Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 7 January 2026 06:46 - - {{hitsCtrl.values.hits}}

|

Labour Deputy Minister Mahinda Jayasinghe

|

Labour Deputy Minister Mahinda Jayasinghe yesterday told Parliament that amendments to the Employees’ Provident Fund Act are being discussed at the tripartite National Labour Advisory Council, as the Government examines whether EPF contributors should be given the option of receiving a regular pension instead of a lump sum upon retirement.

He said the proposal is aimed at strengthening long-term retirement income security for private sector and semi-Government workers amid demographic ageing, while retaining the existing lump-sum withdrawal framework for those who prefer it.

Addressing the House, Jayasinghe stressed that the Government is not seeking to dismantle or replace the EPF, which remains the primary social security mechanism for private sector employees. Instead, the Government is considering whether greater flexibility is needed to address income security risks faced by retirees who currently receive their savings as a single payment.

“EPF for the private sector and semi-Government is a social security scheme, but we have observed that the ability to access funds before retirement can have an impact in terms of social security,” he said, noting that interim withdrawals and lump-sum payments can weaken retirement protection over time.

At present, EPF benefits are paid mainly as a lump sum upon retirement, set at 50 years for female members and 55 years for male members. Limited early withdrawals are permitted for specific purposes, including housing construction and medical treatment, subject to eligibility criteria and documentation.

Jayasinghe said existing provisions allow members to withdraw up to 30% of their EPF balance, with a further 20% permitted after 10 years. Of the 744 applications received for such withdrawals, 702 have already been processed, he told Parliament. However, he cautioned that repeated interim payments undermine the Fund’s ability to provide income security at retirement.

The policy discussion comes at a time when the EPF’s financial position has strengthened, even as demographic and fiscal pressures mount. The EPF continues to dominate Sri Lanka’s superannuation sector, accounting for 81.0% of total sector assets by end-2024.

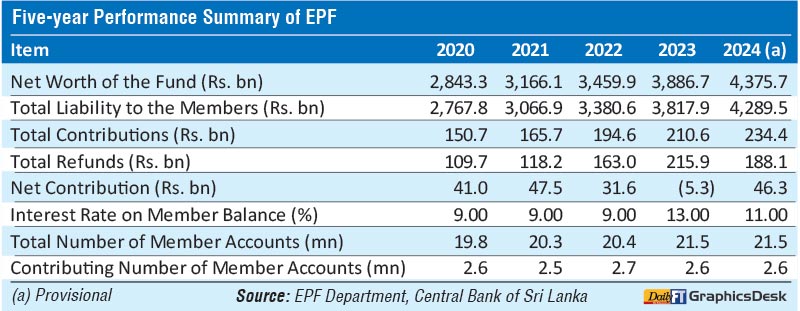

The net worth of the Fund increased 12.6% year-on-year to Rs. 4,375.7 billion by end-2024 from Rs. 3,886.7 billion a year earlier, supported by higher investment income and positive net contributions. Total contributions received during 2024 rose 11.3% to Rs. 234.4 billion, while refunds to members and legal heirs declined 12.9% to Rs. 188.1 billion, resulting in a positive net contribution of Rs. 46.3 billion for the year, compared to a net outflow of Rs. 5.3 billion in 2023.

Investment performance also improved, with total investment income rising 6.8% to Rs. 513.8 billion in 2024. Interest income remained the dominant source, increasing to Rs. 455.1 billion, while dividend income and fair value gains on listed equity investments recorded strong growth. The Central Bank’s Governing Board had approved an interest rate of 11% on EPF member balances for 2024, subject to ministerial concurrence.

Jayasinghe said the National Labour Advisory Council, which brings together representatives of Government, employers and trade unions, is assessing how the legal framework can be updated to reflect evolving labour market conditions while preserving the Fund’s core social security role.

Any move towards an optional pension or annuity scheme, he indicated, would be designed to complement the existing EPF structure rather than replace it, offering contributors a choice between lump-sum withdrawal and a steady retirement income stream.

The Government, he said, is keen to ensure that reforms strengthen long-term social security for private sector and semi-government workers, particularly as Sri Lanka’s population ages and pressures on household retirement savings intensify.

The single largest investor in Government securities, the EPF has long been a captive force for Government Budget deficit financing and underwent a controversial Domestic Debt Optimisation Program restructuring process in 2023.

The EPF was required to participate in the Domestic Debt Optimisation program by exchanging part of its Treasury bond holdings, receiving new Bonds carrying a 12% coupon until end-2025, reducing to 9% thereafter. The Bonds begin maturing from 2027, with returns beyond that point subject to market conditions. Under the framework, pension funds that did not participate in the exchange were to be taxed at 30%, compared to the concessional 14% rate for participating funds at the time.