Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 12 January 2026 03:46 - - {{hitsCtrl.values.hits}}

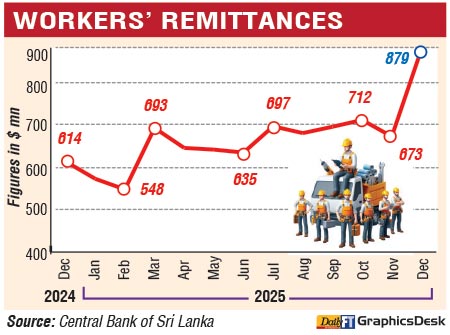

Sri Lanka’s workers’ remittances surged to unprecedented levels in 2025, delivering a crucial boost to the country’s external finances as the economy continues its post-crisis recovery. December inflows soared to a historic high of $ 879.1 million, a sharp 43.2% year-on-year (YoY) increase, pushing total remittances for the year past $ 8.07 billion, marking a 23% YoY increase and the strongest annual performance in the country’s history.

Sri Lanka’s workers’ remittances surged to unprecedented levels in 2025, delivering a crucial boost to the country’s external finances as the economy continues its post-crisis recovery. December inflows soared to a historic high of $ 879.1 million, a sharp 43.2% year-on-year (YoY) increase, pushing total remittances for the year past $ 8.07 billion, marking a 23% YoY increase and the strongest annual performance in the country’s history.

The performance marks the strongest annual inflow on record, underscoring renewed confidence in formal remittance channels and cementing migrant worker earnings as the country’s single largest source of foreign exchange.

The 2025 outcome also surpassed the previous all-time annual record of $ 7.24 billion recorded in 2016 by around 12%, firmly establishing workers’ remittances as the country’s leading source of foreign exchange during its ongoing recovery from the 2022 economic crisis.

Central Bank of Sri Lanka (CBSL) data show that the rebound in remittances has been both sharp and sustained since the crisis-induced collapse in 2022, when inflows fell to a 12-year low of $ 3.78 billion. The turnaround began in 2023, when remittances surged 57% to $ 5.96 billion, marking the strongest post-crisis recovery.

This momentum continued into 2024, with inflows rising a further 10.1% YoY to $ 6.57 billion, supported by a wave of outbound labour migration as Sri Lankans sought overseas employment following the economic collapse.

Although overseas departures eased slightly in 2025, remittance inflows continued to rise, indicating higher per-worker transfers. During the year, 310,915 skilled and semi-skilled workers left the country for foreign employment, including 190,609 men and 120,036 women. Total departures declined 1.2% YoY, yet remittances increased sharply, highlighting improved confidence in formal transfer channels and stronger earnings abroad.

Analysts attribute part of the sustained increase to the CBSL’s decision to abandon the parallel exchange rate regime, which encouraged expatriate workers to shift away from informal channels such as Undiyal and Hawala and remit funds through the formal banking system.

Historically, Sri Lanka’s workers’ remittances averaged around $ 7 billion annually between 2014 and 2018, or roughly $ 600 million per month, reinforcing their longstanding role as a stabilising pillar of the economy.

The record-breaking performance in 2025 now places remittances at the centre of Sri Lanka’s external sector recovery, supporting reserves, liquidity, and broader macroeconomic stability.