Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 23 May 2025 00:06 - - {{hitsCtrl.values.hits}}

|

| Acting CEO Ravi Jayasekera |

Hemas Holdings PLC yesterday announced strong earnings for the financial year ended 31 March 2025 and singled out the continuity of the ‘AAA’ credit rating despite revenue pressures.

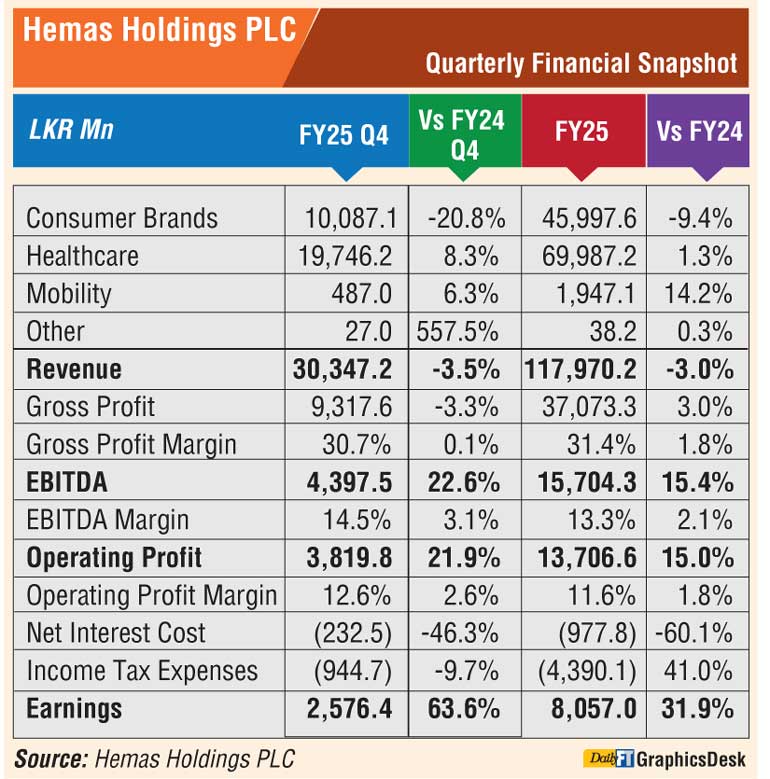

Hemas Group delivered a strong performance during the year, accomplishing cumulative earnings of Rs. 8.1 billion, a year-on-year growth of 31.9%. Healthcare and Mobility sectors witnessed a cumulative revenue growth compared to last year, while the Consumer Brands sector recorded a 9.4% decline.

The Group’s total revenue declined marginally compared to previous year. Despite the dip in revenue, profitability margins strengthened, driven by operational efficiencies and a more favourable macroeconomic backdrop.

During the quarter, a revenue of Rs. 30.3 billion was achieved, a 3.5% decrease from the corresponding quarter of the previous year, while earnings grew by 63.6% to Rs. 2.6 billion compared to the same period last year. Profit growth was primarily driven by strong performances in the Healthcare and Mobility sectors, complemented by a reduction in net finance expenses, which further supported the improvement in earnings.

Hemas also announced a final dividend of 70 cents per share.

The Group’s financial position continues to demonstrate strength and resilience, supported by robust operating cash flows.

In a statement, Hemas said Fitch Ratings reaffirmed the Group’s national long-term rating at ‘AAA (lka) – Outlook Stable’ for the sixth consecutive year—an affirmation of the Group’s solid balance sheet, healthy cash flows, and prudent financial management.

Hemas’ share price appreciated by 16.2% during the quarter, outperforming the ASPI, which declined by 0.8%. In light of this strong performance and to enhance market accessibility, the Group announced a 5-for-1 share sub-division. Post-split, the share now trades at a more accessible level for local retail investors.

Following are excerpts from Hemas Acting CEO Ravi Jayasekera’s review accompanying FY25 results.

Consumer brands

While the broader macroeconomic environment improved and consumer sentiment began to rebound, the sector continued to feel the impact of price reductions implemented in previous quarters, which continued to affect revenue and earnings. Intense competition added to these pressures. However, the sector maintained its market share across most categories, reflecting sustained consumer trust in its brands.

The Learning Segment experienced a slowdown as seasonal inventory levels from the previous quarter normalised. Competition remained strong, particularly in regional markets and the value-for-money segment, with affordability continuing to influence consumer buying behaviour. The Government also introduced a targeted program to support school supply purchases for selected underprivileged students.

Quarterly revenue and earnings declined by 20.8% and 5.4%, respectively, while cumulatively, the sector recorded revenues of Rs. 46.0 billion and earnings of Rs. 5.1 billion, a degrowth of 9.4% and 0.3%, respectively. Despite the revenue contraction, the implementation of efficiency improvement initiatives, productivity enhancements, and supply chain optimisations helped mitigate margin pressures and maintain operational resilience.

Home and Personal Care – Sri Lanka

Trends from the previous quarter persisted, with volume growth seen in the Personal Care and Beauty categories, while Home Care and Personal Wash witnessed volume declines.

Reinforcing its focus on product innovation and portfolio expansion, the company introduced two vibrant fruity fragrance variants and a new deodorant spray under the ‘Goya’ brand, enhancing the personal care offering. In response to rising demand for natural oral care, the ‘Clogard’ salt-based toothpaste was re-launched with a campaign promoting its gum health benefits. The ‘Clogard’ portfolio was further strengthened with the launch of the Proclean Limited Edition toothbrush in a distinctive black design, appealing to discerning consumers. These efforts reflect the business’s commitment to addressing evolving consumer needs and deepening brand engagement across key market segments.

Hemas Manufacturing Ltd. also achieved a significant milestone by securing the ‘Authorised Economic Operator (AEO) Tier 1 Certification’ from Sri Lanka Customs, underscoring its leadership in compliance, operational efficiency, and global trade facilitation.

Consumer brands international

In Bangladesh, the Interim Government took measures to curb inflation, and prices of essential commodities eased through harvest gains, tax cuts, and market controls.

The Value-Added Hair Oil (VAHO) segment, comprising of Kumarika and EVA brands, recorded growth in both volume and revenue. To mitigate the impact of rising input costs – driven by raw material price hikes and Taka depreciation – selling prices were revised in line with market trends, effectively safeguarding profit margins.

Building on consumer insights and robust distribution networks, the business expanded into the male grooming category with the launch of the ‘Vibe’ perfume range, further strengthening its brand footprint in the Bangladesh market.

Learning

The shift in the school year calendar impacted quarterly comparisons, with some demand materialising in the previous quarter, compared to the previous financial year. This year, the Government launched a targeted program offering financial assistance for the purchase of school supplies for selected underprivileged students. This initiative has had a positive impact on overall demand for school stationery products.

‘Atlas’ sustained its leadership position in the stationery market, while gaining momentum in the newly introduced educational toys segment.

Healthcare

The Healthcare sector cumulative earnings increased to Rs. 4.3 billion, supported by improved working capital efficiency, prudent cost management initiatives, and lower finance costs, while cumulative revenues were Rs. 70 billion. Quarterly revenue grew to Rs. 19.7 billion, with earnings of Rs. 1.5 billion.

The recent Gazette notifications on pharmaceutical pricing have prompted the need for a thorough review. In response, the business is working closely with the Sri Lanka Chamber of the Pharmaceutical Industry (SLCPI) to engage with all relevant stakeholders and evaluate the basis of these directives. This collaborative approach is essential to ensure that implementation is guided by principles of fairness and transparency—standards that are crucial for the industry to continue providing high-quality, innovative pharmaceutical products to the market.

Pharmaceuticals

The Pharmaceutical Distribution business recorded a notable increase in its performance, driven by growth in revenue and profitability, whilst cash flow improved, supported by better working capital management and lower finance expenses.

In a landmark achievement for Sri Lanka’s pharmaceutical industry, Morison became the first to locally manufacture two advanced cardiovascular medications—‘Cilnidipine’ and ‘Rivaroxaban.’ ‘Cilnidipine,’ a fourth-generation calcium channel blocker, treats hypertension (high blood pressure), while ‘Rivaroxaban,’ a next-generation oral anticoagulant, is used in the prevention and treatment of thromboembolic disorders. This milestone advances national healthcare self-sufficiency aspirations and provides patients with access to high-quality treatments at a significantly lower cost.

Additionally, the Government’s recent budget proposals included a VAT exemption on imported packing materials for the pharmaceutical manufacturing sector, a measure expected to benefit Morison and support cost efficiency.

Hospitals

The Hospital segment delivered an improved performance during the quarter, marked by a continued enhancement in profit margins and a sustained growth in both outpatient and inpatient revenues.

Hemas Hospital Wattala marked a significant milestone in cardiac care with the commissioning of a state-of-the-art Catheterisation Laboratory (CATH Lab), with an investment of Rs. 1 billion. Equipped with Sri Lanka’s most advanced cardiovascular diagnostic and interventional technology, the facility enables the delivery of precise, minimally invasive procedures, elevating the hospital’s clinical capabilities.

Mobility

During the quarter, the Maritime segment recorded an increase in import volumes, aligning with the rise in inbound cargo at the Port of Colombo. However, this was partially offset by a decline in export and transshipment volumes, and continued pressure from falling freight rates.

In the Aviation segment, Emirates commenced operating the fourth daily flight between Colombo and Dubai. This expansion increased seat capacity on the route by 30%, enhancing convenience for passengers and aligning with Sri Lanka’s broader goal of significantly boosting tourist arrivals in 2025. While the cargo segment recorded improved volumes and yields, passenger sector yields came under pressure due to heightened price competition.

The sector revenues were stable at Rs. 487 million and earnings growing to Rs. 266.7 million. On a cumulative basis, revenue reached Rs. 1.9 billion while earnings rose to Rs. 0.8 billion.

Jayasekera said the Group is positioning itself for the long-term by accelerating growth across larger emerging markets, expanding into adjacencies, and driving technology-led transformation.

To support this ambition, the Group is implementing a new operating model aimed at increasing responsiveness, sharpening strategic focus, and better aligning with long-term goals. This transformation will strengthen organisational agility and enable the Group to capitalise on new growth opportunities.

The Group’s international business aims to leverage Sri Lanka’s natural ingredients and core expertise to offer authentic, high-quality products to global consumers. With a strong base in Sri Lanka and experience in Bangladesh, it is exploring strategic expansion into Southeast Asia and Africa through mergers, acquisitions, and partnerships.

With continued stability in core operations and improved performance over the past year, the Group has strengthened its financial position, improved its balance sheet, and maintained healthy cash flows—laying a strong foundation for accelerated growth. Looking ahead to the next financial year, the Group is poised to enter a phase of increased strategic investments guided by its Long-Range Plan. These investments will focus on unlocking new opportunities and delivering long-term stakeholder value, the Acting CEO added.