Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 1 June 2022 00:25 - - {{hitsCtrl.values.hits}}

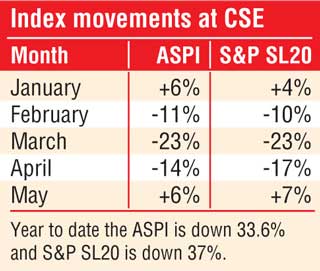

The Colombo stock market in May managed to end its three-month negative run with a modest gain whilst foreigners appear to be seizing select buying opportunities as local remain wary. The 6-7% gain by the ASPI and SandPSL20 Index respectively in May is despite the Colombo Bourse remaining bearish in recent days. The market saw the last monthly gain in January after which it suffered dips.

The Colombo stock market in May managed to end its three-month negative run with a modest gain whilst foreigners appear to be seizing select buying opportunities as local remain wary. The 6-7% gain by the ASPI and SandPSL20 Index respectively in May is despite the Colombo Bourse remaining bearish in recent days. The market saw the last monthly gain in January after which it suffered dips.

Year to date the ASPI is down 33.6% and SandPSL20 is down 37%.

Despite bearish sentiment from locals, foreigners stepped up buying. Yesterday the market saw net foreign buying of Rs. 67 million on top of Rs. 92 million on Monday. In May CSE saw a net foreign inflow of Rs. 150 million though year to date it is a net outflow of Rs. 1 billion.

Asia Securities said the indices trended downwards throughout the session on Tuesday dragged by price declines in LOFC (-6.3%), LOLC (-4.7%), EXPO (-2.9%), BIL (-3.8%), and LIOC (-2.8%). Turnover amounted to Rs. 1,623 million (previous session Rs. 1,395 million) on the back of retail and HNI buying in BIL (Rs. 398 million), EXPO (Rs. 236 million), and LOFC (Rs. 135 million).

Foreigners’ inflow was boosted by net buying in COMB (Rs. 56 million), HNB (Rs. 41 million), and KHL (Rs. 24 million). Overall, 58 stocks recorded price gains during the session and 119 settled with losses.

First Capital said the Bourse closed down for the sixth straight session in response to the amendment of 5 Acts to boost the country’s revenue, which mainly includes a tax hike to 2019 levels.

It said the country has been severely hit by food shortages and is expected to worsen after October 2022. With that, the index plunged down significantly as soon as the market opened and remained negative throughout the session while closing the day at 8,108, losing 123 points.

Even though retailers remained on the side-lines due to margin calls, turnover witnessed a slight improvement of 16.4% which was largely led by Food, Beverage and Tobacco and Transportation sectors with a joint contribution of 48%.

NDB Securities said indices closed in red as a result of price losses in counters such as LOLC Holdings, Expolanka Holdings and Sampath Bank.

It said high net worth and institutional investor participation was noted in Commercial Bank, John Keells Holdings and Printcare. Mixed interest was observed in Expolanka Holdings, Lanka IOC and John Keells Hotels, whilst retail interest was noted in Browns Investments, LOLC Finance and SMB Leasing voting and nonvoting.

Food, Beverage and Tobacco sector was the top contributor to the market turnover (due to Browns Investments), whilst the sector index lost 2.21%. The share price of Browns Investments decreased by Rs. 40 cents (3.85%) to close at Rs. 10.

Transportation sector was the second highest contributor to the market turnover (due to Expolanka Holdings) whilst the sector index decreased by 2.91%. The share price of Expolanka Holdings lost Rs 6.50 (2.92%) to close at Rs. 216.25.

LOLC Finance, John Keells Holdings and Lanka IOC were also included amongst the top turnover contributors. The share price of LOLC Finance moved down by 60 cents (6.32%) to close at Rs. 8.90. The share price of John Keells Holdings closed flat at Rs 124. The share price of Lanka IOC declined by Rs. 1.60 (2.79%) to close at Rs. 55.70.

Separately Royal Ceramics announced an interim dividend of 75 cents per share, whilst Malwatte Valley Plantations and United Motors Lanka announced their final dividends of 12 cents and 50 cents per share respectively.