Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 27 January 2026 03:16 - - {{hitsCtrl.values.hits}}

The Insurance Regulatory Commission of Sri Lanka (IRCSL) has intensified its national effort to ensure the expeditious settlement of insurance claims following the catastrophic impact of Cyclone Ditwah. Working in close collaboration with all 14 licenced general insurers, the IRCSL has established a unified mechanism to provide expeditious financial relief to affected families, households, businesses, and property owners.

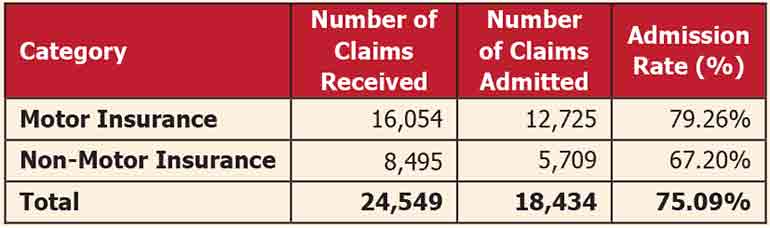

As of 19 January, the insurance sector has recorded a total of 24,549 claims. This reflects a steady increase in insured property.

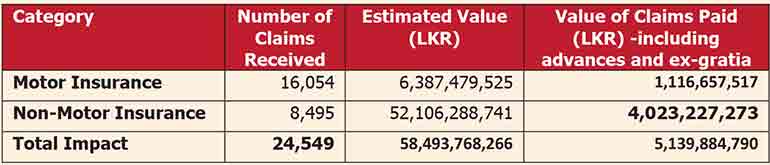

Overall, non-motor insurance claims account for the larger share of the total financial impact, despite motor insurance representing the majority in claim volumes.

The estimated total value of claims reported to the insurance industry has reached approximately Rs. 58.5 billion, underscoring the severe financial impact of the disaster.

A total financial relief of Rs. 5.1 billion has been disbursed to affected policyholders, underscoring the insurance industry’s commitment to timely recovery and financial stability. The non-motor segment accounts for the larger share of the payout value, amounting to Rs. 4 billion, reflecting the higher severity and complexity associated with property and commercial losses.

As part of the expedited relief process, the insurance industry has formally validated and admitted liability for a significant portion of the claims received.

The insurance industry has responded promptly in validating and admitting liability for reported losses. To date, insurers have formally admitted 18,434 claims, representing 75.09% of the total claims received. This includes 12,725 motor claims admitted out of 16,054 received, reflecting an admission rate of 79.26%, and 5,709 non-motor claims admitted out of 8,495 received, corresponding to a 67.20% admission rate.

The IRCSL has directed all licenced general insurance companies to expedite the assessment and settlement of remaining claims, in order to support national recovery efforts and ensure timely relief to affected individuals and businesses.

Compensation for minor property damage continues to be fast-tracked, enabling affected households to commence urgent repairs and restore basic living conditions without delay.

Insurers have been instructed to release advance and interim payments for large and complex claims, thereby providing critical liquidity support to households and businesses during the recovery phase.

The insurance sector remains financially resilient, with local insurers working closely with international reinsurance partners to mobilise the required funds and manage the impact of these exceptionally high claim payouts.

The IRCSL acknowledged that practical hurdles remain. Technical officers and service providers, including vehicle repair garages and loss adjustors/assessors, were themselves victims of the disaster in several regions.

This disaster has once again highlighted the critical role of insurance in strengthening financial resilience against climate-related risks. The IRCSL urges the public, Local Government authorities, and other relevant institutions such as the Urban Development Authority (UDA) and the Road Development Authority (RDA) to place greater emphasis on risk mitigation and climate-resilient construction practices, particularly in high-risk areas.

The IRCSL reaffirms its commitment to safeguarding policyholders’ interests and ensuring that the insurance sector plays a proactive role in supporting Sri Lanka’s recovery efforts and long-term disaster preparedness.