforts on improving supply chain efficiency and internal processes coupled with improved performance of the export portfolio positively contributed to the growth in profitability of the Sector.

She said market-wide price reductions were witnessed during the quarter, attributed to the reduction in global commodity prices and appreciation in the domestic currency. However, a noticeable slowdown in consumer demand was seen across the modern and general trade channels post festive season. The increase in taxes, higher tariffs on electricity and high borrowing costs had an ongoing influence on buying patterns, despite the price reductions.

In the stationery market, the demand for value-for-money alternatives continues to surge at a significant rate as consumers remain cautious amidst the increased pressures on disposable income. The relaxation of import restrictions, the appreciation of the rupee, and the decline in paper prices have resulted in the market experiencing an influx of brands. There has been a slowdown in secondary purchases from retailers due to the anticipation of future price reductions.

With the slowdown in the global commodity prices and appreciation of the domestic currency, price revisions were made across the portfolio in the Home and Personal Care segment to a greater extent. However, the benefit was partially negated by the escalation of domestic overhead costs under an inflationary environment.

Hemas’ Learning Segment witnessed a reduction in demand in comparison to the previous quarters attributed to the slowdown in back-to-school season and market anticipations of future price reductions. Premium market segment witnessed over 10 percentage points growth in market share owing to the success of the brand ‘Innovate”.

During the quarter, the Group acquired the remaining 24.9% stake in Atlas Axillia Company Ltd for a total consideration of Rs 3.4 billion, making it a fully owned subsidiary of the Hemas Group. The increase in stake was in line with the commitments made to the prior shareholders and aligns seamlessly with our investment mandate, which focuses on investing in consumer and healthcare companies that bring value accretive opportunities to the Group.

In line with the Group's strategic objective of promoting internationalisation and exports, Consumer Brands International Sector made significant steps during the quarter.

Despite the market contraction, the Bangladesh business witnessed volume growth, primarily driven by the increased traction for the personal care brand “Actisef,” which was launched to reduce high single category concentration. Revenue growth in the face of mounting economic pressure was supported by consumer promotions and recent launches featuring reduced pack sizes, while the total revenue of the segment received a substantial boost of over 16% from the contributions of new product launches.

While the Home and Personal Care Sri Lanka business successfully extended its operations to new geographies in East Africa, The Learning Segment demonstrated substantial advancement in the export arena through the initiation of manufacturing for globally recognised brands and the launch of its newest brand ‘ignite’ in the Gulf region.

Hemas’ Healthcare Sector posted a revenue of Rs. 17.6 billion for the quarter, a growth of 12.5% over last year mainly due to the improved performance of the Pharmaceutical Business. However, the Sector failed to convert the growth momentum in revenue into profits, primarily due to increased finance costs and taxes. The operating profit for the quarter declined marginally to Rs. 1.1 billion while the earnings declined by 33.3% to Rs. 475.3 million.

During the year the Pharmaceutical Distribution Business introduced over 30 products into the market in many key categories including urology, anti-infective and respiratory spaces providing the customers with a wider variety of choices in chronic therapeutic segments. Despite the double-digit contraction witnessed in the market, Pharmaceutical Business volume contraction remained a low single digit range as Hemas continued to prioritise availability of medication in the country.

Occupancy at both the hospitals remained high with over 60% overall occupancy under improved medical admissions. Despite the decline in overall surgical admissions due to reduced disposable income, many key anchor specialties including Urology and Gastro-Enterology witnessed significant growth in value and volume terms.

During the quarter, the Mobility Sector achieved a revenue of Rs. 417.5 million. However, the operating profit and earnings experienced a contraction of over 40%, reaching Rs. 224.5 million and Rs. 121.7 million, respectively, primarily due to the impacts of currency appreciation, volume decline, and reduced demand.

Commenting on the outlook, Hemas Group CEO Kasturi C. Wilson said: “We acknowledge the challenges present in the macro economy and maintain a cautious yet optimistic outlook on the immediate future.”

She said the Group will embark on a transformation journey to improve efficiency, deploy cost-saving initiatives, and prioritise digitisation to foster sustained growth. Understanding the ever-evolving shifts in consumer needs and catering to them through innovative solutions would be the core of our business strategy.

“Our commitment to investing in teams remains a primary focus area as we propel our growth to the next level. Empowering our teams to embrace challenges and pursue growth will continue to be a cornerstone of our strategy going forward,” Wilson added.