Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 2 October 2025 00:30 - - {{hitsCtrl.values.hits}}

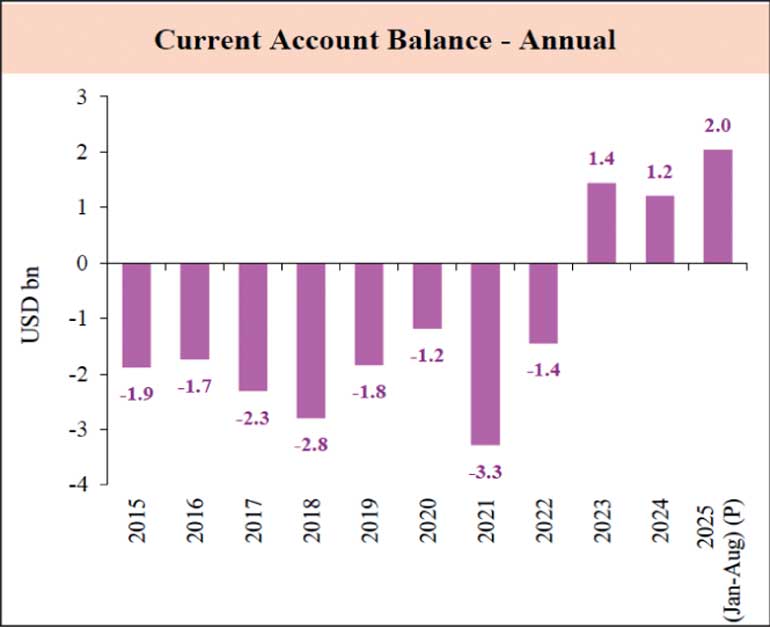

Sri Lanka’s current account surplus expanded in the first eight months of 2025, reaching $ 2.04 billion on the back of stronger remittances, services and tourism earnings, and moderate export growth, even as the merchandise trade deficit widened, the Central Bank of Sri Lanka (CBSL) said.

In its latest external sector data release, the CBSL said that the current account registered a surplus of $ 2.04 billion during the first eight months of 2025, up 26.1% year-on-year (YoY) from $ 1.6 billion in the same period last year.

Merchandise trade dynamics showed signs of easing as the trade deficit narrowed in August 2025 to $ 414 million, compared to $ 422 million a year ago, with exports growing at a faster pace, up 4% YoY to $ 1.28 billion in August 2025, compared to imports, which grew 2.6% to $ 1.69 billion during the month.

In the first eight months of 2025, the merchandise trade deficit widened 19.6% to $ 4.26 billion, up from $ 3.56 billion a year ago. Imports grew by 10.5% YoY to $ 13.34 billion, compared to $ 12.07 billion a year earlier, while merchandise exports grew at a slower 6.7% to $ 9.07 billion from $ 8.5 billion a year ago.

The terms of trade deteriorated in August 2025, as the rise in import prices outpaced the increase in export prices, while the Sri Lankan rupee depreciated 3.3% year-to-date (YTD) to end-September 2025 against the US Dollar.

The services sector declined by 5.4% year-on-year in August 2025 to $ 291 million relative to its $ 308 million performance in the corresponding period of 2024.

However, net inflows in the services sector recorded a 2.3% YoY increase during January-August 2025, amounting to $ 2.66 billion.

Tourist arrivals reached 198,235 during the month of August 2025, marking a growth of 20.4% compared to August 2024.

However, tourism earnings fell 8.2% YoY to 259 million. Further, earnings from tourism were estimated at $ 2.3 billion during January-August 2025, recording a 5.7% increase compared to $ 2.1 billion in the corresponding period of 2024.

Workers’ remittances amounted to $ 681 million in August 2025, up 18% from a year ago with cumulative remittances growing 19.3% to $ 5.1 billion from $ 4.3 billion a year ago.

However, foreign investment activity was mixed.

Foreign investments in the Government securities market continuing to record a net inflow of $ 32.9 million in August 2025, compared to $ 30 million outflow a year ago.

Foreign investments in the Colombo Stock Exchange (CSE), covering both primary and secondary markets, recorded a net outflow of $ 15.2 during the month, down 219.6% from a $ 12.7 million inflow a year ago.

During the eight-month period, the CSE recorded a $ 69 million outflow, down 258% from a $ 43.6 million inflow a year ago while inflows to Government securities surged 155% to $ 140.2 million compared to a $ 251 million outflow a year ago.

Debt related investment inflows grew 34% YoY to $ 714 million in the eight-month period while portfolio investments fell 39% to $ 332.6 million.

Gross official reserves, including the swap facility with the People’s Bank of China (PBOC), was up marginally from a month earlier at $ 6.2 billion as of end-August 2025 amid debt servicing, the CBSL said.