Thursday Mar 12, 2026

Thursday Mar 12, 2026

Tuesday, 27 January 2026 03:06 - - {{hitsCtrl.values.hits}}

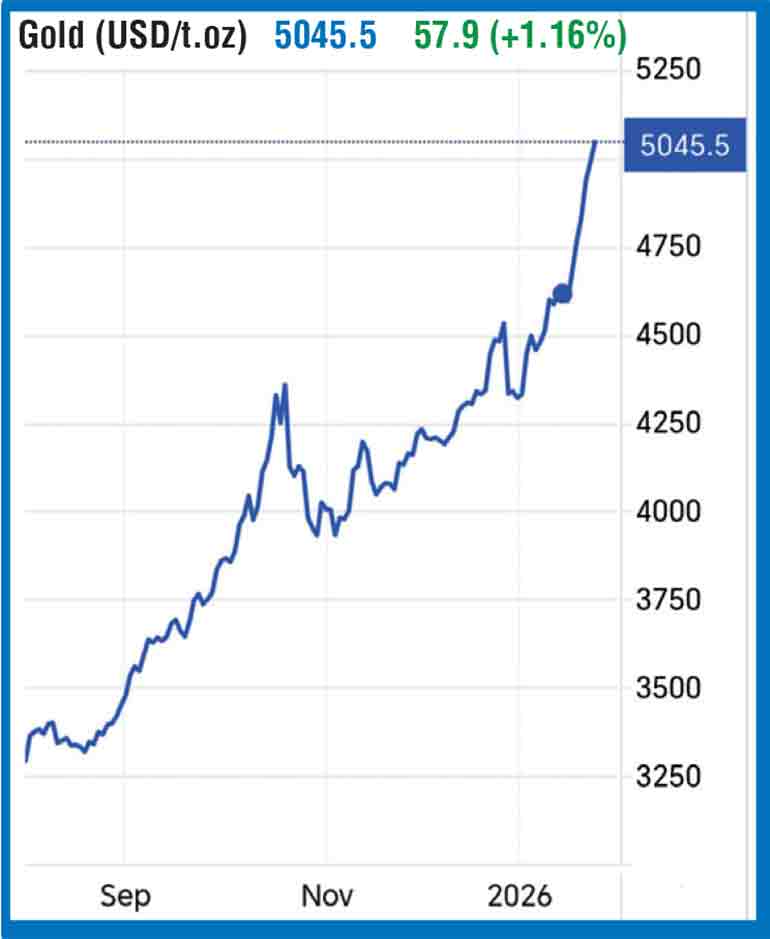

Gold surged to a record high above $ 5,000 an ounce yesterday, extending a historic rally as investors piled into the safe-haven asset amid rising geopolitical uncertainties.

Spot gold rose 1.79% to $ 5,071.96 per ounce by 0159 GMT, after touching $ 5,085.50 earlier. US gold futures for February delivery gained 1.79% to $ 5,068.70 per ounce.

The metal soared 64% in 2025, supported by sustained safe-haven demand, US monetary policy easing, robust central bank buying – with China extending its gold-buying spree for a 14th month in December 2025 – and record inflows into exchange-traded funds. Prices have gained more than 17% this year.

The latest catalyst “is effectively this crisis of confidence in the US administration and US assets, that was set off by some of the erratic decision-making from the Trump administration last week,” said Kyle Rodda, a senior market analyst at Capital.com.

US President Donald Trump abruptly stepped back last week from threats to impose tariffs on European allies as leverage to seize Greenland. Over the weekend, he said he would impose a 100% tariff on Canada if it followed through on a trade deal with China.

He has also threatened to hit French wines and champagnes with 200% tariffs in an apparent effort to pressure French President Emmanuel Macron into joining his Board of Peace initiative. Some observers fear the Board could undermine the UN’s role as the main global platform for conflict resolution, though Trump has said it will work with the UN.

“This Trump administration has caused a permanent rupture in the way things are done, and so now everyone’s kind of running to gold as the only alternative,” Rodda added.

Meanwhile, a rising yen dragged the dollar broadly lower early yesteday, with markets on alert for possible intervention in the yen and investors cutting dollar positions ahead of this week’s Federal Reserve meeting.

A weaker dollar makes greenback-priced gold more affordable for holders of other currencies.

“We expect further upside (for gold). Our current forecast suggests that prices will peak at around $ 5,500 later this year,” said Metals Focus Director Philip Newman.

“Periodic pullbacks are likely as investors take profits, but we expect each correction to be short-lived and met with strong buying interest,” he added.

Spot silver was up 4.57% at $ 107.65 per ounce, after hitting a record of $ 108.60. Spot platinum rose 3.26% to $ 2,857.41 per ounce, while spot palladium rose 3.2% to $ 2,074.40 per ounce. (The Hindu Business Line)