Monday Feb 02, 2026

Monday Feb 02, 2026

Monday, 2 February 2026 00:23 - - {{hitsCtrl.values.hits}}

The current account reached a $ 1.7 billion surplus in 2025, up 43.8% from a year ago on record workers’ remittances and higher services inflows despite a widening trade deficit.

The current account maintained a surplus for the second consecutive month amounting to $ 45.2 million in December 2025, although declining from $ 81.7 million in November 2025.

Sri Lanka maintained a current account surplus for much of 2025, going into deficit only in September ($ 199.5 million) and October ($ 183 million), ending the year with a $ 1.7 billion surplus, up 43.8%, data released by the Central Bank of Sri Lanka (CBSL) showed.

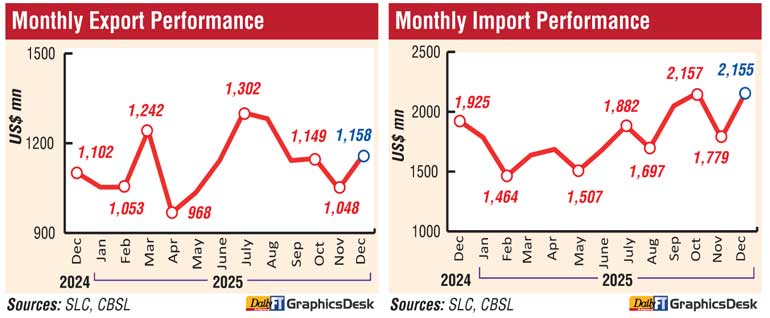

According to the CBSL External Sector Performance – December 2025 report, merchandise trade dynamics continue to shift, with the trade deficit increasing in December 2025 to $ 997.2 million, up from $ 822.7 million a year ago, as imports growth outpaced exports’.

Imports in December 2025 increased 12% year-on-year (YoY) to $ 2.15 billion, while the growth was 14% for the year to $ 21.47 billion. Exports were up 5.1% YoY to $ 1.15 billion in December 2025, and up by 6.3% in the year to $ 13.58 billion.

The CBSL said that vehicle imports amounted to $ 301 million in December, with cumulative inflows rising to $ 2.05 billion in 2025.

The terms of trade deteriorated in December 2025 as the decline in export prices exceeded the decline in import prices, the CBSL said, adding, however, that the terms of trade in 2025 deteriorated marginally compared to the previous year.

Net inflows from services recorded a strong 170.4% YoY increase in December 2025, reaching around $ 343.8 million, with the annual figure increasing 7.9% YoY to $ 3. 7 billion.

Workers’ remittances posted the highest monthly inflow since December 2020, with inflows growing 43.2% YoY to $ 879.1 million in December 2025. Remittances were up 22.8% for the full year at $ 8 billion. Workers’ remittances reached a historic high and may include other remittances, such as those received following Cyclone Ditwah, the CBSL said.

Tourism earnings, however, fell 14.8% YoY to $ 308.6 million in December 2025, gaining a marginal 1.6% growth during the year to $ 3.2 billion.

In December 2025, tourist arrivals recorded an increase on both month-on-month and YoY basis. Tourist arrivals in 2025 surpassed the level recorded in 2018, while recording a YoY growth of 15.1% compared to 2024. However, tourist earnings remained below the 2018 level, due to the downward revision of estimates of average expenditure per day and the average duration of stay by the Sri Lanka Tourism Development Authority, the CBSL said.

Foreign investment in Government securities recorded a $ 4.6 million net outflow in December 2025 and a net inflow of $ 248 million for the year, compared to a net outflow of $ 178.9 million the previous year, while the Colombo Stock Exchange reported net outflows of $ 6.7 million in December 2025 and $ 122 million for the full year, compared to a $ 33 million net inflow in 2024.

Gross official reserves, including the swap facility with the People’s Bank of China, stood at around $ 6.8 billion by end-December 2025, even amidst continuous external debt service payments due to receipts from multilateral institutions and net foreign exchange purchases by the CBSL.

The rupee recorded a 5.6% depreciation against the US dollar on a year-to-date (YTD) basis by end-December 2025, but appreciated 0.2% in January 2026.