Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 29 May 2023 01:16 - - {{hitsCtrl.values.hits}}

Hemas Holdings Chairman Husein Esufally with Group CEO Kasturi C. Wilson

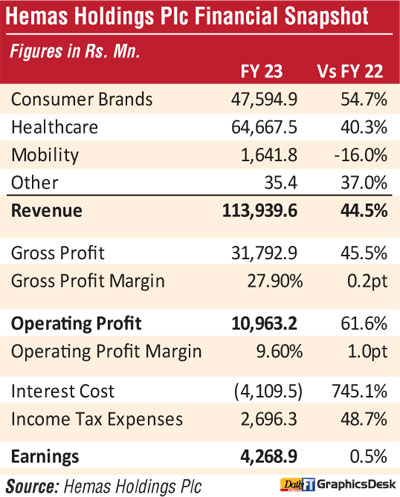

Hemas Holdings has seen a healthy 62% rise in Operating Profit to Rs. 11 billion in FY23 on the back of a 44.5% gain in revenue to Rs. 114 billion but earnings remained flat at Rs. 4.3 billion due to higher finance costs and taxation.

Hemas Holdings has seen a healthy 62% rise in Operating Profit to Rs. 11 billion in FY23 on the back of a 44.5% gain in revenue to Rs. 114 billion but earnings remained flat at Rs. 4.3 billion due to higher finance costs and taxation.

Net finance cost rose to Rs. 3.2 billion from Rs. 135 million in FY22 whilst pre-tax profit amounted to Rs. 7.7 billion as against Rs. 6.6 billion. Post-tax profit grew to Rs. 5 billion from Rs. 4.8 billion in FY22.

Hemas Holdings Chairman Husein Esufally told shareholders the Company performed commendably amidst one of the most challenging years in Sri Lanka’s history.

“This is now the fourth consecutive year where the business dealt with the aftermath of black swan events.

The Company’s ability to sustain and grow the business despite the unfavourable operating environment, demonstrates the resilience of our business portfolio, the strength of our brands and business relationships, and the agility and the commitment of our people,” he said.

“The economic crisis in Sri Lanka has had a profound impact on businesses on both the supply and demand sides, and Hemas was no exception,” Esufally said in his review in Hemas FY23 Annual Report.

According to him on the supply side, access to foreign currency proved to be a major constraint and Hemas’ Business Units were forced to make portfolio choices to best satisfy customer needs whilst managing profitability.

“Due to the challenges, we were unable to benefit from the normal trade and credit terms, which resulted in significant investments in working capital to ensure an uninterrupted supply of products into the market. The cost of raw materials, energy, and other inputs rose sharply due to the depreciation of the LKR and the rise in global commodity prices,” he said.

“Businesses were forced to make regular price adjustments whilst minimising the impact on the customer by focusing on operational efficiencies. Even though commodity prices eased towards the second half of the year, businesses remained vulnerable to inflationary pressure,” Esufally said.

“The rising cost of living and deteriorating wallet sizes led to demand contraction in markets across the board. Consumers were compelled to make difficult choices, leaving them with no option but to curtail consumption, even in essential categories. The Businesses responded to these challenges by adopting an agile model, empowering teams to maintain service levels and overcome unforeseen challenges,” Hemas Chairman emphasised.

During the year, the Consumer Brands Sector had to adopt a dynamic pricing strategy, striking a balance between passing on the impact of rising costs to consumers, whilst attempting to maintain margins. Cost optimisation and efficiency improvement initiatives were prioritised to minimise the burden of rising prices on consumers. Price reductions were made in the second half of the year to pass down the benefit of declining global commodity prices.

He said consumers were forced to change buying habits and multiple new product offerings were introduced to cater to these evolving needs.

Despite extremely challenging circumstances, the Hemas’ Healthcare Sector ensured availability of essential medicines in the market.

“With the commencement of commercial production at our Homagama pharmaceutical manufacturing plant, a number of new affordable medicines under the ‘Morison’ brand were introduced. Increased focus on key specialties including gynaecology, urology and fertility resulted in a double-digit growth in the core revenue of the Hospitals Business,” he added.

Commenting on the future outlook, Hemas Chairman said: “We are confident but not complacent about the future of Sri Lanka.”

He said Hemas appreciates the efforts of the Government in pushing through much needed reforms, and hopes that there will be political consensus around staying committed to the IMF program, as there is really no plan B.

“If we do this successfully, Sri Lanka can look to achieve long-term stability and sustainable growth, which would build back a better future for all our people,” Esufally said.

“While the core business remains our top priority, we will also actively pursue inorganic growth opportunities in the Consumer and Healthcare spaces and on international expansion. The Group will also continue to drive internal reforms to ensure that we remain agile and efficient,” Hemas Chairman added.

Hemas has announced a final dividend of Rs. 1.95 per share for FY23 payable on 24 July, 2023 on top of first interim dividend of 40 cents bringing the total to Rs. 2.35 per share, lower from Rs. 4.35 per share in FY22. Dividend payout for FY23 is 33% down from 61%,

Group CEO Katsuri C. Wilson in her review said Group’s strategic focus has resulted in a resilient performance during the current financial year. “Strong emphasis on customer-centric decision making has resulted in improved market share across key businesses,” she said adding the 61.6% rise in operating profit was despite the heightened margin pressure amidst increasing input costs resulting from foreign exchange pressure, interest, and domestic inflation.

She said that notwithstanding the challenges posed by adverse macroeconomic conditions, the Group remained steadfast in its commitment to its strategies, which have proven effective in navigating through successive crises. The Businesses strengthened the core by focusing on market share gains, maintaining margins through efficiency improvements while expanding the product portfolio to meet the evolving consumer needs.

With the decline in disposable income of the consumers, Home and Personal Care Segment introduced value-for-money alternatives while the Pharmaceutical Manufacturing Arm of the Group, Morison, introduced multiple high quality affordable medication in key therapeutic segments. High concentration on internationalisation and exports was a priority resulting in a 59.2% growth in export revenue within the year.

“We efficiently adapted and successfully navigated the economic crisis by proactively identifying potential risks and opportunities. This was combined with strategic planning and preparedness, accompanied by strong relationships with our business partners. We are confident that these relationships and capabilities will continue to be advantageous in the future,” Wilson said.

Liquidity was a key success factor in facing the challenges of increased investments in working capital. The Group’s strong financial position under a relatively low debt-to-equity ratio and stable cash flows enabled it to weather the storm of unfavourable headwinds encountered during the past year. This, in combination with improved operating profits and presence in defensive

industries enabled the Group’s long term rating of ‘AAA (lka)’ Stable Outlook to be affirmed by Fitch Ratings for the fourth consecutive year.

Group CEO also said in the face of margin pressure, Groupwide digitalisation and efficiency improvement strategies including digital-health projects at Hospitals, material requirements planning (MRP) and sales force automation (SFA) projects at Consumer and Pharmaceutical Businesses assisted us to improve customer service, reduce costs while increasing productivity.

She said even while facing multiple challenges, including rising costs, lower foreign exchange liquidity and rupee depreciation, the Consumer Brands Sector delivered a commendable performance in the financial year 2022/23.

The Sector’s revenue grew by 54.7% year-on-year to reach Rs. 47.6 billion, reinforced by strong contributions from all business segments. Consequently, operating profits witnessed an increase of 94.6% year-on-year to reach Rs. 5.9 billion while the earnings increased by 46.0% to reach Rs. 3.2 billion. Price increases were unavoidable due to the significant increase in input costs. The sector was highly prudent in its pricing decisions and invested in efficiency improvement initiatives to minimise the impact on customers.

In spite of the extreme market conditions, the Healthcare Sector delivered stable financial performance for the year 2022/23 with a 40.3% growth in revenue mainly due to National Medicines Regulatory Authority (NMRA) approved price adjustments. However, price increases could not fully compensate for the impact of extreme currency devaluation which resulted in a relatively lower growth in operating profits for the period of 31.8%. Further, the dual impact of elevated interest rates and increased investments in working capital due to devaluation of currency, resulted in a 23.1% decrease in earnings to reach Rs. 2.0 billion for the year.

The Mobility Sector witnessed an underlying revenue growth of 21.6% under elevated freight rates and air fares while the earnings posted an underlying growth of 17.0% against last year driven by the contribution from both the Aviation and Maritime verticals.

Commenting on what lies ahead, Wilson said regardless of the economic crisis, Hemas has displayed its resilience by maintaining profitability and achieving growth, while being stronger in the core which is reflected in the share gains. The Group’s steadfast strategy, centred on its key businesses of Healthcare and Consumer, has enabled it to thrive despite the challenges.

“We are aware of the challenges that will be present in the years to come and have utilised our learning from the previous year to strengthen our internal processes to face the headwinds. As the Sri Lankan economy navigates the expected economic contraction of over 3% in 2023, we anticipate the operating environment to remain volatile and inflationary pressure to adversely impact the aggregate demand of the economy, thereby hampering the growth aspirations of many industries,” she said.

Against this backdrop, Wilson said Hemas Group will focus on the defensive core of the businesses and continue to invest in adjacent spaces where there are opportunities for organic and inorganic growth. The Group will actively seek strategic opportunities to expand its dollar-denominated revenue base, beyond the current and adjacent market spaces.

“Continuing the success of the current financial year, driving the export portfolio and international revenue would be a focal point for the Consumer Brands Segment. While expanding into premium and underpenetrated categories in the domestic market, the Sector will also engage in purpose-led initiatives that would assist in empowering the communities to meet the challenges head-on,” she said.

According to Wilson, Hemas remains dedicated to addressing the challenges encountered by the healthcare ecosystem in Sri Lanka. The Pharmaceutical Distribution and Manufacturing Businesses will collectively ensure continuous supply of essential medication in the country. The Group will continue to drive digitalisation at Hospitals to face the medical practitioner shortage and encourage the ecosystem to formulate urgent solutions.

“The Pharmaceutical Segments will be working with our global channel partners to ensure availability of essential medication, while the ‘Homagama’ factory contributes to lower the import dependency of multiple essential drugs with the introduction of affordable new medicines under the ‘Morison’ branded portfolio,” she said.

“As we step into our seventy fifth year in operation, I would like to reiterate the commitment of the Hemas team to ensure long-term value creation and successful implementation of prudent strategies that would support the communities and the country in rebuilding the shaken-up economy,” Group CEO Wilson told shareholders.

The Board of Directors of Hemas Holdings Plc comprises H. N. Esufally (Chairman), Dr. S. A. B. Ekanayake (Deputy Chairman), K.C. Wilson (Group CEO), A. N. Esufally, I. A. H. Esufally, M. A. H. Esufally, A. S. Amaratunga, J. M. Trivedi, P. Subasinghe and R. P. Pathirana.