Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 8 November 2022 00:26 - - {{hitsCtrl.values.hits}}

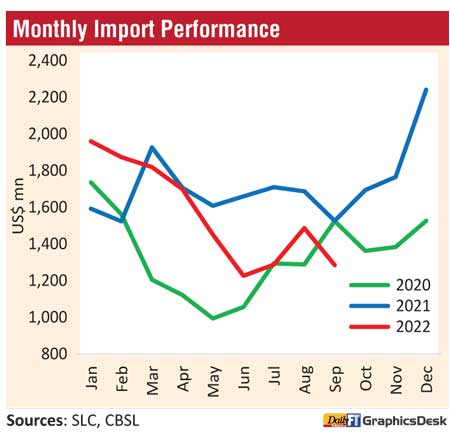

The dip in imports continued in September though yet to decline to lowest in recent years despite stepped up controls.

The dip in imports continued in September though yet to decline to lowest in recent years despite stepped up controls.

September 2022 saw $ 1.28 billion in imports, down from $ 1.48 billion in the previous month and 16% year on year. However, the June 2022 figure at $ 1.22 billion remains the lowest so far this year suggesting there is room for further decline given the foreign exchange crisis. The lowest import figure was in May 2020 at $ 994 million as an immediate impact of the COVID-19 pandemic.

The Central Bank said import expenditure declined for the seventh consecutive month, on a year-on-year basis. In the first nine months imports were down by 5.7% to $ 14 billion.

CBSL said a decline in import expenditure in September was observed in investment goods (-54% to $ 169 million) and non-food consumer goods (by 60% to $ 80 million) mainly resulting from the measures to compress imports. However, an increase was recorded in imports of intermediate goods (7.7% to $ 913 million) and food and beverages by 11% to $ 121 million.

Expenditure on the importation of consumer goods declined by 35.3% to $ 201 million in September 2022, compared to September 2021, led by lower expenditure on non-food consumer goods. The decline in import expenditure on non-food consumer goods was observed in all subcategories, with a notable drop in imports of medical and pharmaceuticals (mainly, the higher base in expenditure on vaccines), telecommunication devices (mainly, mobile telephones) and home appliances (mainly, televisions).

Expenditure on the importation of food and beverages increased by 10.7% to $ 121 million in September 2022 (y-o-y), mainly with an increase in import volumes of sugar and cereals and milling industry products (primarily, rice).

Further, imports of spices and beverages also improved to some extent. In contrast, expenditure on dairy products (mainly, milk powder), oils and fats (mainly, coconut oil), seafood (mainly, dried fish), fruits and vegetables declined in September 2022, compared to September 2021, which was mostly led by lower import volumes.

Expenditure on the importation of intermediate goods increased by 7.7% in September 2022, compared to September 2021, with a substantial share of increase contributed by fuel imports.

Expenditure on fuel, which comprises crude oil, refined petroleum and coal, increased by 87.3% to $ 376.4 million in September 2022, due to the increases of import volumes and prices of refined petroleum products, compared to September 2021. Import volumes of coal continued to remain at marginal levels from June 2022.

Further, import expenditure on diamonds and precious stones and metals (primarily, industrial diamonds) and fertiliser (primarily, urea), also recorded an increase during September 2022, compared to September 2021. Meanwhile, many other types of intermediate goods recorded a notable decline, including base metals (mainly, iron and steel), textiles and textile articles (mainly, fabrics), vehicle and machinery parts (mainly, motor vehicle parts), food preparation (mainly, fat and oil), wheat and maize, etc.

Import expenditure on investment goods declined by 53.7% in September 2022, compared to September 2021, resulting from a decline in all subcategories. A notable decrease in import expenditure under machinery and equipment was recorded due to the declines in the expenditure on transmission apparatus and computers.

Import expenditure on building material decreased, mainly owing to lower imports of iron and steel (primarily, iron bars and rods) and articles of iron and steel. Expenditure on importation of transport equipment declined mainly due to lower imports of railway equipment.

The import volume index declined by 25.6% (y-o-y), while the import unit value index increased by 13.1%, in September 2022, implying that the decline in import expenditure in September 2022 was mainly driven by the volume effect.

Earnings from exports remained robust in September 2022 with $ 1.08 billion. As a result, the merchandise trade deficit recorded a notable contraction in September 2022 to $ 206 million (y-o-y). With exports up 11.7% to $ 9.98 billion in the first nine months, the cumulative trade deficit amounted to $ 4.1 billion lower in comparison to $ 6 billion a year ago.

The Terms of trade, i.e., the ratio of the price of exports to the price of imports, deteriorated by 1.1% in September 2022, compared to September 2021, as the increase in import prices surpassed the increase in export price.

In terms of exports, earnings grew by 4.3% in September to $ 1,079 million. An increase in earnings was observed in industrial and agricultural exports, while a decline was recorded in mineral exports.

Cumulative export earnings from January- September increased by 11.7% YoY, amounting to $ 9,981 million. This growth was entirely driven by the improvements observed in industrial exports.

Export earnings from industrial goods increased in September 2022 by 4.2% YoY. The major export segments, such as garments; machinery and mechanical appliances (mainly, electronic equipment and mechanical appliances parts); and gems, diamonds, and jewellery contributed to this increase.

Export of garments to most major markets improved except for the US. Most of the other industrial export categories also showed an improved performance, particularly, leather, travel goods and footwear and base metals and articles.

In contrast, export earnings from petroleum products; rubber products (primarily, rubber gloves); food, beverages and tobacco, printing industry products, and plastics and articles thereof declined in September 2022 YoY.

Export earnings from petroleum products in September recorded a decline of 44.1% YoY, due to lower volumes of bunker and aviation fuel supplied despite a notable increase in average export price.

Earnings from agricultural goods exports in September increased by 4.5%, mainly due to the increase in earnings from tea, minor agricultural products (mainly, edible nuts) and spices (mainly, cinnamon; and nutmeg and mace), while export earnings from unmanufactured tobacco and vegetables increased marginally.

Although the export volumes in September 2022 were lower than a year earlier, the unit price of tea exports increased, resulting in an increase of earnings from tea. However, there was a decline in export earnings from coconut related products (primarily, fibres, desiccated coconut and coconut oil), seafood (primarily, shrimps and prawns) and natural rubber.

Export earnings from mineral exports in September declined by 1.7% YoY, mainly due to a decline in export earnings from precious metals.

The export volume index declined by 6.7% YoY, while the unit value index improved by 11.8% YoY, in September 2022, indicating the increase in export earnings in September 2022 could be attributed to higher export prices.